Turkey’s post-coup purge is trashing its currency and junking its bonds

“We expect a period of heightened unpredictability that could constrain capital inflows.” That’s one way to describe the chaos in Turkey’s economy since a coup against president Recep Tayyip Erdogan was foiled on July 15.

“We expect a period of heightened unpredictability that could constrain capital inflows.” That’s one way to describe the chaos in Turkey’s economy since a coup against president Recep Tayyip Erdogan was foiled on July 15.

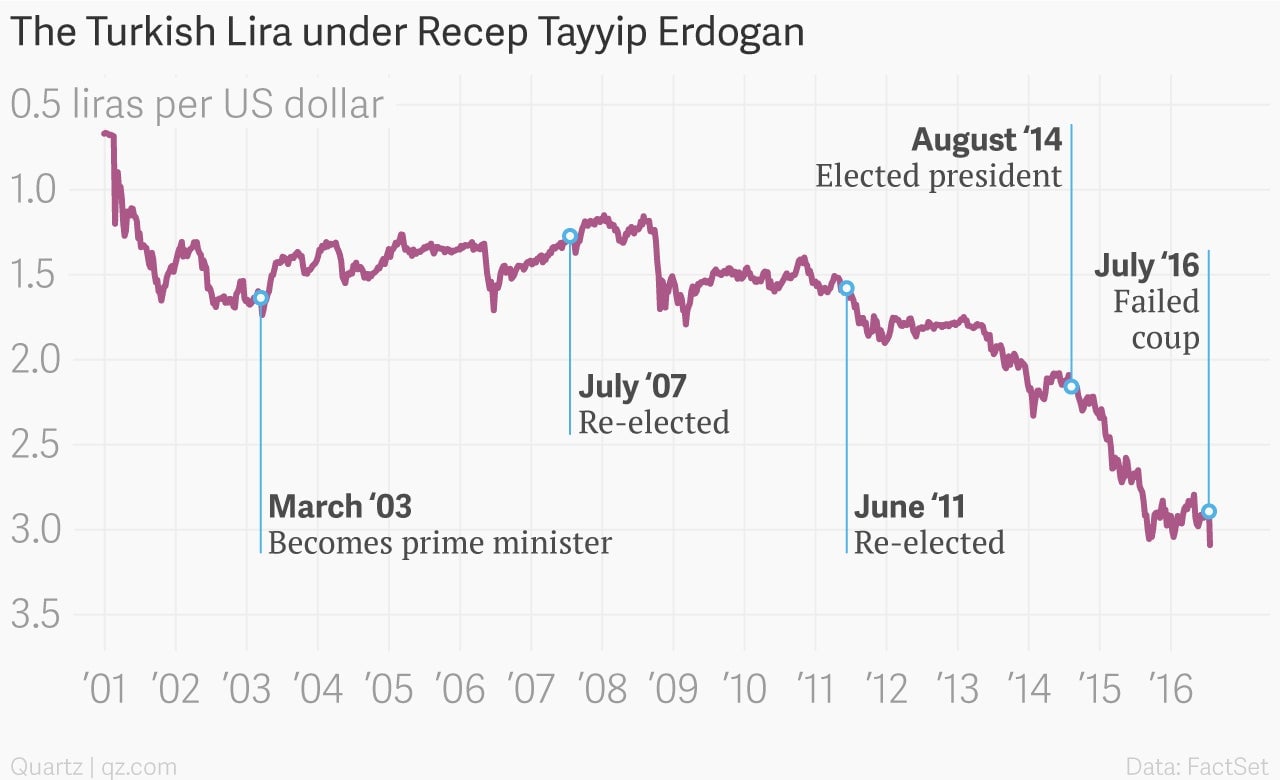

Standard & Poor’s cut the country’s credit rating further into “junk” status today (July 20), and warned that more downgrades could be on the way thanks to “heightened unpredictability.” The Turkish lira, which has steadily lost value throughout Erdogan’s long and increasingly autocratic reign, touched a new all-time low against the dollar on the news.

“We believe the polarization of Turkey’s political landscape has further eroded its institutional checks and balances,” S&P said in a statement.

Tens of thousands of soldiers, police, judges, teachers, and others have been sacked or arrested following the coup attempt, in which more than 200 were killed and 1,500 were wounded in the fighting.

Turkey relies heavily on foreign investment to finance its large and persistent deficits, which makes its cratering currency a big concern. The government will need to roll over some $170 billion in foreign debt over the coming year, a sum worth nearly a quarter of its annual GDP. Turkey has enough foreign-currency reserves to cover only two months of borrowing, imports, and other payments.

“Given the political uncertainty, Turkey’s policymakers will likely stray from their commitment to enact reforms intended to wean the economy away from its dependence on foreign financing,” S&P noted, with great understatement.