Quartz Chartbook: 19.2 million euro zone workers can’t find a job, and other important economic data today

Up from 12.0% in February, that translates to about 19.2 million people jobless. Here’s a look:

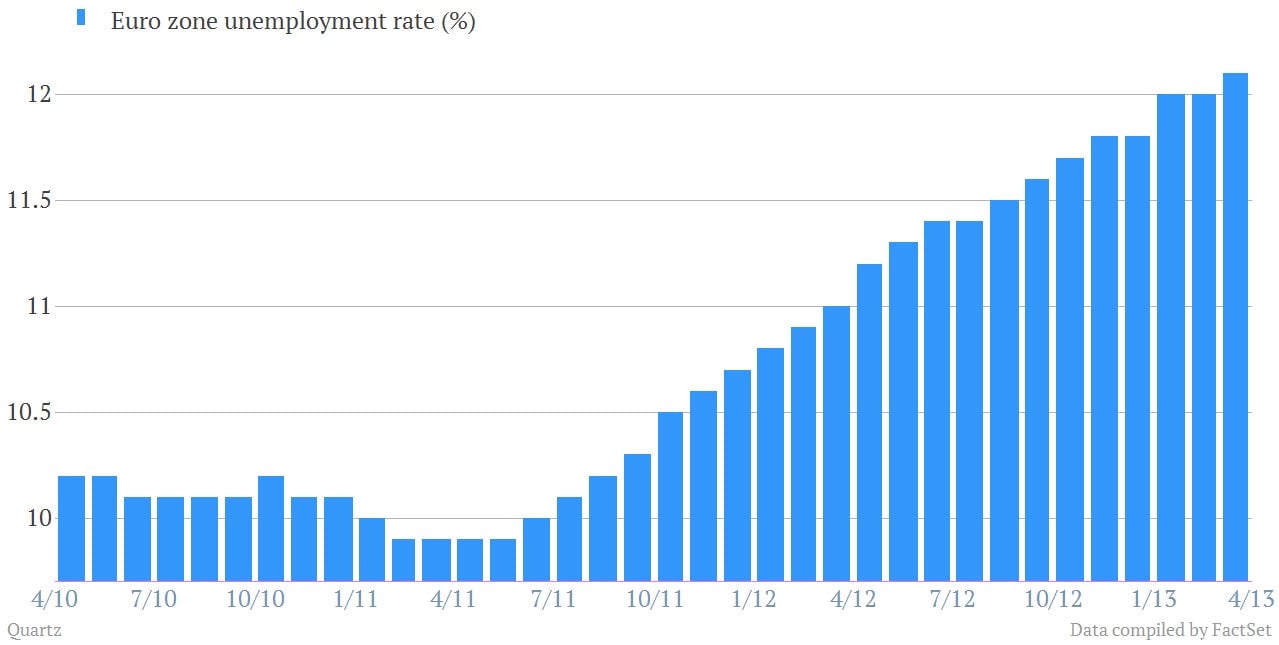

Euro zone unemployment continues to rise, hitting a high of 12.1% in March—that’s the highest it’s ever been (pdf).

Up from 12.0% in February, that translates to about 19.2 million people jobless. Here’s a look:

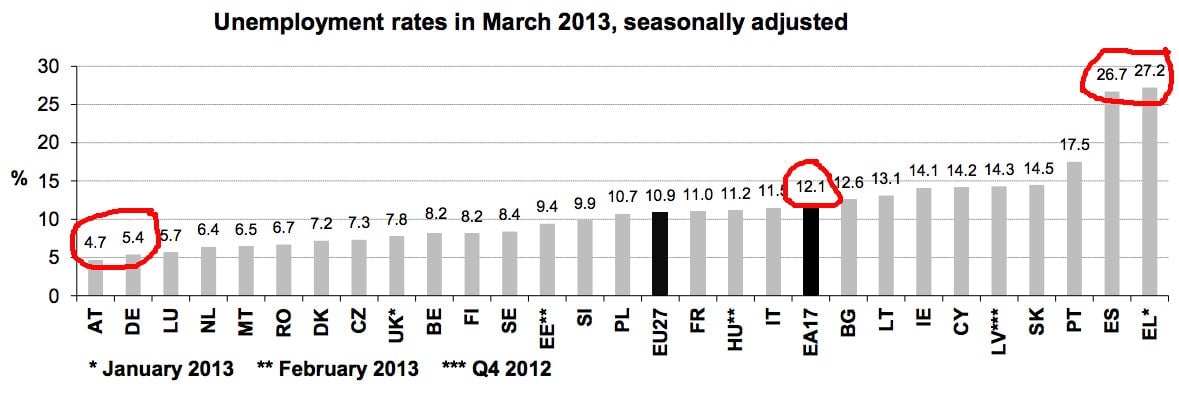

Greece and Spain had the highest unemployment rates, at 27.2% and 26.7% respectively, while Austria and Germany had the lowest:

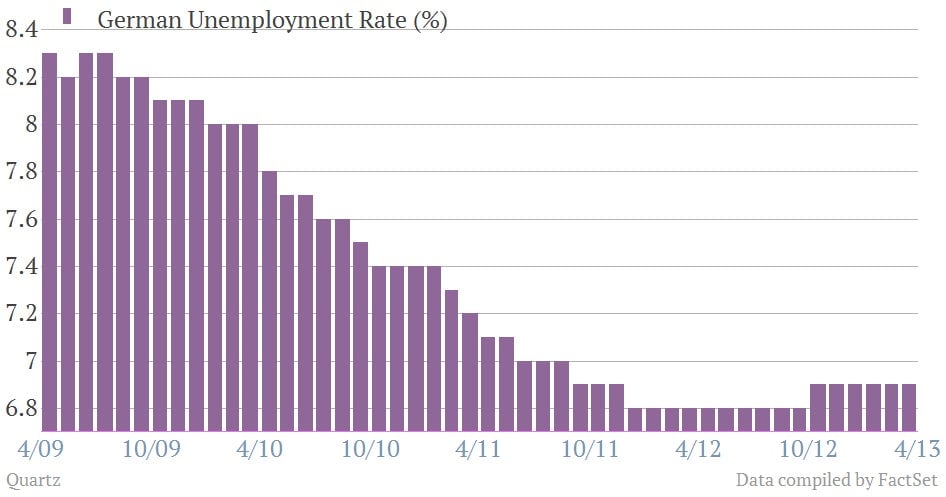

Germany, which calculates its unemployment rate differently from Eurostat, announced today that its unemployment rate stayed at 6.9% in April.

That’s despite adding 4,000 people to the 2.94 million Germans who are out of work:

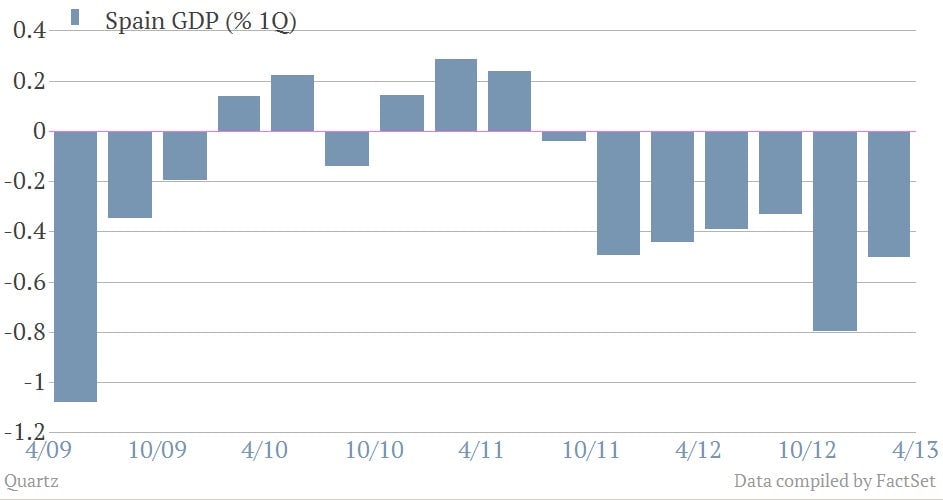

Spain’s youth unemployment is now 55.9%, by far the highest in the EU. But there’s little hope that will change soon—the country’s Q1 GDP fell 0.5% compared with the previous quarter, in line with expectations.

That’s less bad than the 0.8% contraction in the last quarter of 2012 from the previous quarter, though a sign of any rapid improvement on the horizon it’s not:

Inflationary pressures eased still more in the euro zone in April, with flash estimates putting it at 1.2%, compared with 1.7% in March.

This tees the European Central Bank up for a rate cut when it meets on Thursday, though as we’ve already argued, this probably won’t actually do much.

And just where was that disinflationary pressure coming from? Not food, drink and tobacco, which jumped 2.9% in April, from 2.7% in March. People are still eating, drinking and smoking. However, there’s a worrisome sign embedded in the data. While a lot of the drop in inflation was due to falling energy costs, a slowing rise in service sector prices, which make up nearly half of the weighting, is responsible as well. They rose only 1.1%, from 1.8% in March. That aligns with falling service-sector output data (pdf) that signal a weakening of euro zone demand.

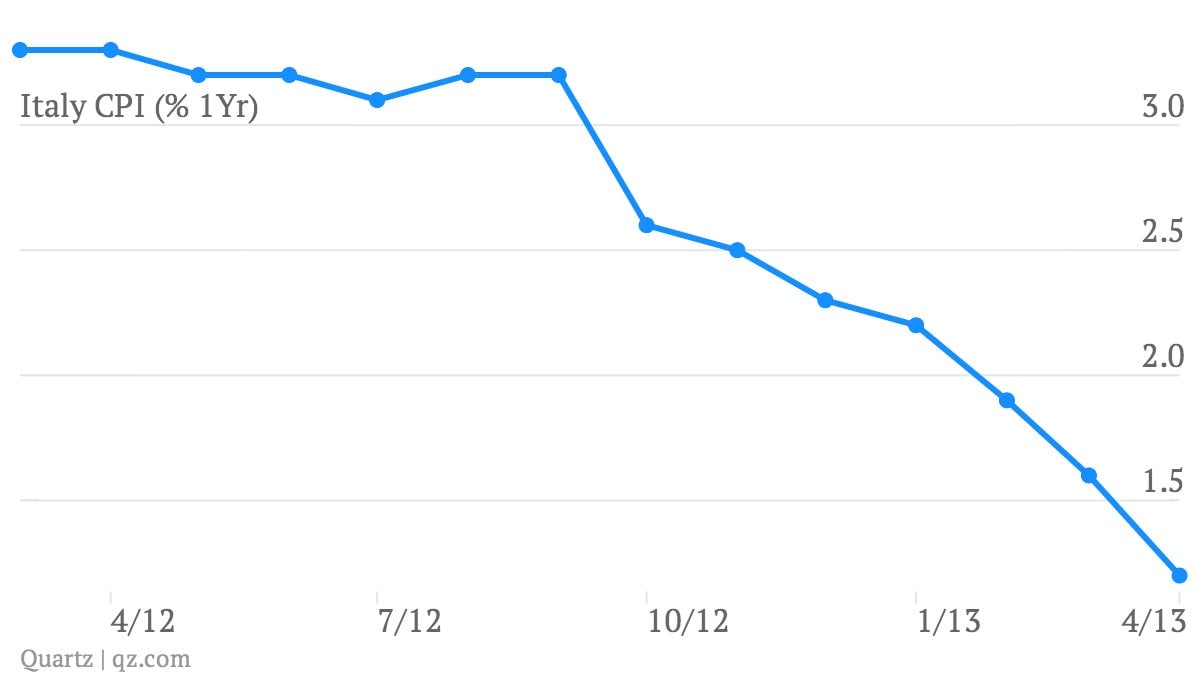

There are hints of slowing inflation elsewhere in the euro zone. Preliminary estimates of Italian CPI have it falling to 1.2% growth in April, down from 1.6% in March:

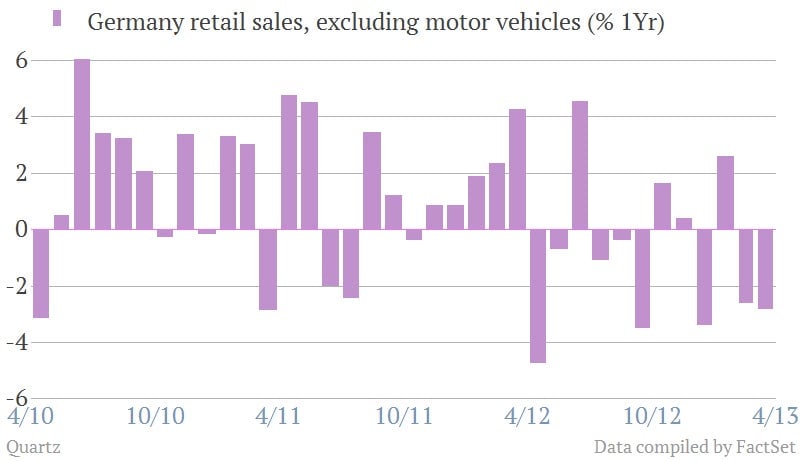

Meanwhile, German retail sales fell in March, as well, shrinking 2.8% year-on-year, from a 2.6% decline in March:

However, France’s producer price index, which is often a leading indicator of consumer prices, held steady in April, at 1.9%: