The case for ETFs in 3 charts

You’re probably familiar with the concept of mutual funds, and may even own at least a few in your 401(k) or other accounts. Yet, you may be less informed about another investment vehicle that has become widely used by many types of investors: exchange-traded funds (ETFs). You may even own them and wonder what they are.

You’re probably familiar with the concept of mutual funds, and may even own at least a few in your 401(k) or other accounts. Yet, you may be less informed about another investment vehicle that has become widely used by many types of investors: exchange-traded funds (ETFs). You may even own them and wonder what they are.

First, a basic definition. ETFs combine familiar features of mutual funds and individual stocks. Like mutual funds, most ETFs are made up of many stocks, bonds or other assets. Like an index fund, an ETF aims to track the performance of a specific market benchmark, like the S&P 500 or the Russell 2000. And like shares of stock, ETFs are traded on an exchange throughout the day.

Want to get grounded in ETFs? Here are three facts to get started.

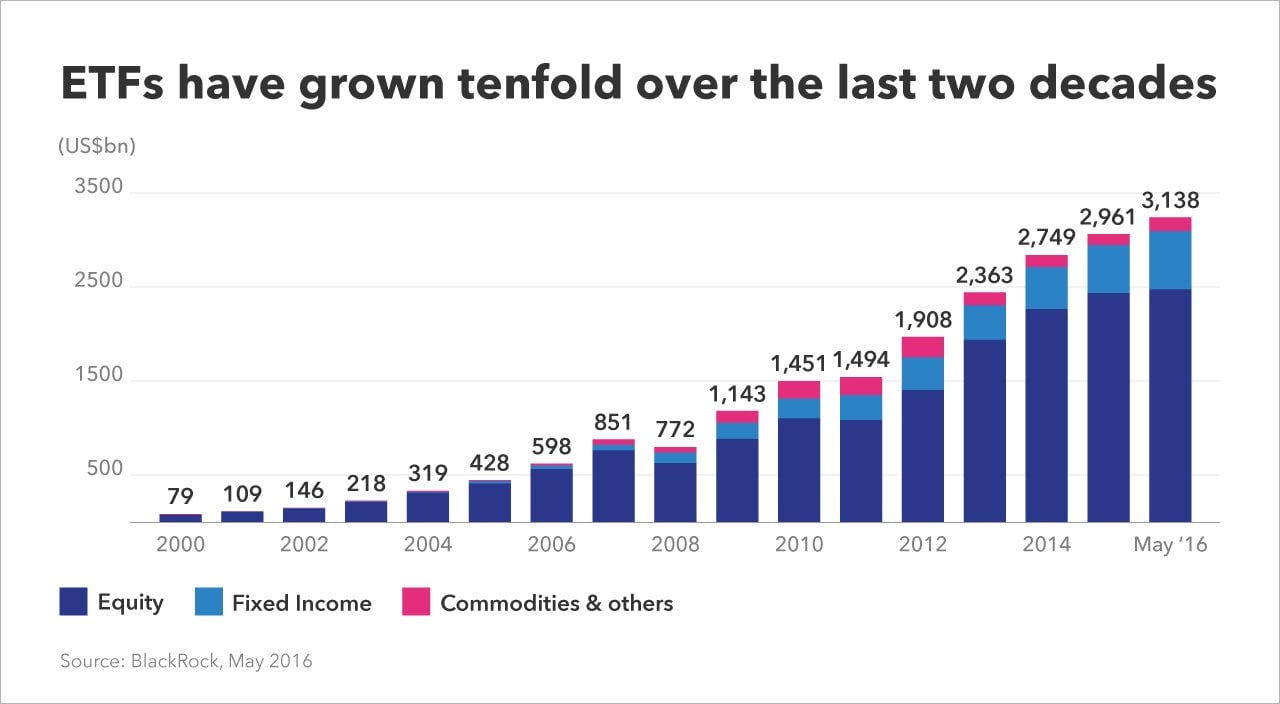

One: ETFs are not niche products

ETFs have been around for more than two decades, but they’ve really taken off in the past five years or so. Today, investors of all types — from individuals to sophisticated institutions — have helped increase ETF assets to more than $3.1 trillion globally. And while that’s still a fraction of the $21 trillion invested in mutual funds, ETFs are growing at a faster pace, more than doubling in size over the past five years.1

Part of the appeal of ETFs is their flexibility. Unlike mutual funds, which can only be bought or sold once a day, at a price established at the market close, ETFs can be traded whenever the market is open, just like stocks. Investors can also trade them in the same way they do stocks, including selling short, or buying on margin, and there is no minimum investment amount required. Learn more about the differences between ETFs and mutual funds here.

Two: Lower costs help you keep more of what you earn

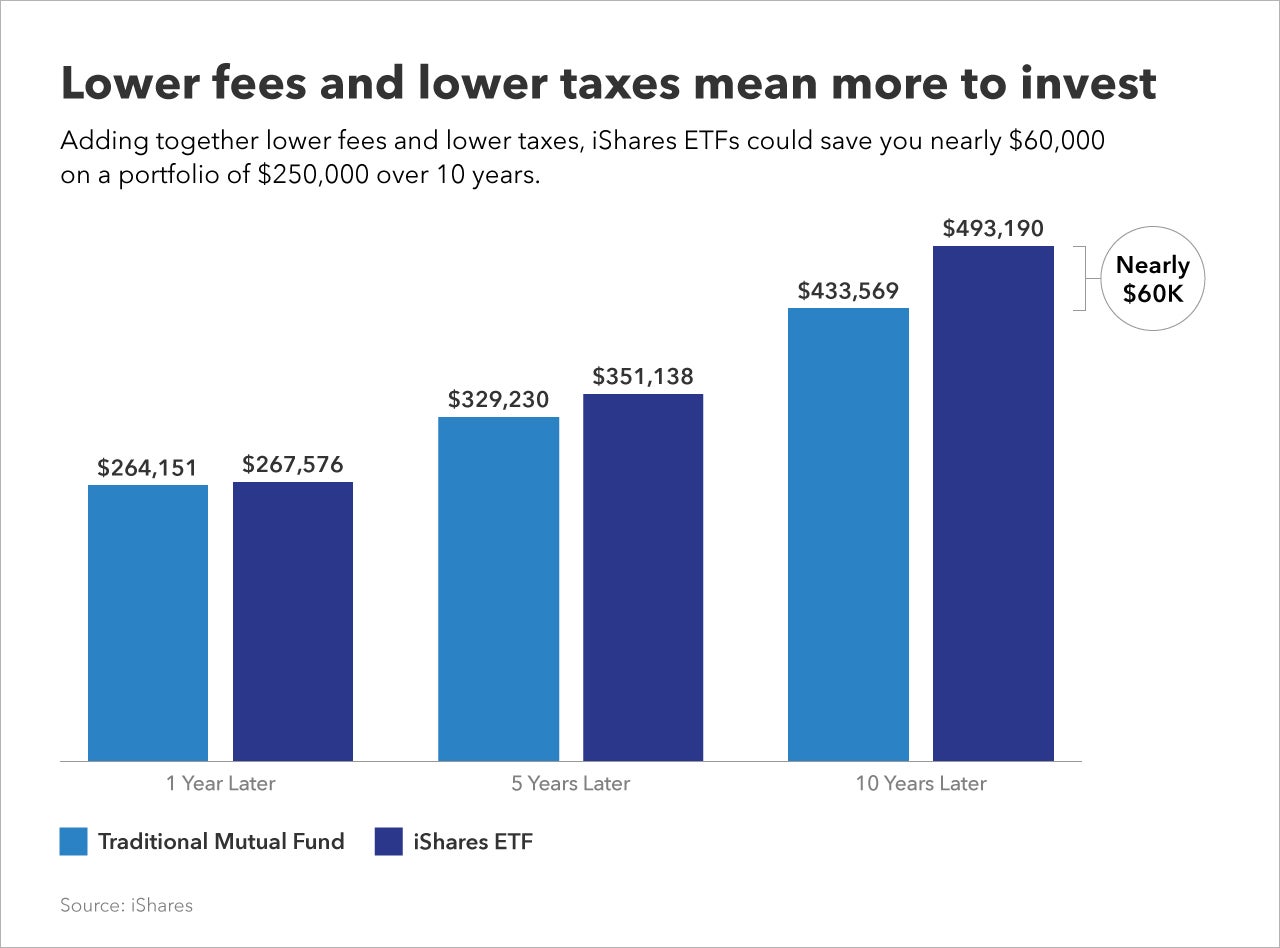

An even bigger draw of ETFs is the bottom line—reducing costs. The fees for most ETFs tend to be much lower than mutual funds, which means more money gets put to work for you.

In fact, iShares Core ETFs average about one-tenth the net expense ratio of most mutual funds.² The impact of these cost savings can be meaningful, particularly over time or when market returns are sluggish.

Here’s another potential benefit. ETFs tend to be relatively tax efficient and incur fewer undesirable capital gains distributions. So you can save up front, over time and on your tax bill.

Source: Chart reflects the hypothetical growth of a fictional investment of $250,000 with an 8% return and assumes the reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses have been deducted. The graph is for illustrative purposes only and is not indicative of the performance of any actual fund or investment portfolio. For more information on the differences between ETFs and mutual funds, click here.

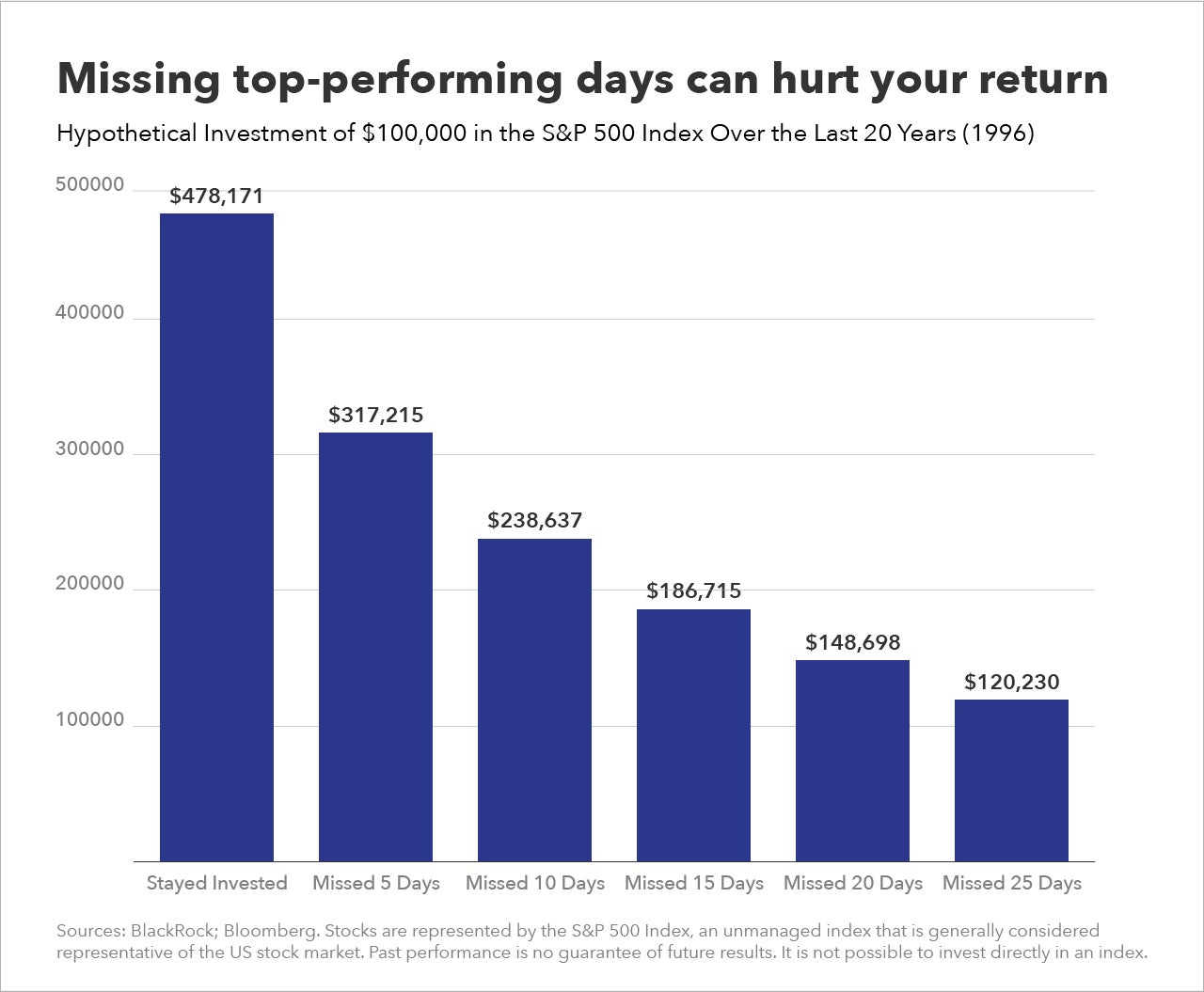

Three: ETFs make it easy to get in—and stay in—the market

Ultimately, of course, pursuing your financial goals is about staying invested. Timing market ups and downs is nearly impossible to get right, and missing out on the rebounds can be costly. In the example here, missing just the five top-performing days over the past 20 years would have cost more than $160,000; missing the top 25 days would have nipped nearly 75% of potential gains.

So instead of trying to outsmart the market, it may make more sense to simply be in the market, smartly.

For illustrative purposes only. The graph above shows how a hypothetical $100,000 investment in stocks would have been affected by missing the market’s top-performing days over the 20-year period from January 1, 1996 to December 31, 2015.

This article was produced on behalf of iShares by Quartz creative services and not by the Quartz editorial staff.

1. Sources: BlackRock, Strategic Insight Sim, ICI. ETF AUM as of 1/31/16; MF AUM as of 4/30/2016; ETF growth as of 12/31/2015.

2. Source: Morningstar, as of 12/31/15. Comparison is between the average Prospectus Net Expense Ratio for the iShares Core Series ETFs (0.11%) and the average Prospectus Net Expense Ratio of active open-end mutual funds (1.24%) available in the U.S. (excluding municipal bond and money market funds) on 12/31/2015.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Transactions in shares of ETFs will result in brokerage commissions and will generate tax consequences. All regulated investment companies are obliged to distribute portfolio gains to shareholders. Certain traditional mutual funds can also be tax efficient.

The iShares Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”). iSHARES and BLACKROCK are registered trademarks of BlackRock. All other marks are the property of their respective owners.

iS-18588-0715