As Trump calls out China for currency manipulation, Taiwan may be the real offender

“Cheating” China was one of Donald Trump’s best-loved campaign trail bugbears. And it still is, it turns out. After facing blowback for his phone call with Taiwan’s president—a move that snubbed China, which claims sovereignty over Taiwan—Trump defended himself via his favorite spleen-venting medium:

“Cheating” China was one of Donald Trump’s best-loved campaign trail bugbears. And it still is, it turns out. After facing blowback for his phone call with Taiwan’s president—a move that snubbed China, which claims sovereignty over Taiwan—Trump defended himself via his favorite spleen-venting medium:

He’s wrong on the currency part. In the last few years, China hasn’t been devaluing the yuan, as we’ve discussed before. In fact, it’s been selling off its US-dollar assets to keep the yuan more valuable than it should be—in effect, making Chinese exports more expensive.

Here’s the real kicker, though: it’s much more likely that Taiwan, and not China, is manipulating its currency.

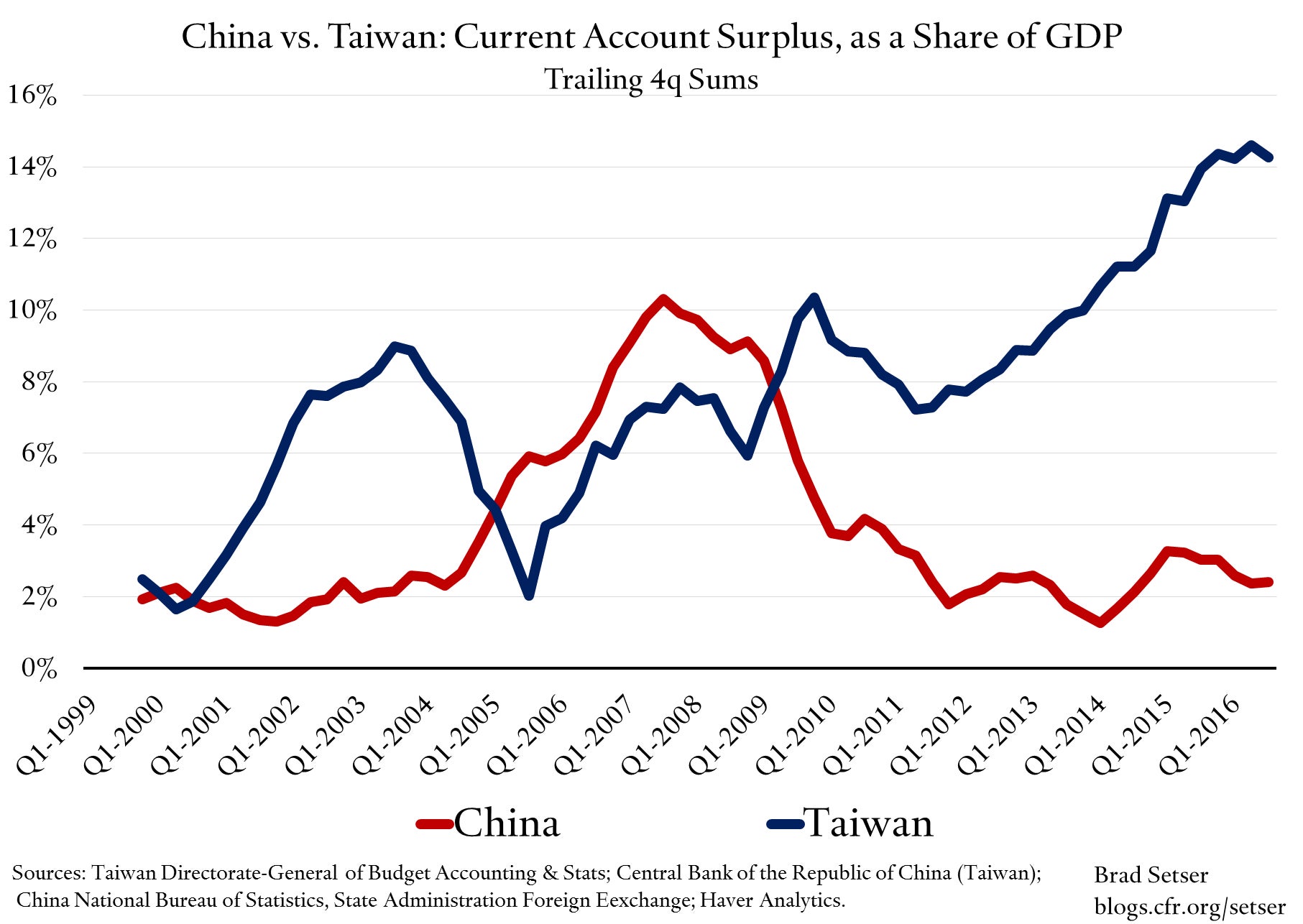

Let’s review the evidence. The size of a country’s current account surplus—which represents how much more it saves than it consumes, and exports than it imports—is a reliable clue to whether a country has been cheapening its currency to boost its export sectors, helping it keep its people employed. Taiwan has long run a colossal external surplus, notes Brad Setser, a senior fellow at the Council on Foreign Relations—and as you can see, it’s now bigger than ever. Little surprise, then, that Taiwan’s central bank has bought up as much as $3 billion in foreign currency each quarter of this year, as Setser notes. That keeps the New Taiwan dollar from strengthening.

How does that compare with China?

As you can see, China too once ran a massive external surplus. But it has lately shrunk to around 2% of GDP. And for the last few years, the Chinese yuan’s real effective exchange rate (which reflects a currency’s inflation-adjusted value against a basket of other currencies) has climbed sharply.

Those who agree with Trump might point to the Aug. 2015 drop in the yuan’s value as an instance of “devaluing,” i.e. deliberately making the yuan cheaper. However, that drop was actually due to the PBoC changing its policy so it manipulated the yuan less than it had been doing. The yuan depreciated because investors thought it was overvalued.

And though the yuan has weakened throughout 2016 as investors moved their money out of China, the People’s Bank of China has still been selling down its reserves—which pushes up the yuan’s value. That suggests the central bank is trying to prevent the yuan from weakening at a faster pace. (A rapid depreciation could trigger a self-reinforcing panic).

It’s easy to dismiss Taiwan given how small it is compared with China.

“But it is also factually true that Taiwan has a bigger current account surplus and a more consistent pattern of intervention to resist appreciation over past few years than China does,” writes Setser. “Which adds to the awkwardness of singling China out… if that is in fact what President-Elect Trump plans to do.”

Correction (Dec. 6, 2016, 1pm): An earlier version of this post said China’s currency has been overvalued since 2011. However, there is no consensus among economists about whether the yuan is overvalued or undervalued.