IMF: Sorry, everyone—the global economy will produce $216 billion less than we thought

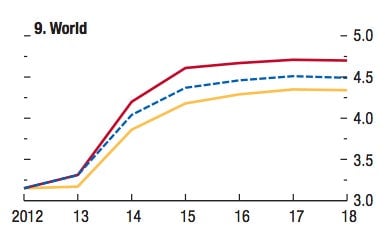

In a report titled “Hopes, Realities, Risks” (pdf), the IMF revised its estimates for global economic output today, saying it now expects 3.3% GDP growth, down from the 3.5% it projected back in January. That would put global GDP at around $74.3 trillion for 2013.

In a report titled “Hopes, Realities, Risks” (pdf), the IMF revised its estimates for global economic output today, saying it now expects 3.3% GDP growth, down from the 3.5% it projected back in January. That would put global GDP at around $74.3 trillion for 2013.

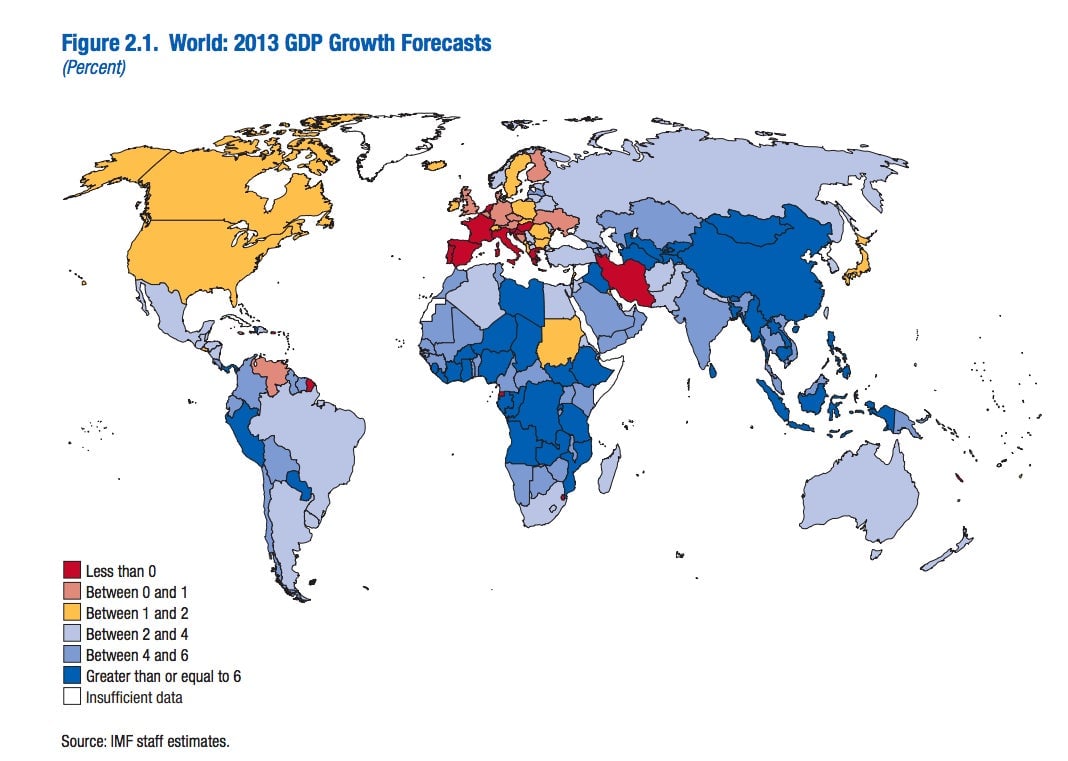

“We have moved from a two-speed recovery to a three-speed recovery,” said Olivier Blanchard, the IMF’s chief economist. “Emerging market and developing economies are still going strong, but in advanced economies, there appears to be a growing bifurcation between the United States on the one hand and the euro area on the other.”

Here are the biggest hopes, realities, and risks influencing the IMF’s $216 billion revision:

Things are looking worse in the -stans. Remarkably, not the euro zone. No, the area in need of the biggest downgrade was the Commonwealth of Independent States, excluding Russia, whose combined GDP the IMF expects to grow 0.8% less than it originally epxected. Still, that growth is still pretty darned good, at 3.5%.

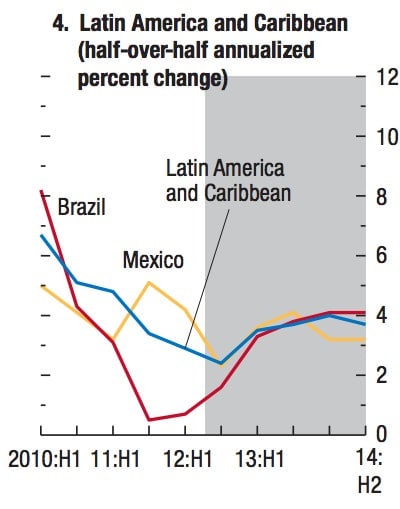

Or in Brazil, either. The IMF shaved 0.5% off its estimate for Brazil’s 2013 GDP, putting the country at 3.0% growth for 2013. Despite monetary easing, “supply constraints could limit the pace of growth in the near term,” says the report.

And, of course, the usual suspects. The IMF reduced the growth outlook for France and Italy by 0.4% apiece, contributing to an even more dramatic contraction in the overall euro zone—growth of -0.3%, compared with the previous -0.1%—than the IMF expected last January. Here’s why we all should care:

Abenomics, you have a believer. The IMF gave Japan’s GDP growth outlook a 0.4% boost, due to a first-quarter accleration caused by stimulus, the cheaper yen, and improved export demand. The IMF now expects 2013 GDP growth to come in at 1.6%, up from the 1.2% it projected in January. The IMF expects private demand to continue to “garner speed, helped by aggressive new monetary easing offset by the winding down of the stimulus and the consumption tax increase.”

ASEAN’s domestic demand continues to power growth. The IMF boosted its combined economic output estimate for ASEAN—meaning, Indonesia, Malaysia, the Philippines, Thailand and Vietnam—up to a whopping 5.9%. That’s up from the 5.6% it projected a few months ago. “A large pipeline of projects under the Economic Transformation Plan will propel strong investment in Malaysia; robust remittance flows and low interest rates should continue to support private consumption and investment in the Philippines; and Indonesia will benefit from a recovery of commodity demand in China,” says the report. “In Thailand, growth is expected to return to a more normal pace after a V-shaped recovery driven by public reconstruction and other flood-related investment in 2012.”

Bonus predictions for 2014: The IMF nudged Japan’s 2014 GDP up to 1.4%, from 0.7%. Meanwhile, South Africa’s 2014 growth outlook took a 0.8% hit, and was downgraded to 3.3% GDP growth.