Procter & Gamble’s turnaround isn’t fast enough

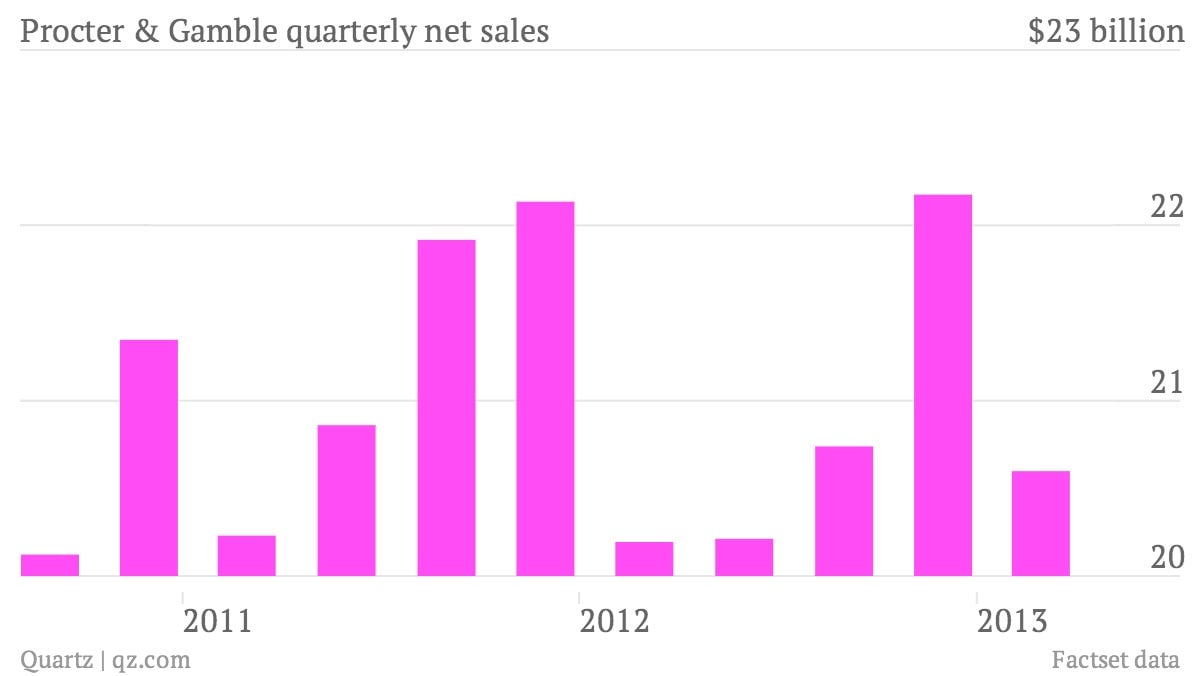

The numbers: Procter & Gamble reported net income of $2.56 billion for the quarter ended March 31, marking a 6% increase year on year and beating profit expectations. But sales, at $20.6 billion, slightly missed analyst expectations of $20.7 billion. The company also gave a disappointing earnings forecast for the next quarter, at $0.69 to $0.77 per share instead of an estimated $0.88 a share.

- The numbers: Procter & Gamble reported net income of $2.56 billion for the quarter ended March 31, marking a 6% increase year on year and beating profit expectations. But sales, at $20.6 billion, slightly missed analyst expectations of $20.7 billion. The company also gave a disappointing earnings forecast for the next quarter, at $0.69 to $0.77 per share instead of an estimated $0.88 a share.

- The takeaway: Sales of P&G’s Tide Pods, the next big thing in laundry detergent, are helping its business in the US, and a worse-than-usual cold and flu season in the US boosted personal healthcare products by 5%. But shampoo and skin-care sales fell in the last quarter, and the company is blaming currency fluctuations and higher marketing costs for its next quarter outlook. P&G’s main failing when it comes to mass consumer products is that it lags in emerging markets. The company makes almost 40% of its revenues from these markets, but its competitors Unilever and Colgate both get more than half from there.

- What’s interesting: The slow pace of P&G CEO Bob McDonald’s turnaround attempts could give activist investor Bill Ackman more fodder in his campaign for McDonald’s ouster. Last year McDonald announced a plan to cut $10 billion in costs before 2016 which included thousands of job cuts.