An Obama official says the biggest threat from AI is that we won’t invest enough in it

In 2014, the Pew Research Center asked a panel of 1,896 experts if artificial intelligence would destroy more jobs than it created within a decade. The answer, including responses from Google’s chief economist and MIT computer scientists, was definitive: they have no idea (pdf). The group came down almost 50-50 on both sides of the argument.

In 2014, the Pew Research Center asked a panel of 1,896 experts if artificial intelligence would destroy more jobs than it created within a decade. The answer, including responses from Google’s chief economist and MIT computer scientists, was definitive: they have no idea (pdf). The group came down almost 50-50 on both sides of the argument.

What’s virtually certain is that AI will cause upheaval in the labor markets. And the best way to combat that may be more of the same. The last 200 years of technological revolutions have taught economists that job creation and destruction go hand in hand. When technologies such as the internal combustion engine, electrification, and information technology were embraced by the market, new jobs were generated as fast as old ones disappeared for the most part. Better products were built. Economies became more efficient. Living standards rose.

Artificial intelligence promises to deliver yet another explosion of wealth, argues Erik Brynjolfsson, a professor at the Massachusetts Institute of Technology, who studies how technology affects business and productivity. Only this time there is a problem: many workers may not share in that new wealth.

“The number one effect of AI is making the pie bigger,” said Brynjolfsson in an interview. “You can have a growing pie but have lots of people who are worse off. That’s the challenge.”

The Obama administration suggests Brynjolfsson may be right. In a speech last week (pdf), Jason Furman, Obama’s chief economist and chairman of the US Council of Economic Advisors, warned that next wave of automation enabled by AI is set to be different than those that came before.

“The issue is not that automation will render the vast majority of the population unemployable,” he says. Instead, jobs created by AI could come too slowly, pay too little, and exclude the least skilled who need them most. Workers who lack the skills or opportunity to quickly find new, decent jobs enabled by automation could find themselves effectively excluded from the job market. That “leaves us with the worry that the only reason we will still have our jobs is because we are willing to do them for lower wages,” says Furman.

He noted two trends in the national economic data suggesting AI has the potential to eliminate good jobs faster than the US workforce could secure new ones, at least in the short term.

The first is that AI is likely to hit the poor and low-skilled workers hardest. A CEA analysis found the likelihood of AI displacing jobs is highest among those paying $20 or less, shifting the burden on lower-income Americans.

The second is that decades of declining demand for labor in the US will amplify displacement caused by automation. Workforce participation is at a 60-year low. As people drop out of the labor pool, fewer low-skilled workers, particularly men, have the training or ability to jump the ladder to the new, more skilled jobs created by AI, says Furman.

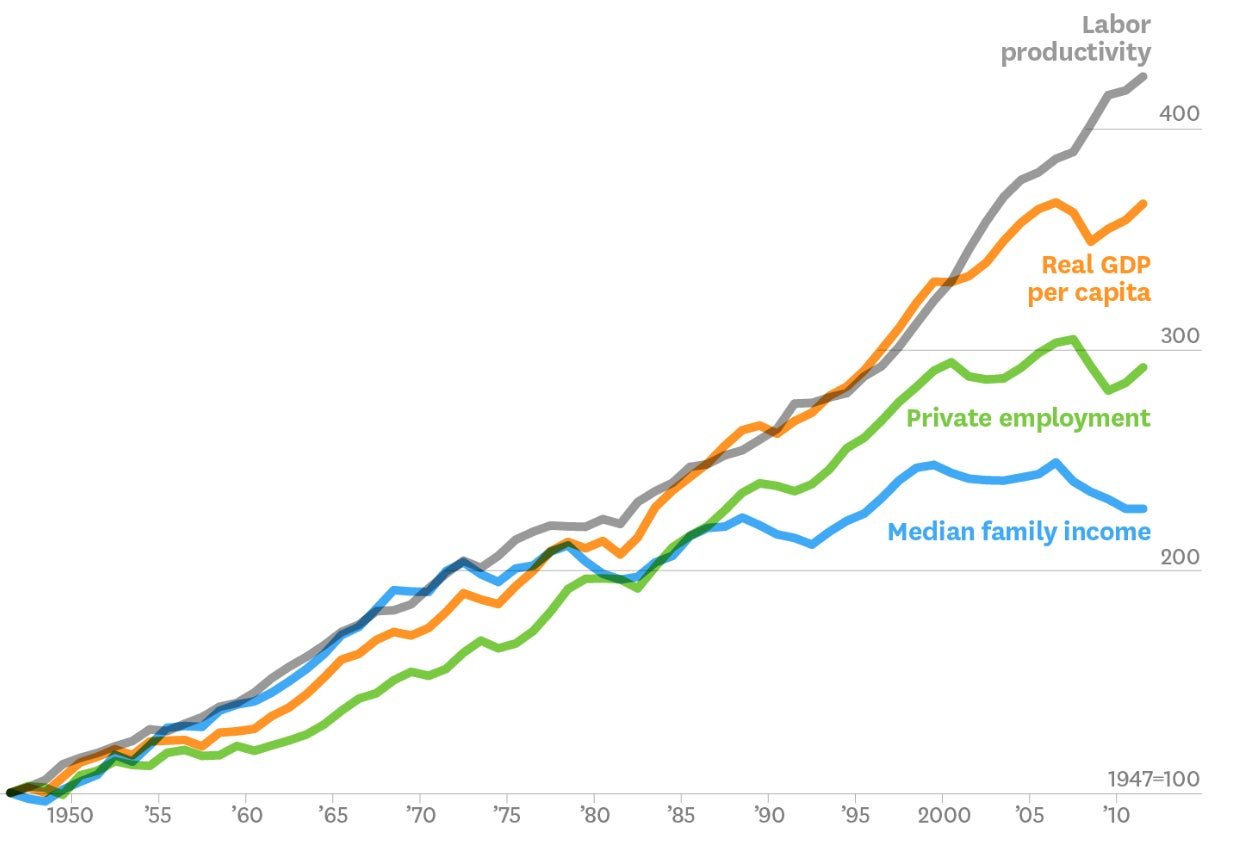

This is a striking break from the past. After WWII, the four major measures of national economic health rose in near unison for decades: per capita GDP, labor productivity, the number of jobs, and median household income, according to Brynjolfsson. That everyone would share in the dividends of technological progress came to seem axiomatic.

Then came what Brynjolfsson and his colleague Andrew McAfee at MIT call the Great Decoupling. In the 1980s, economic gains stopped being tied to workers’ welfare. Incomes and job prospects tapered off for most Americans, even as productivity and GDP continued their ascent.

Digital technology is now creating winner-take-most markets that have decoupled much of the economy’s wealth creation from its workers, argue the MIT researchers. While the industrial revolution demanded an enormous labor force to make, maintain, and operate its machines, this is not true for the latest wave of automation. Digital goods demand only a fraction of the labor to make and distribute globally. Artificial intelligence is set to extend this automation beyond routine tasks such as bookkeeping or banktelling into lower-skill jobs that have traditionally required personal interactions and situational adaptability.

In the short run, says Furman, not all workers will have the training or ability to find the new jobs created by AI. The worry is that the temporary condition could become the norm. “This ‘short run’ could last for decades,” he said. “In fact, the economy could be in a series of ‘short runs’ for even longer.”

The cure, claims Furman, is the same force driving automation deeper into the heart of the American economy. “Our first impulse should be to embrace [artificial intelligence] fully,” said Furman. “The biggest worry I have about AI is that we will not have enough of it.”

Furman is betting technological innovation, spurred by AI, will boost productivity growth, a primary driver of wages, and lead demand for new types of jobs. There’s plenty of room for improvement. Public investment in AI (outside the military and intelligence agencies) is still minuscule compared to the private sector. The NSF contributed just $200 million to AI research last year (pdf) versus $2.7 billion invested by the private sector.

The second approach is promoting policies that bring labor markets back into equilibrium as fast as possible. Furman advocates skills training, job search assistance, and policies such as the earned income tax credit and Temporary Assistance for Needy Families that boost incomes. He called for measures to strengthen ”what is already successful in our social safety net” rather than more radical policies such as a basic income, a guaranteed minimum payment to some or all citizens, being promoted in places like Silicon Valley.

Brynjolfsson said despite the dire trend lines, there was plenty of room for optimism. ”We should put in place policies that make the rich, richer and the lower and middle class rich was well,” he said. “If AI is growing the pie, that’s mathematically possible.”