Chinese solar panel prices reverse four-year slide thanks to demand in China

Finally, some good news for China’s struggling solar panel manufacturers. For the first time in four years, prices of Chinese photovoltaic modules sold in Europe rose, according to a report released today.

Finally, some good news for China’s struggling solar panel manufacturers. For the first time in four years, prices of Chinese photovoltaic modules sold in Europe rose, according to a report released today.

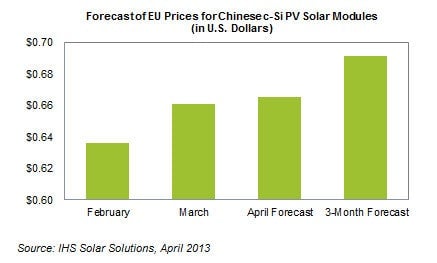

Okay, the price hike in March was just an average 4%. Hardly enough to put a dent in the billions of dollars in debt Chinese manufacturers accumulated in a frenzy of factory building that helped send photovoltaic module prices plummeting 75% since 2009. China holds 80% of the world’s solar manufacturing capacity, while 57% of photovoltaic modules are installed in Europe, said market research firm IHS.

Still, the report identifies trends that offer some hope for Yingli, Trina, LDK Solar and other Chinese photovoltaic manufacturers – or at least their bankers.

IHS predicted the average selling price of Chinese solar modules will rise by another 1% in April and then by 4% in the following three months.

And just what is the potential savior of the Chinese solar industry? The Chinese market. Prices jumped in Europe because of rising demand in China. Japan also plays a role as it is in the midst of a solar building boom as it seeks new energy sources to replace its crippled nuclear industry.

“Both countries at present are soaking up massive volumes of modules, helping boost worldwide pricing,” IHS said.

LDK Solar’s earnings report on April 18 confirmed that trend. Chief financial officer Jack Lai said on a conference call that in the fourth quarter China was LDK’s largest market, accounting for nearly 34% of sales. About 25% of sales were in Europe.

“We believe we’ll see improved demand in the near term with China’s policies and we have advanced our efforts to expand our photovoltaic development business there,” said LDK president Xingxue Tong on the call.

China has set a target of installing 10,000 megawatts of solar generating capacity in 2013. That’s more than triple the amount of solar the country brought online last year.

There were some darker portents in the March price hike, though. It is widely expected that Europe will impose tariffs on Chinese solar modules in retaliation for alleged dumping of products below their cost. IHS said that has caused Chinese manufacturers to withhold shipments to Europe, helping prompt the rise in prices.