A standoff in Vienna will determine who is the world’s real king of oil

The fate of oil prices—including whether motorists pay more or less at the pump in the coming months—is playing out right now in Vienna. The key is who leaves Austria the leader of the world’s oil-producing countries. Saudi Arabia insists it remains the prestigious king of oil; not so fast, say Iran, Iraq, and Russia.

The fate of oil prices—including whether motorists pay more or less at the pump in the coming months—is playing out right now in Vienna. The key is who leaves Austria the leader of the world’s oil-producing countries. Saudi Arabia insists it remains the prestigious king of oil; not so fast, say Iran, Iraq, and Russia.

Until that question is decided, look for OPEC to remain in chaos, oil prices to continue gyrating, and gasoline and diesel prices with them, but at the current, relatively low level. As of publication, oil prices are plunging, with traders losing confidence that the cartel will manage to strike a deal on cutting about 1 million barrels a day of its production.

The brinksmanship is unfolding at Vienna’s luxury Kempinski Hotel, where ministers from the OPEC cartel have been in long meetings ahead of their formal session tomorrow. Some of the old mystery over the direction of oil prices has lapsed as OPEC now live-casts some of its proceedings.

But the drama remains. OPEC continues to produce a third of the world’s oil supply, by far the largest single chunk. Since the 1970s, the Saudis, with among the world’s largest oil reserves and the greatest readiness to turn on and off the tap at will, have been the statesmen of oil, the most influential actor determining supply and price. But their suzerainty has been shaken over the last few years by the US shale revolution, which has added millions of unexpected barrels onto the market, and diluted the Saudis’ power.

Two years ago, the Saudis tried to end the shale threat by flooding the market with oil, forcing down prices, and thus sweating out high-price shale drillers. To a degree, it has worked—the oil price plunge has forced more than 200 North American oil and gas companies into bankruptcy.

But since the nadir of under $30 a barrel in January, prices have slowly climbed back up—Crude Oil Brent is trading at $46.87 a barrel as of this writing. That, along with much more efficient drilling, has rescued shale.

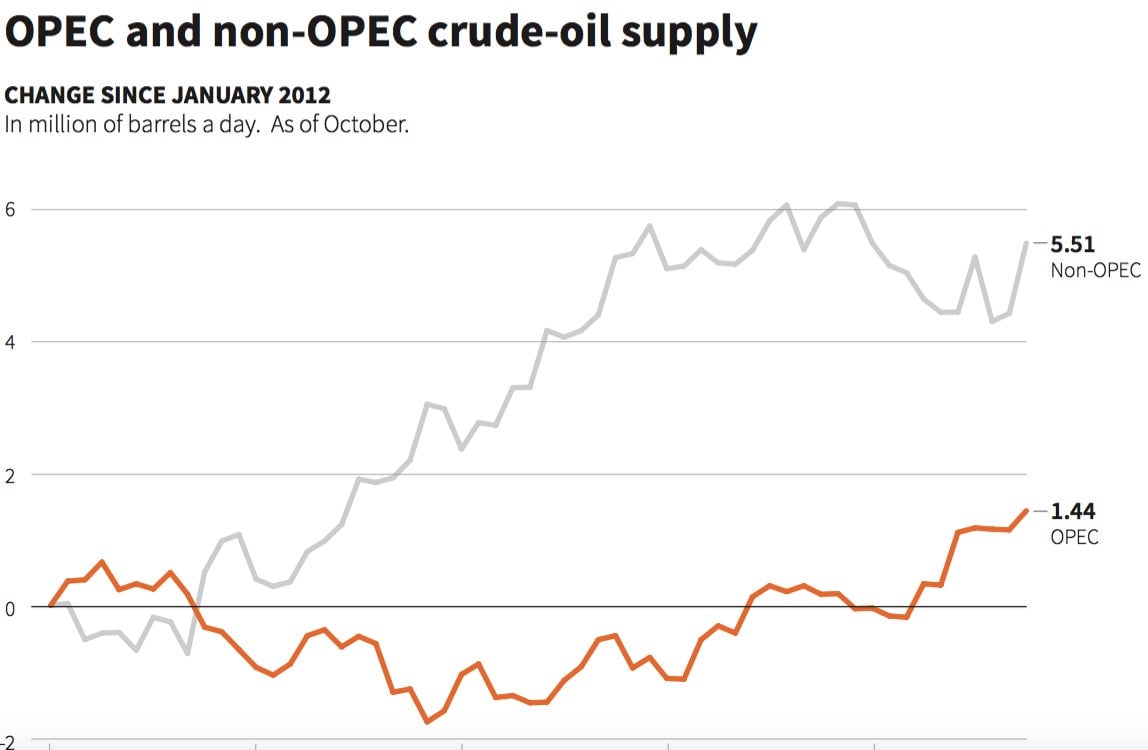

Drillers who are still operating have restarted rigs they had idled: the number of operating rigs is up 50% from the trough in May, according to Baker Hughes, and climbing each week. US oil production is still well off its peak of about 9.6 million barrels a day in 2015, but has climbed back to about 8.7 million barrels a day, the highest it’s been since June, according to the US Energy Information Administration. In the chart below, US shale makes up almost all the increase in non-OPEC production.

Meanwhile, the world’s petro-powers—OPEC plus Russia—are suffering from enormous budget deficits, and are desperate for oil prices to go up.

Analysts say that rising demand is gradually soaking up the excess oil supply. By the second half of next year, Goldman Sachs said in a note to clients yesterday, the oil market will be in balance, and prices will tick up above $50 a barrel.

Everyone in Vienna concurs that cutting OPEC production to accelerate that perceived trend is a great idea—but no one can agree on who should do the cutting. Well, that’s not precisely true. Everyone thinks that the Saudis should do all or most of the cutting, except for the Saudis, who are insisting that the pain be more evenly shared.

Specifically, the Saudis want Russia, Iran, and Iraq to cut. And until the others agree, the Saudis say they are prepared to wait out the natural order of the market over the coming months. The other three, unsure whether the Saudis are bluffing, are reportedly sticking mostly to their own stubborn posture, with Russia as of now refusing even to send its oil minister to Vienna. In a note to clients today, Citigroup’s global head of commodities research Ed Morse said he thinks Iran and Iraq will blink. “Our belief that the Saudi threat is credible, and that the Iranians/Iraqis are aware of this, is why we think a deal gets done.”

Goldman is not so sure—it pegs the chance of a deal at just 30%.

In the end, only the four cartel members know whether they will finish their poker game by tomorrow.