Baidu’s spending is freaking out investors who don’t get that making brain-like computers ain’t cheap

The numbers: Ouch. Sure, revenue was up 40% from Q1 last year, hitting $961 million, as Baidu announced after market close yesterday. And net profit for the first quarter came in at $328.9 million, an 8.5% increase year-on-year. But the company missed analyst estimates; so far today, the stock has tumbled 7.4%.

The numbers: Ouch. Sure, revenue was up 40% from Q1 last year, hitting $961 million, as Baidu announced after market close yesterday. And net profit for the first quarter came in at $328.9 million, an 8.5% increase year-on-year. But the company missed analyst estimates; so far today, the stock has tumbled 7.4%.

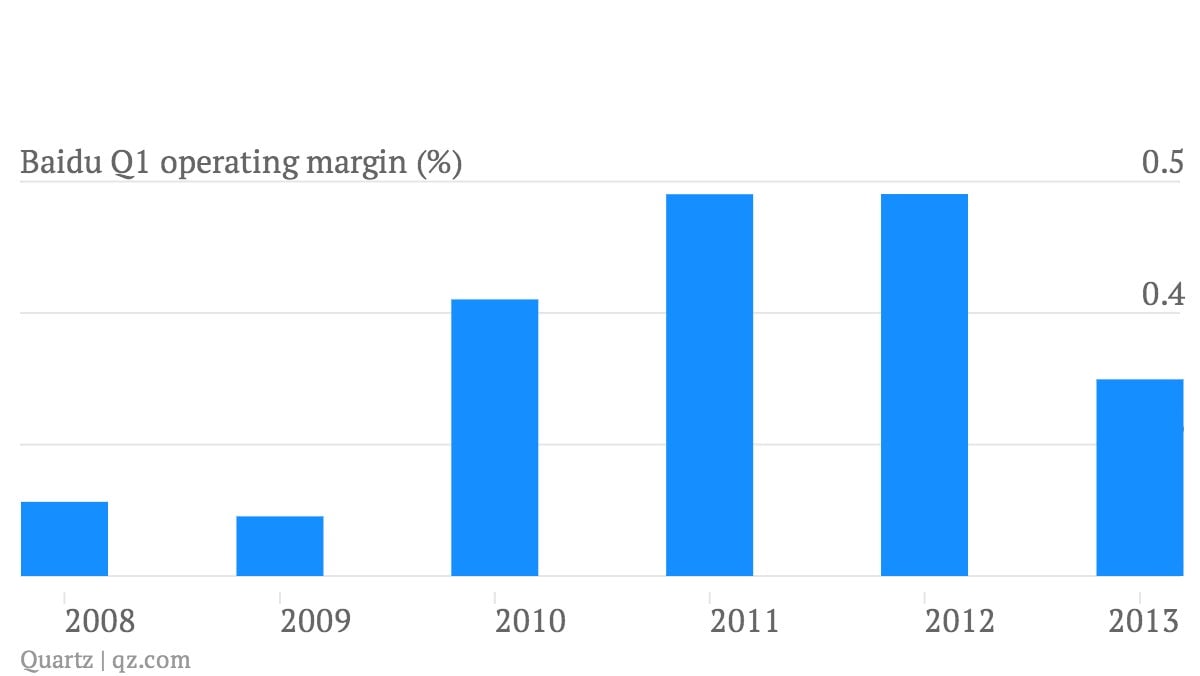

The takeaway: The real concern here is that Baidu’s costs keep rising, even as user numbers boom for its website, mobile search engine and mobile apps. For example, content costs jumped to 1.6% of total revenues in Q1 2013, up from 0.7% in the same period a year ago. A lot of that is because of Baidu’s struggle to consolidate iQiyi, its video-streaming site, said the company.

What’s interesting: Baidu seems serious about developing artificial-intelligence-based search, a goal that puts it in the company of the likes of Google and Microsoft. It discussed its Institute of Deep Learning (link in Chinese) at length, and noted that it leads the market in recognition of Mandarin and image-recognition accuracy. Apparently, image- and voice-based search queries are growing fast, and even as it works on improving those interfaces, we know it has more up its sleeve. So who cares about those profit margins … right?