The effects of euro zone austerity are starting to infect Germany—time for Schadenfreude?

For the last long while, the euro zone’s fortunes have cleaved neatly between the “core” and rapidly deteriorating ”periphery,” which essentially meant on-the-road-to-recovery Germany versus rapidly deteriorating Spain, Italy, France and other southern European countries.

For the last long while, the euro zone’s fortunes have cleaved neatly between the “core” and rapidly deteriorating ”periphery,” which essentially meant on-the-road-to-recovery Germany versus rapidly deteriorating Spain, Italy, France and other southern European countries.

Perhaps no longer. The preliminary reading of Germany’s April purchasing managers’ index (PMI), the index of private-sector business activity, fell for the first time since November 2012 (pdf).

One big reason for that tumble is Germany’s trade with its neighbors, says Tim Moore, an economist at Markit, which publishes the data. Germany exports around 40% of its goods to euro zone neighbors, and nearly 60% when you include the rest of the EU.

“Weakness in euro area demand is a key drag on manufacturing exports at present, with companies exposed to southern Europe reporting especially subdued sales,” Moore tells Quartz. “Investment goods producers seem to have been particularly badly hit, following cuts to capital spending projects amid uncertainty about the euro area economic outlook.”

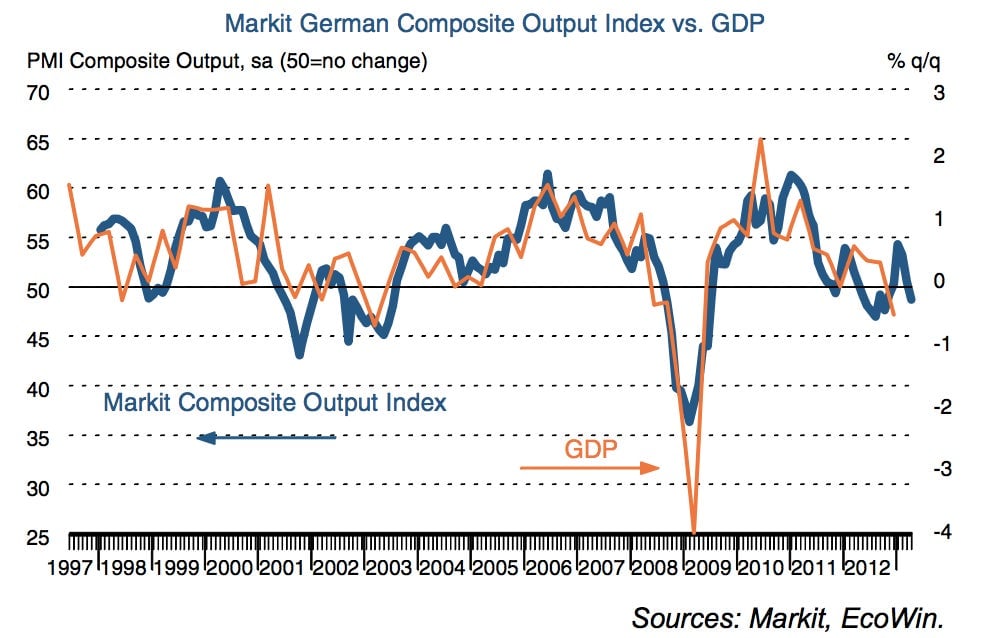

This signals a grim start for the German economy’s second quarter. Here’s a look at how PMI typically relates to GDP:

It’s not all bad news. “PMI data has suggested that overall manufacturing export volumes have been fairly resilient in Germany so far this year, as euro area weakness has been offset to a degree by exposure to emerging markets,” Moore says.

That said, domestic demand may be softening. Moore points out that signs of weakening in the services sector signal that “there should be some caution about the degree to which domestic spending will provide an impetus to service sector growth, at least in the near term.”

While the periphery of Europe might feel some Schadenfreude, weakness at the core is bad for it as well. While the euro zone’s overal April PMI, which Markit also released today, held steady for once, manufacturing continued to tank, coming in at a four-month low (pdf).

“The renewed decline in Germany will also raise fears that the region’s largest growth engine has moved into reverse, thereby acting as a drag on the region at the same time as particularly steep downturns persist in France, Italy and Spain,” said Markit’s chief economist, Chris Williamson.