Largest-ever leveraged buyout will also be a “spectacular” failure

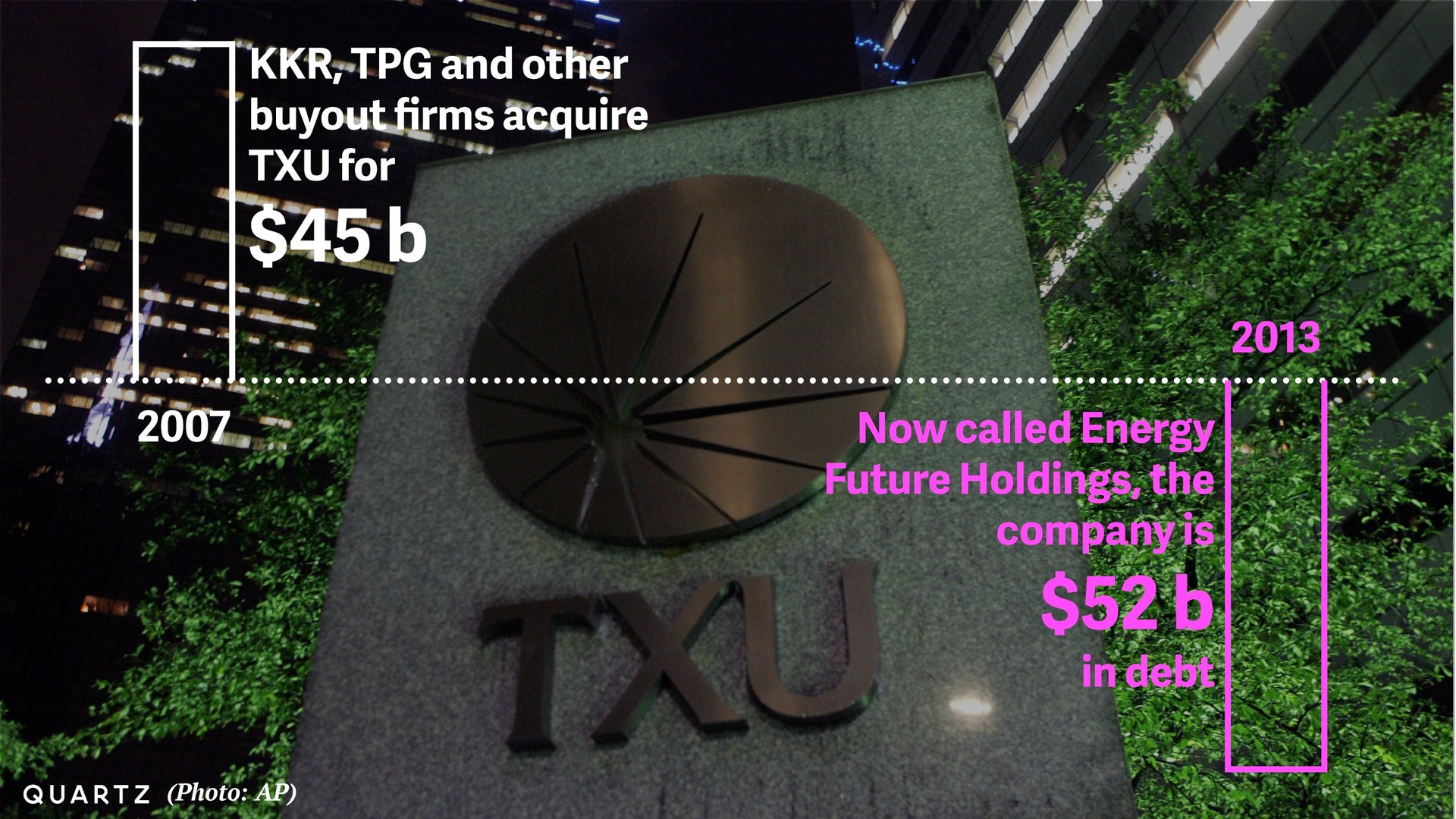

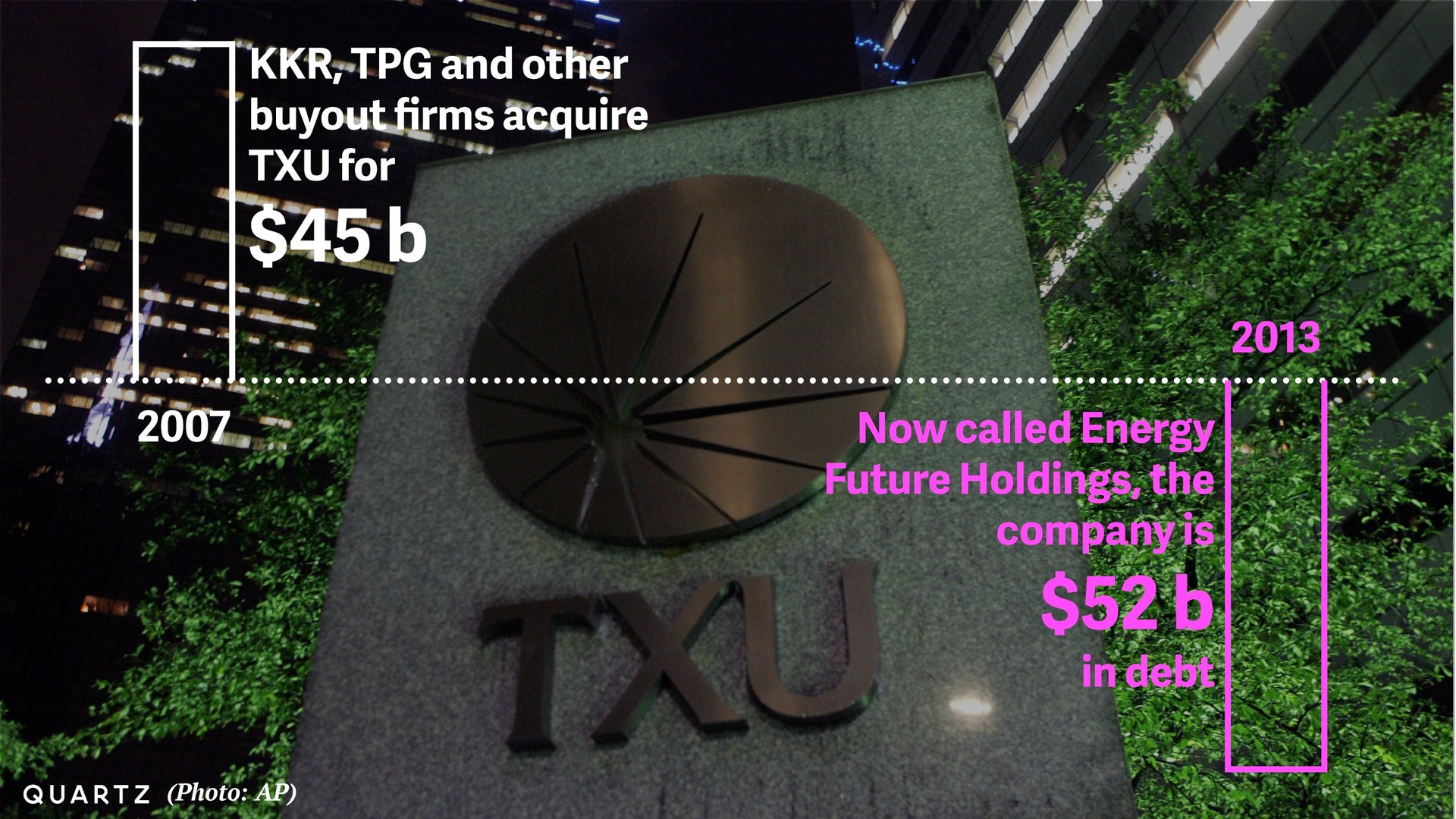

Private equity firms binged on buyouts during the boom of 2005 to 2007. The most eye-popping deal was the purchase of Texas power company TXU Corp. KKR, TPG and other buyout firms acquired the company for about $45 billion, including debt. It is still the biggest leveraged buyout (LBO) in history and showed the clout private equity firms can wield. Now TXU, which is known as Energy Future Holdings, is drowning in $52 billion in debt. That means the biggest-ever LBO will also go down as the biggest ever buyout failure.

Private equity firms binged on buyouts during the boom of 2005 to 2007. The most eye-popping deal was the purchase of Texas power company TXU Corp. KKR, TPG and other buyout firms acquired the company for about $45 billion, including debt. It is still the biggest leveraged buyout (LBO) in history and showed the clout private equity firms can wield. Now TXU, which is known as Energy Future Holdings, is drowning in $52 billion in debt. That means the biggest-ever LBO will also go down as the biggest ever buyout failure.

In 2007, KKR and the other private equity firms were betting on rising natural gas prices. But instead, those prices fell dramatically at the same time that US gas supply rose. Energy Future’s debt load began to rise and its losses mounted. Next month, cash payments for the interest on certain bonds are due. An even bigger bill will hit in October 2014, when almost $4 billion in loans mature.

That means it’s just a matter of time before Energy Future will have to go through some sort of restructuring, whether it’s through a bankruptcy or other means. A host of restructuring advisers have already been hired to help the various parties work through what could be one of the biggest bankruptcies in US history, if it goes down that route. “It’s going to be huge, spectacular,” said one source, whose firm is working on Energy Future, when asked how big a failure it could be.

The owners of Energy Future, which also includes Goldman Sachs, can take some solace in that they were not alone in betting on the biggest utility company in Texas. Warren Buffett also invested $2 billion in the bonds of a unit of Energy Future. His firm, Berkshire Hathaway, had to write down almost the entire amount of that investment. Buffett called the bond buy a “big mistake” in a letter to shareholders.

There could be some winners in the collapse of Energy Future, but it will likely require patience and hope that gas prices will recover. Early last year, some hedge funds and private equity firms not involved in Energy Future’s ownership began assessing ways they could make money when the restructuring hits, according to sources. Activist investor Bill Ackman famously made a killing on his investment in mall operator General Growth Properties as it sped toward bankruptcy a few years ago.

Since the financial crisis, LBOs worth more than $10 billion have been fairly rare. Those that breached the threshold in recent months had unique characteristics. Although Blackstone and Silver Lake are vying for PC maker Dell, it also involves a founder CEO who is the largest shareholder. The Heinz buyout earlier this year had Buffett as an investor.

That doesn’t mean private equity buyers aren’t looking for big deals. Some have made money, like the acquisition of hospital chain HCA. But other big LBOs like Freescale Semiconductor and Clear Channel have been busts. Energy Future is just another one to add to the list of cautionary tales.