After Brexit, everything is low

It’s been a week since the UK voted to leave the EU. The referendum completely upended British politics, and markets have had a pretty wild ride, too. Investor anxiety about Brexit, on top of other worries, pushed a range of assets to historic lows last week, in some cases the lowest lows on record…

It’s been a week since the UK voted to leave the EU. The referendum completely upended British politics, and markets have had a pretty wild ride, too. Investor anxiety about Brexit, on top of other worries, pushed a range of assets to historic lows last week, in some cases the lowest lows on record…

Government bond yields: All-time lows

The yield on Britain’s 10-year government bond hit a record low, as investors sought a safe place to store their cash. Benchmark government bonds are also sitting at record-low yields in the US and Japan, while Swiss debt is now trading at negative interest rates all the way out to 50 years (paywall), a sign of nervousness among investors.

The pound vs. the dollar: 30-year low

Volatility, uncertainty, potential rate cuts, a looming recession. Does it have even further to fall?

Deutsche Bank’s share price: All-time low

The German financial giant was dubbed the riskiest bank in the world by the IMF (paywall), in the same week that it failed a US stress test for the second year in a row. And that was on top of Brexit’s potential chill on markets and M&A activity in Europe.

EU unemployment rate: Seven-year low

It’s not all bad news! Unemployment across the EU—a sclerotic, job-killing leviathan, to take the Brexiteers at their word—fell in May to the lowest since 2009, in data released on July 1. (The German jobless rate now stands at 4.2%, the lowest since reunification.) Will Brexit-related jitters reverse the trend?

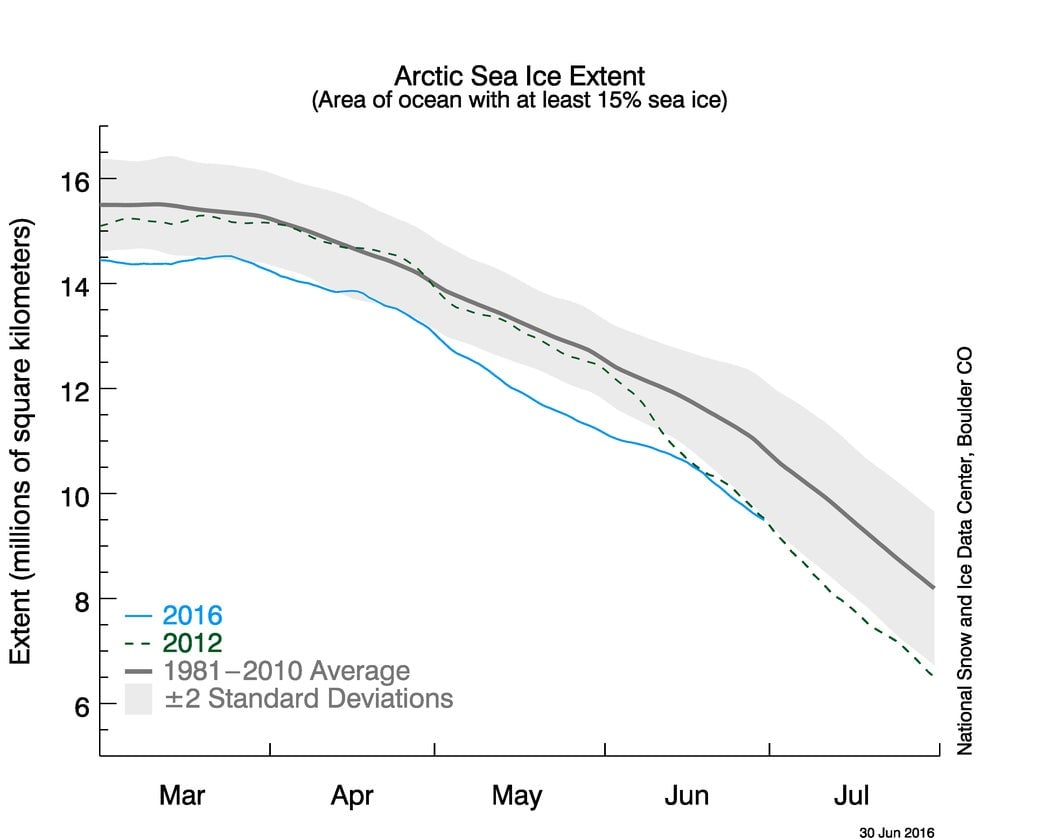

Arctic sea ice: Record low

This has little to do with the EU, but it puts our fretting about bond yields, currency values, and other things in perspective. Relentlessly rising temperatures have caused sea-ice cover in the Arctic to retreat to all-time lows throughout this year.