Turkey’s economy comes of age with a prized investment-grade rating

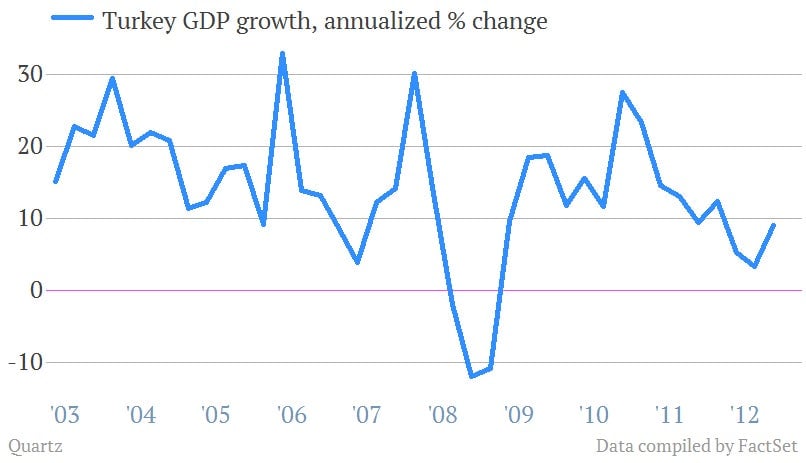

Moody’s Ratings agency upgraded Turkey’s long-term credit rating to Baa3 for the first time today, giving the country an investment-grade rating at two out of the three major credit ratings agencies. In a post-financial crisis world, Turkey has leveraged an important geopolitical position with competitiveness, prudent fiscal policy, and economic reforms, even as more advanced economies struggle to grow.

Moody’s Ratings agency upgraded Turkey’s long-term credit rating to Baa3 for the first time today, giving the country an investment-grade rating at two out of the three major credit ratings agencies. In a post-financial crisis world, Turkey has leveraged an important geopolitical position with competitiveness, prudent fiscal policy, and economic reforms, even as more advanced economies struggle to grow.

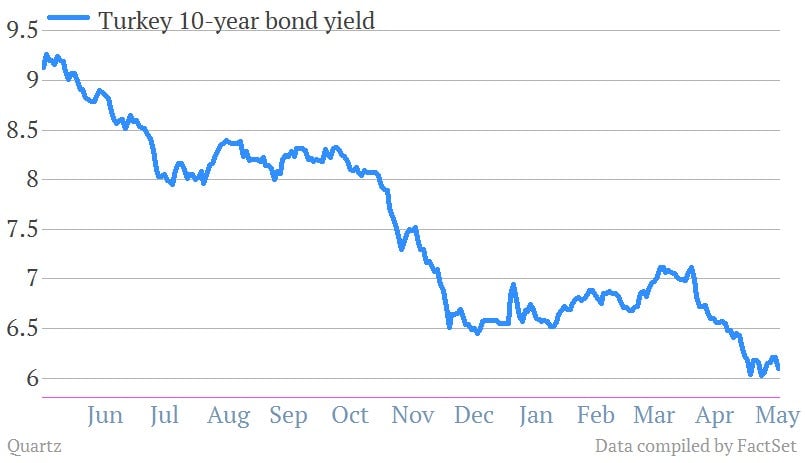

Turkey hasn’t missed out on benefiting from the global “search for yield.” With the safest assets yielding a pittance, investors have flooded into places like Turkish government bonds which are considered more risky. That’s driven the yield on those bonds—the price Turkey’s government has to pay to borrow for a certain number of years—down more than three percentage points over the last year.

But the country hasn’t used the promise of easy financing to expand its debt burden; to the contrary, in fact. Since 2009, the country has slashed its public debt from 46.09% of GDP to 36.06% of GDP. It’s also reduced the share of its debt denominated in foreign currencies (which means it won’t be forced to pay back debts in potentially more expensive currencies) from 46.3% in 2003 to 27.4% in 2012. Nor have companies gone crazy issuing debt they may not be able to pay back; total outstanding corporate debt is at about the same level it was five years ago ($217 billion).

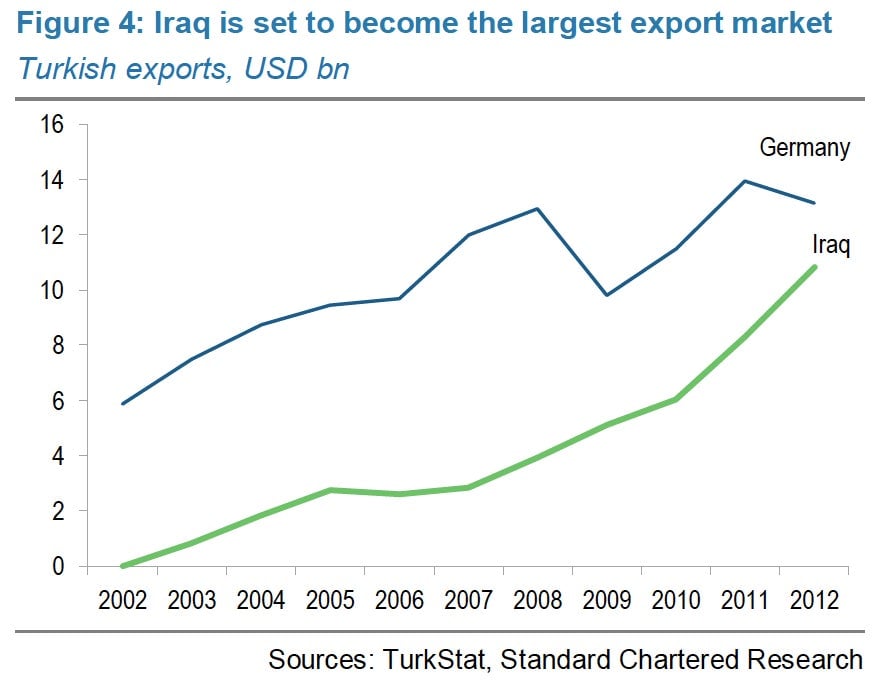

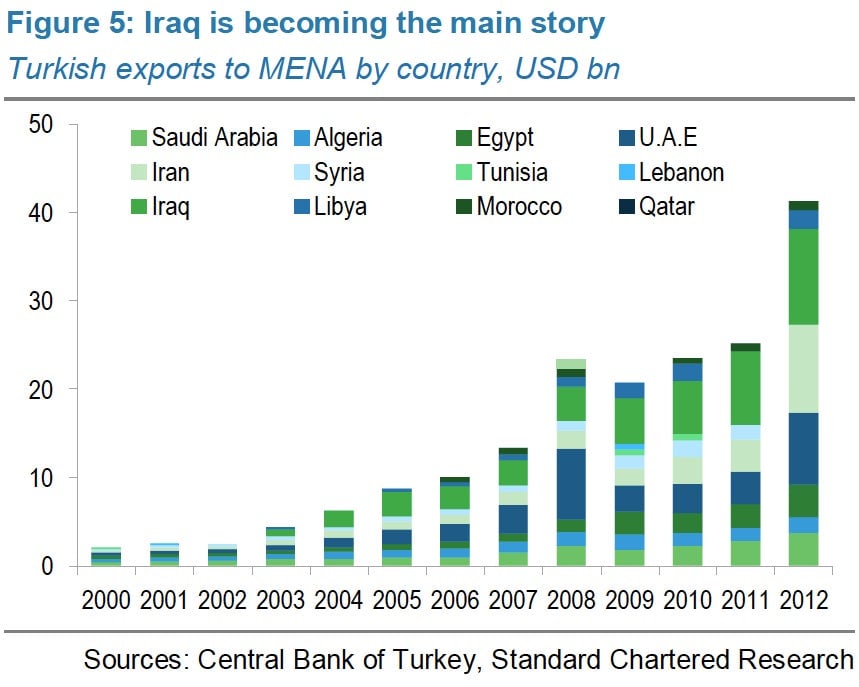

Turkey exports the highest number of goods to Germany—an economy that’s remained relatively resilient despite crisis elsewhere in the euro area. Its second-biggest export market is Iraq, with which it has been developing close economic ties.

But even beyond that, Turkey has become a crucial economic bridge between the West and the East, cultivating strong trade relationships with Middle Eastern and North African neighbors.

With seemingly sustainable growth, low public debt, strong regional partnerships, and tame inflation, then why is Turkey only now becoming an investment-grade prospect? Moody’s warns that external vulnerabilities—susceptibility to economic and geopolitical shocks from Europe or the Middle East—still have the capacity to jolt Turkey’s economic success.

Located at the hotbed of two continents and numerous geopolitical conflicts, it’s unlikely that these kind of threats will subside anytime soon. Even so, today’s Moody’s upgrade is an important achievement; with a credit rating equal to Spain’s, Turkey has arrived on the global economic playing field.