I watched my parents tear each other apart over money because they never learned to talk about it

This question originally appeared on Quora: What are some ways parents can teach young children early to be smart financially? Answer by Arshad Ahmad, associate vice-president and professor of finance and business economics at McMaster University.

This question originally appeared on Quora: What are some ways parents can teach young children early to be smart financially? Answer by Arshad Ahmad, associate vice-president and professor of finance and business economics at McMaster University.

Here’s a story—my story—of what happens when parents don’t teach themselves, let alone their children, about money—and how emotionally-charged money matters can become. In my formative years, it took me a long time to understand the root of recurring tensions that led to terrifying fights my parents had about money matters. What was curious to me was that as a family, we would engage in other critical and intelligent discussions about health, war, and peace, or about life-and-death issues, but never about money. It was a taboo subject until the day my father passed.

As the years went by, in trying to understand these family tensions, I rationalized their extreme behavior as a mental health issue. Why else would otherwise loving, highly intelligent parents turn on each other so savagely in seemingly ridiculous arguments about money? I thought this aversion had to be more than a cultural issue. We acquired more and more things, always ate well, life opportunities were on the rise—and yet there was never enough money. The breadwinner inherited extraordinary privileges and exerted a lot of control, and identities were implicated. During the most hurtful parts of a fight, money matters added the most fuel to the fire. Issues that could have been discussed during a nice walk in a park were instead time bombs in a jungle where emotions that most of us simply didn’t know how to deal with flared.

Looking back at those difficult episodes and their multiplier effects, I believe that these tensions were rooted in financial illiteracy. My parents never developed a language, a skill set, or even a curiosity to resolve why this monkey was on their backs.

So what should other parents do?

They should consider money-related conversations essential—as essential as conversations about health and education. If they don’t, other members of the family, including young children, who incidentally have a better ability to ask questions freely, should persist and do whatever it takes to bring financial topics out into the open in a healthy and respectful way until everyone is comfortable exchanging their views.

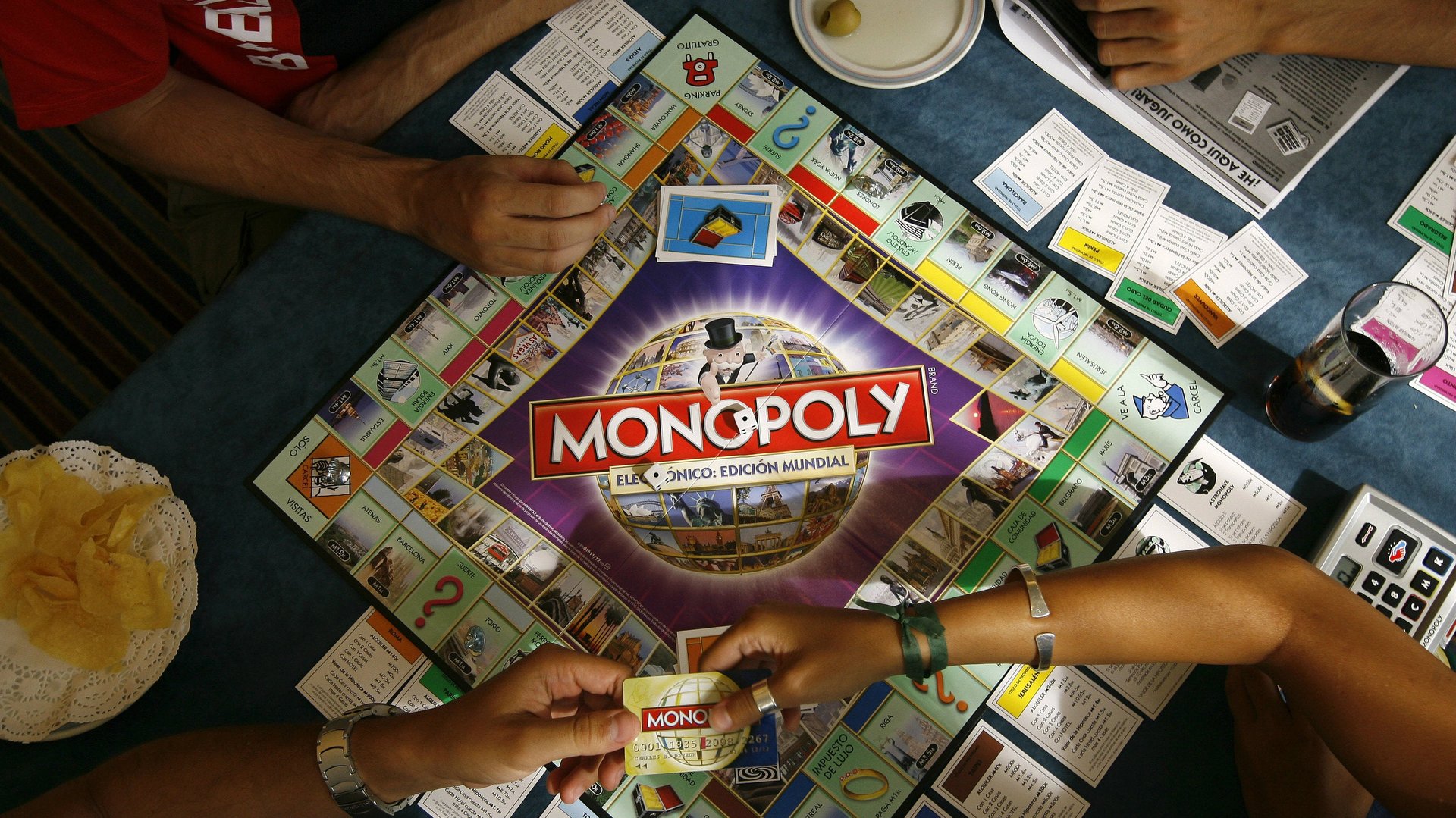

Besides engaging the whole family in money-related issues honestly and openly, I recommend parents learn to admit when mistakes are made, and also work to model good behaviors. I’m sure everyone has experience with this first category. Mistakes are great learning opportunities, so let’s use them to bring families together. Of course, we can also all be proud to share successes, but let’s do so by representing them not as singular achievements, but in building confidence and using good judgement. Or, consider this final idea: learn with and through your children. Visit a financial institution together and explore how some of the financial products work, especially those that enable young people to get a head start—such as an education fund, a tax-free savings vehicle, etc.

You can follow Quora—the knowledge sharing network where compelling questions are answered by people with unique insights on Twitter, Facebook, and Google+.

More from Quora: