It’s time to say “goodbye” to very small banks

Like it or not, really small US banks are a thing of the past. New regulations, advantages to diversity and economy of scale, and increasingly high overhead costs are slowly eliminating the smallest banks in the United States. Although bank profits in 2012 were the highest they’ve been since 2006, most of those profits were accrued at the countries largest banks and not at the smallest ones. Bill Haraf and Mike Phleger, both advisors from Promontory Financial Group, explain (pdf):

Like it or not, really small US banks are a thing of the past. New regulations, advantages to diversity and economy of scale, and increasingly high overhead costs are slowly eliminating the smallest banks in the United States. Although bank profits in 2012 were the highest they’ve been since 2006, most of those profits were accrued at the countries largest banks and not at the smallest ones. Bill Haraf and Mike Phleger, both advisors from Promontory Financial Group, explain (pdf):

Community banks in particular face daunting revenue challenges, including sluggish loan demand, thin lending margins, and competitive pressure from large banks with cheaper funding sources. Conditions on the expense side of the equation are hardly much better, as higher regulatory expectations and technology investment imperatives have made it difficult for companies to cut their way to prosperity.

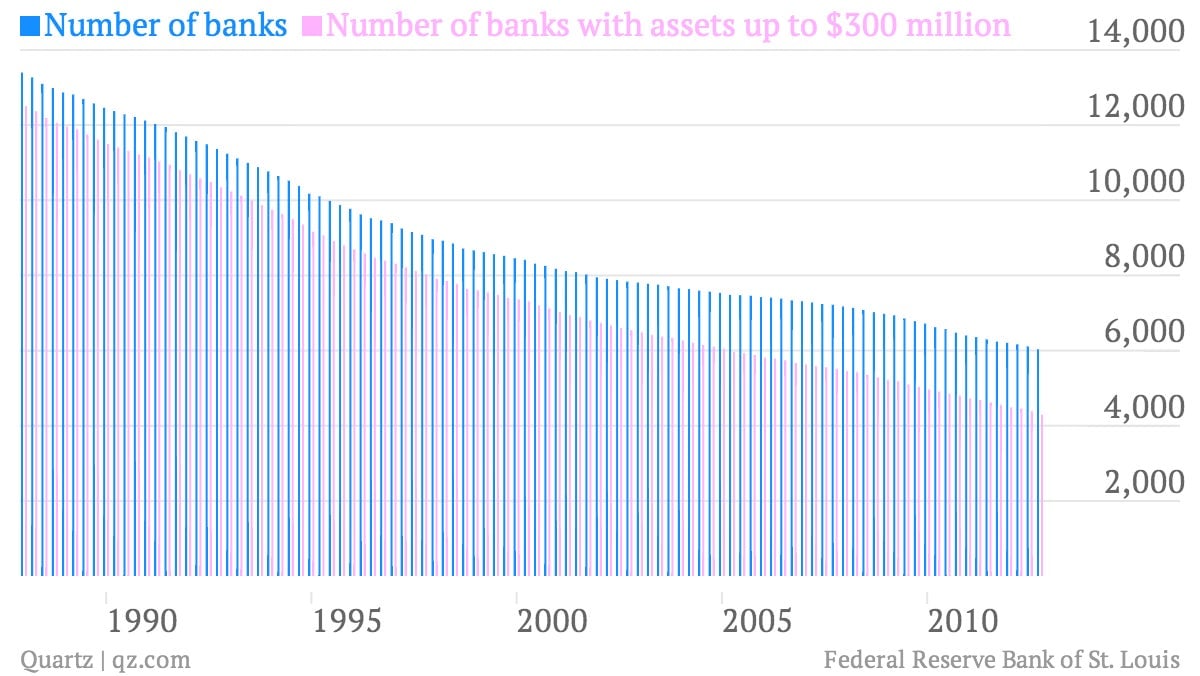

This is part of a trend that’s been happening for years. Factoring out the decline in the number of banks with assets up to $300 million, the number of banks in the US hasn’t really fallen by much. There were 7,364 fewer banks in the US in the third quarter of 2012 than there were at the beginning of 1988, when the Federal Reserve began compiling this data. The number of very small banks declined by 8,216 in that time period. (Some of these banks simply got bigger and are still in existence today.)

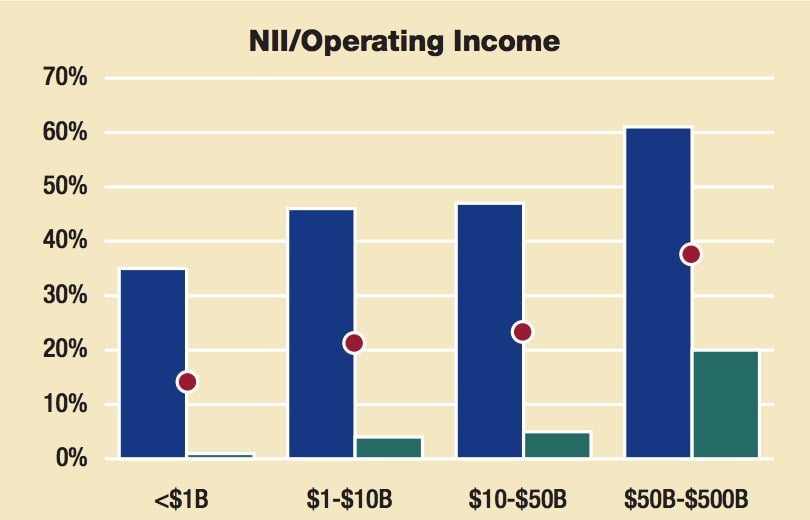

But it also points to clear economic advantages of size, and not just in systematically important (or “too big to fail”) institutions. The number of banks with assets between $300 million and $1 billion has grown by 120% in that time period. The number of banks with assets between $1 billion and $10 billion is up 36%. Phleger and Haraf predict that the small banks (by their definition, those with less than $10 billion in assets) have much to gain from growing just a little bit, writing, “Healthy community banks have much to gain from acquisitions — more so than large banks that cannot meaningfully increase scale through community-bank deals.”

It’s highly likely that the US could see a growing number of medium-sized regional banks, diminishing the pinch of legal costs associated with regulation but more diversified and big enough to cut down on funding costs.