Yet another sign that European monetary policy no longer works

The European Central Bank cut interest rates from 0.75% to 0.50% yesterday, a long overdue attempt to loosen credit in a recession that has seized peripheral Europe and is seeping into the euro zone’s strongest economies. Although big companies may be able to borrow money, small- and medium-sized ones can’t—and these businesses are the drivers behind economic growth.

The European Central Bank cut interest rates from 0.75% to 0.50% yesterday, a long overdue attempt to loosen credit in a recession that has seized peripheral Europe and is seeping into the euro zone’s strongest economies. Although big companies may be able to borrow money, small- and medium-sized ones can’t—and these businesses are the drivers behind economic growth.

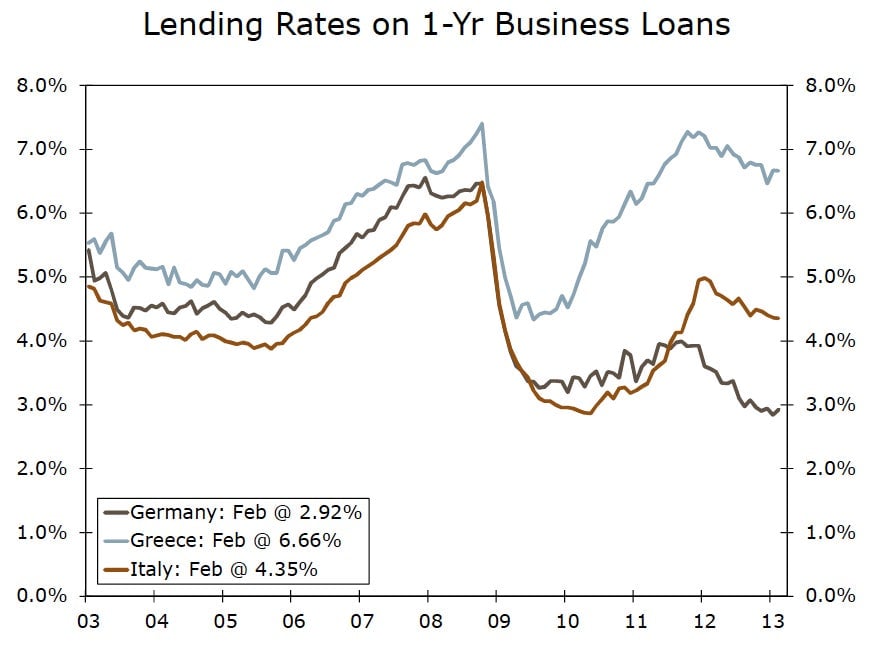

This problem is magnified in peripheral Europe. The chart above shows that business owners in Greece were paying a whopping 6.66% to borrow money for a single year, while their German friends got to borrow at an interest rate below 3%. Although Greeks have long paid a higher interest rate to borrow money than Germans have, the premium has skyrocketed since 2009. Italians, who traditionally borrowed more cheaply than Germans, are now paying well over a percentage point more than them to borrow the same money.

We’ve been haranguing you for the past week about how a rate cut wouldn’t help Europe return to growth because low interest rates offered by the ECB aren’t reaching the consumer. Interest rate changes move through the banking system. Investors continue to have very real concerns about certain banks, and are charging banks more to borrow. So even though the ECB has cut interest rates by a full percentage point from July 2011, only German borrowers appear to have seen the full effect.

Wells Fargo’s Jay Bryson and Zachary Griffiths apparently agree with us:

The level of the ECB’s policy rates is not the main problem faced by the European financial system today. Rather, lending standards are much tighter in peripheral European economies, which continue to struggle with sovereign debt problems, than in the core countries. Lending to the non-financial sector in peripheral European economies is especially weak today. A solution to the European sovereign debt crisis, which is at the heart of the financial problems in Europe, is beyond the scope of the ECB.

If they have any hope of boosting lending and returning the regional economy to growth, European policymakers will need to take action well beyond cutting rates.