How much should you worry about North Korea? The SEC has some numbers on that

One measure of how seriously the corporate world has taken rising tensions with North Korea: Companies are talking about it a lot more in their regulatory filings.

One measure of how seriously the corporate world has taken rising tensions with North Korea: Companies are talking about it a lot more in their regulatory filings.

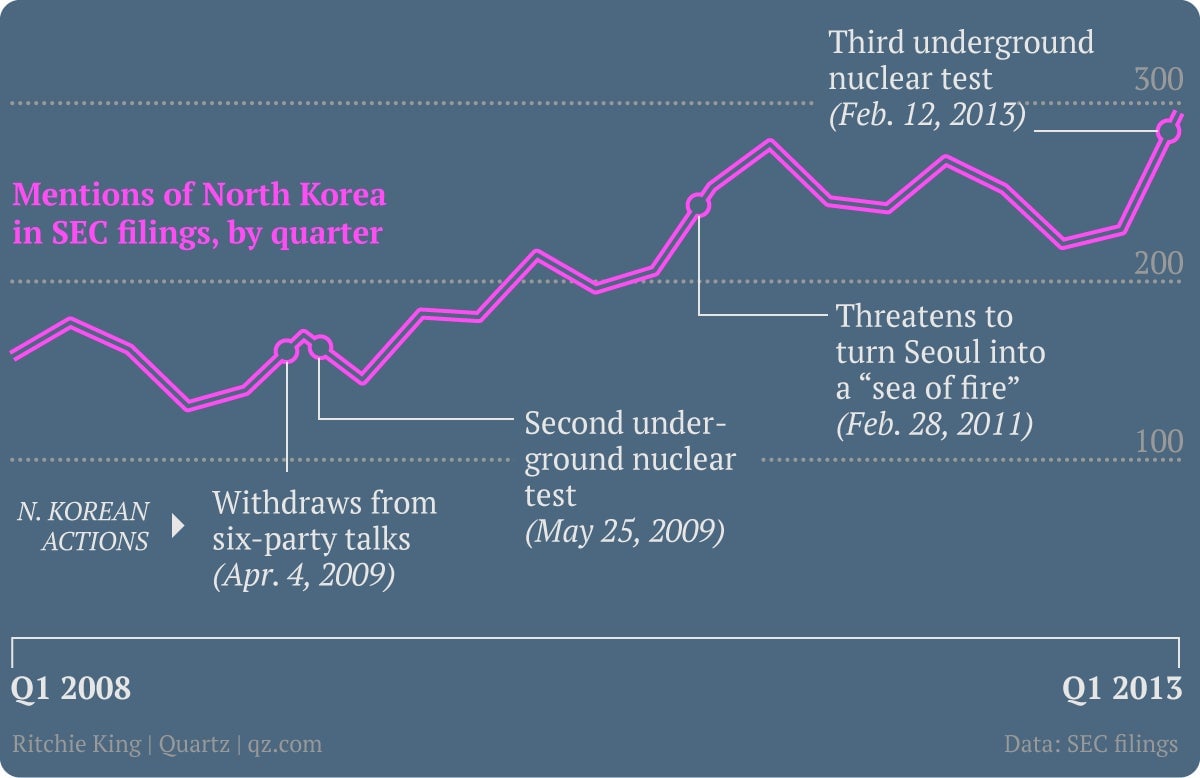

References to North Korea in filings with the Securities and Exchange Commission jumped 29% during the first quarter of this year, and rose 10% compared to the same quarter last year. It marked the highest point since second quarter of 2011, just after Pyongyang threatened to unleash a “sea of fire” on South Korea.

Any good business school teaches that what gets measured, gets done. Similarly, company disclosures help to highlight what keeps executives up at night. It isn’t a perfect gauge—companies may try to gloss over serious concerns, and filings generally lag events by anywhere from a few days to several weeks. But if companies start warning investors more often about something, pay attention.

In the case of references to North Korea, the baseline level of disclosure has grown as companies inform investors more about dealings with governments that the US considers sponsors of terrorism. In June 2011, the SEC stepped up its inquiries to companies that might have ties to Iran, North Korea or other pariahs. And the Dodd-Frank financial-regulation bill included explicit requirements that companies disclose more about transactions with Iran; references to North Korea may have tagged along.

Even so, disclosures appear to rise soon after tensions do (see the Arms Control Association’s detailed North Korea chronology). The real test will come with the wave of first-quarter reports that are due before a major May 10 filing deadline for big companies. If Pyongyang’s third nuclear test and increasingly aggressive stance over the past few days don’t lead companies to raise a more red flags, we’d be surprised.