Sequestration is bad medicine for CVS

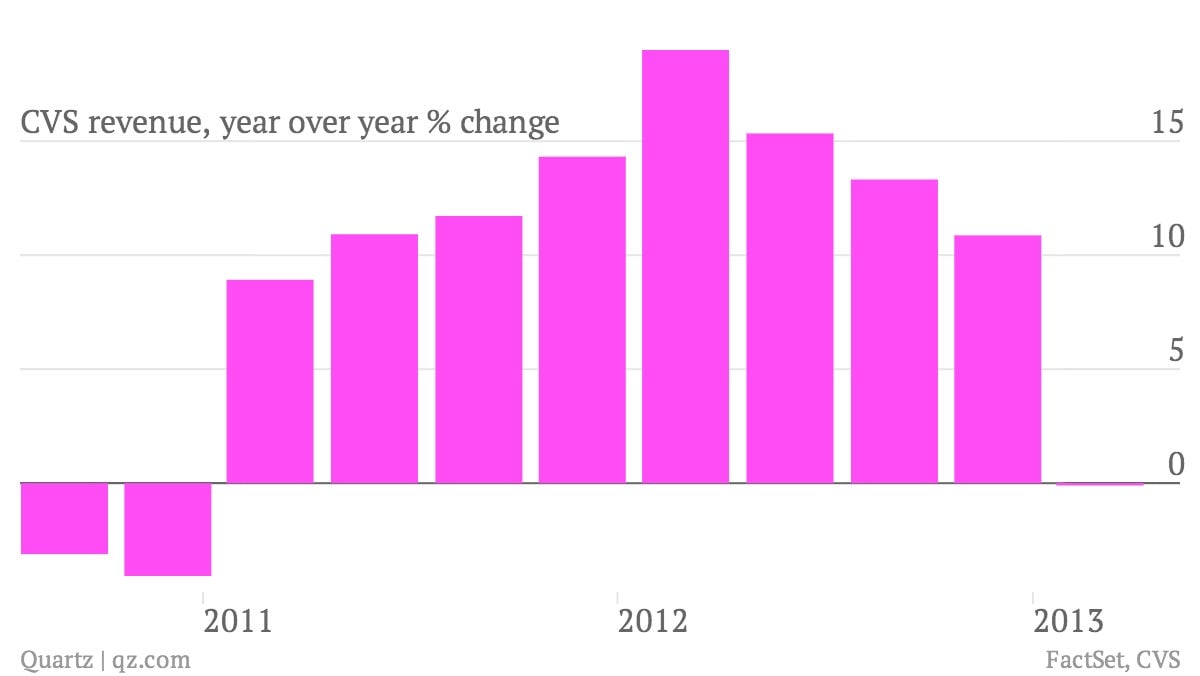

The numbers: Drug retail chain CVS Caremark beat analyst estimates, reporting a higher net income of $956 million on revenue of $30.76 billion. CVS shares were up by about 1.2% today.

The numbers: Drug retail chain CVS Caremark beat analyst estimates, reporting a higher net income of $956 million on revenue of $30.76 billion. CVS shares were up by about 1.2% today.

What’s interesting: A harsher flu season and a boost in generic drug profitability were good news for CVS. Still, the company decided to narrow its earnings forecast because of the mandatory US federal budget cuts known as sequestration. Those cutbacks have hurt spending on drugs through the Medicare health care program for senior citizens, which will hurt CVS.

The takeaway: Consolidation in the drug store space has been active, and CVS’s earnings forecast shows the sector is still facing some pressure. Just last year, Walgreens bought a 45% stake in European counterpart Alliance Boots. Two years earlier, Walgreens bought Duane Reade, a chain based in New York. The ultimate deal in this space would be a tie-up between CVS and Walgreens. Part of the thinking is that it would give them more bargaining power over pharmacy benefit managers, which administer prescription drug programs. CVS had looked last year at acquiring Walgreens, which wasn’t interested, sources say. CVS declined to comment. But one possibility that remains is an acquisition of the smaller Rite Aid, which is often rumored to be an acquisition target.