Role reversal: Mexicans finally show confidence; Brazilians betray doubt

Mexico has been called a pessimistic nation, full of modesty, doubt and fatalism. Brazil is said to have the opposite problem: unbridled optimism, sometimes out of line with reality.

Mexico has been called a pessimistic nation, full of modesty, doubt and fatalism. Brazil is said to have the opposite problem: unbridled optimism, sometimes out of line with reality.

It’s tempting to dismiss those old lines as oversimplified—except for the fact that opinion polls bear them out, even when economics suggests it should be otherwise. Mexicans remain wary, despite a steady surge in growth; Brazilians are expectant, even as their once-explosive economy tumbles.

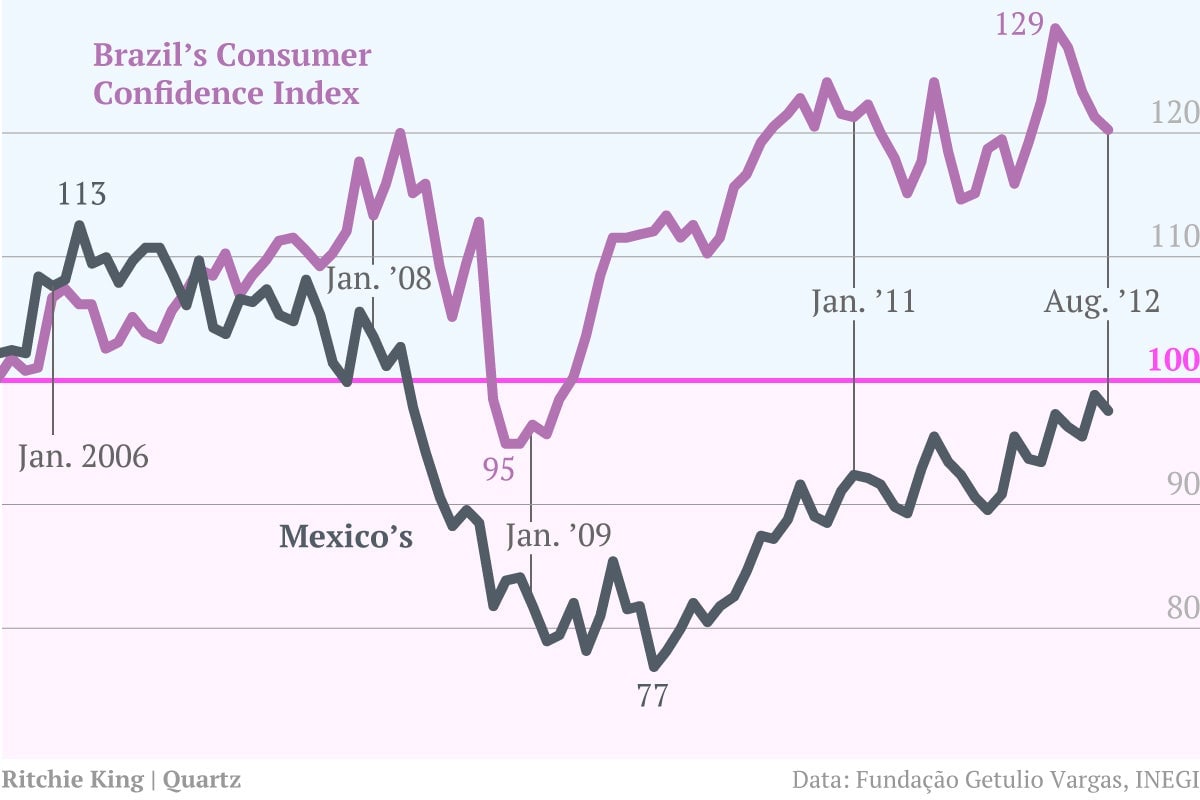

Case-in-point: consumer confidence still hasn’t returned to pre-crisis levels in Mexico, but it shot back up in Brazil by the end of 2009, when scores of other countries were still mired in financial chaos. Now, Latin America’s two biggest economies are seeing a kind of emotional re-coupling, as Mexican consumers start embracing their boom and Brazilians start to show signs of pausing.

Mexico: not everything’s a downer

When asked about their place in the world, Mexicans are far more likely than Brazilians to say their country is losing importance. Most Mexicans see the world getting worse; most Brazilians see things improving.

That pessimism is piqued by Mexico’s bloody drug war, which has claimed some 50,000 lives and paralyzed parts of the economy with fear, depressing investment and consumer sentiment. Mexico was also among the hardest hit by the 2009 recession, as close ties to the US brought a 5.9% contraction. As the saying goes, when the US sneezes, Mexico gets the flu. Yet it also seems that when the US gets a shot in the arm, Mexico leaps out of bed: growth has been averaging 4.6% a year since 2010, as the Americans who buy 80% of Mexican exports start spending again. Nor is it just thanks to exports; there has been a surge in construction too, a sign of growing domestic demand.

Capital markets are pumped on the progress. Investors have been shifting assets into Mexican equities partly to protect themselves from a downturn for Brazilian commodities firms, which are vulnerable to China’s cooling. Goldman Sachs’ Jim O’Neill, who coined the term “BRIC,” predicted Mexico would by 2020 overtake Russia and India as the world’s seventh-biggest economy. Analysts at Nomura say Mexico could surpass Brazil, the world’s sixth-largest, in that same time.

Inflation quickened to 4.6% last month, but that mostly reflects rising global food prices. The central bank, which dismissed that uptick as temporary, has held its benchmark rate at 4.5% for more than 3 years—a blend of price and rate stability that should be giving consumers faith.

And slowly, it is doing so. Retail sales rose 2.6% on the year, less than forecast but still reflecting what Barclays calls a “solid trend,” buoyed by strong growth in services. Consumer confidence, a canary-in-the-coal-mine leading indicator, gained 4.5% in the last year, with households rating both their own and the national economic situation more favorably.

Brazilian optimism: still eking out that high

If Mexicans have been slow to celebrate their recovery, Brazilians have been slow to sober from their boom. After averaging 3.9% a year from 2002-10, economic growth plunged from 7.5% in 2010 to 0.5% this year. But Brazilians still think salvation is coming: “Though actual signs of a more sustainable rebound are still tentative, most local investors expect the much-anticipated recovery to finally happen,” Nomura’s Tony Volpon wrote in a research note last week.

Policymakers have played on that optimism, pumping tax breaks to industry and cheap credit to consumers in the hope that Brazil can spend its way out of a downturn. Since last year, the central bank has slashed its benchmark rate by five full percentage points to a record 7.5%—although inflation, at 5.3% this month, is raising questions about how long that will help.

Consumer enthusiasm has finally started to show signs of strain, after holding strong throughout the downturn (it’s still up 5.9% on a year ago). Confidence levels shot to an all-time peak in April, before plunging for four straight months ahead of a slight recovery in September.

The perception gap is about jobs

Why do Mexicans and Brazilians see things so differently? Culture is certainly part of it, but it’s also tied to the structure of unemployment.

The jobless rate is nearly equal in both countries, but its history is not. When Brazilian unemployment fell to 5.3% last month, it marked a record low that far beat expectations. It also signaled a tightening labor market and impending wage spike—great for workers, if bad for central bankers looking to stall inflation.

Mexico’s 5.4% rate, though, is only the lowest in two years, so workers who remember joblessness below 4% in 2006 and 2007 don’t see it as a great thing. Moreover, wages haven’t shot up like they have in Brazil, because although the economy’s growth has created some two million jobs since 2009, migrants are returning from the US and snapping them up. So Mexico is growing, but consumers are only just starting to bet that their wallets will grow fatter too.