Americans are driving less, and have been for years

It’s been more than five years since US driving peaked in 2007, and today’s new data (pdf) from the US Department of Transportation shows the drop continues from last year, with 3.7 billion fewer miles travelled this March, compared with March 2012.

It’s been more than five years since US driving peaked in 2007, and today’s new data (pdf) from the US Department of Transportation shows the drop continues from last year, with 3.7 billion fewer miles travelled this March, compared with March 2012.

Driving, the quintessential US mode of transit, has not increased in half a decade, even though the economy and population have continued to grow. That’s the longest slump in vehicle usage since the early 1980s.

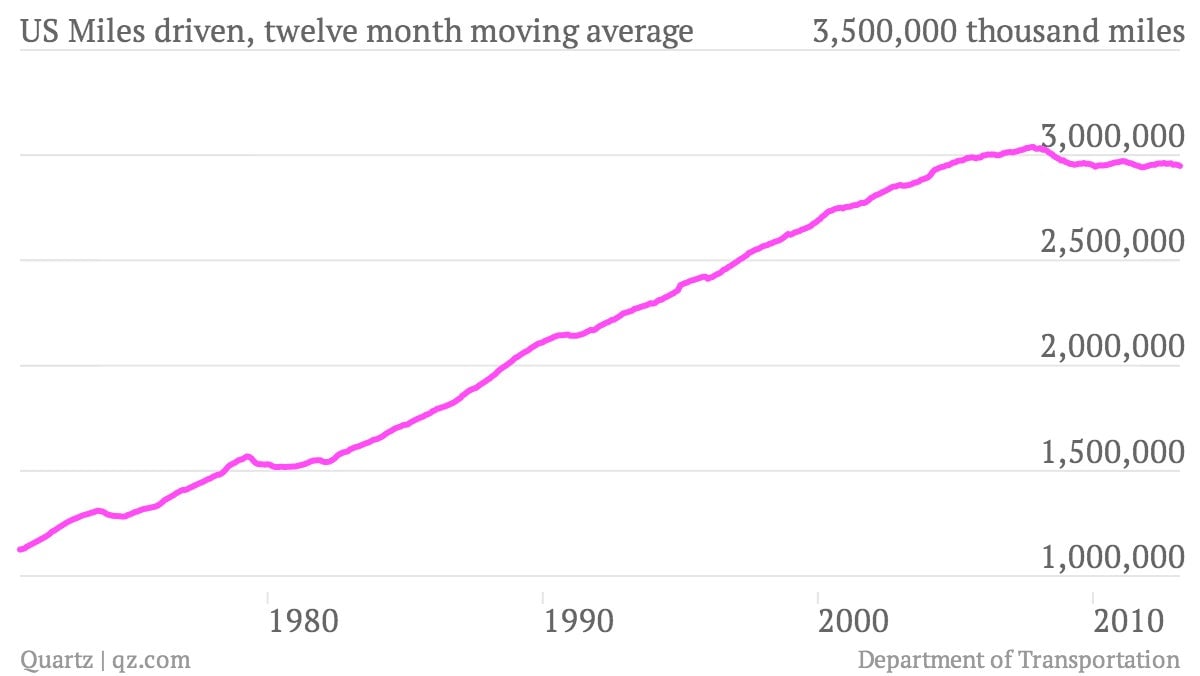

The number of miles driven hasn’t recovered since the recession ended. Usage has hovered steadily below an average of three billion miles a year:

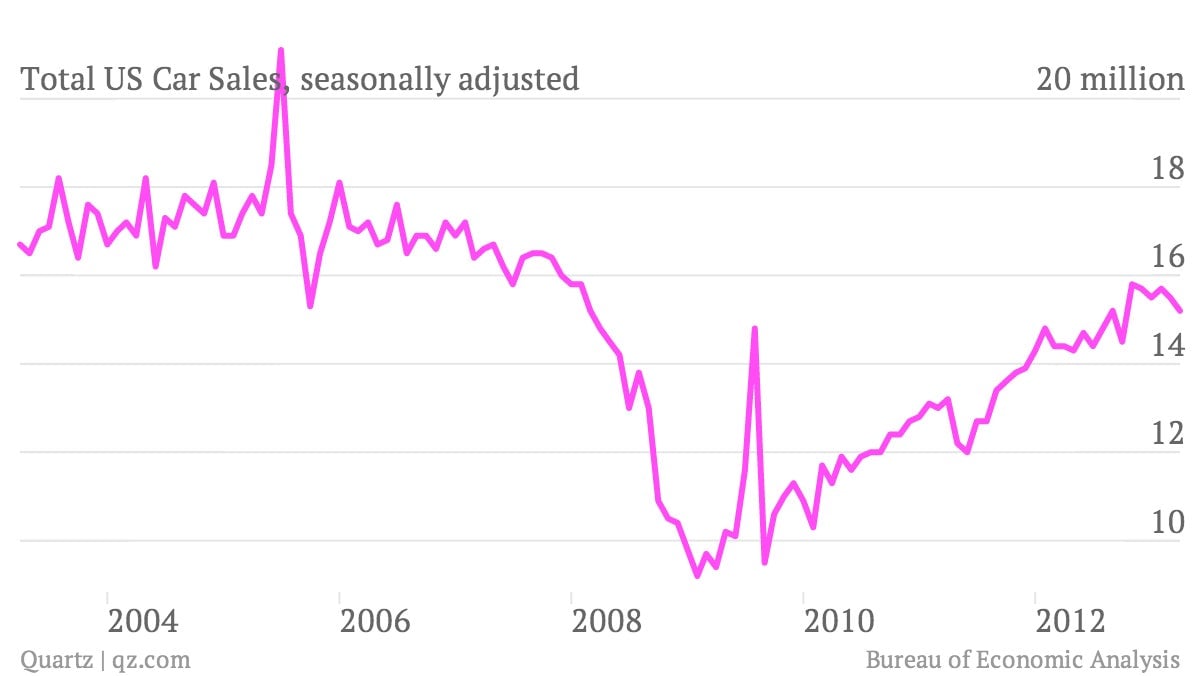

This is reflected in US auto sales, which haven’t recovered to pre-recession levels either:

People don’t make as many big purchases, like cars, when money is tight. Since the recession, automakers have benefitted from an unleashing of pent-up demand —in other words, people who put off purchases have finally given in. (As for the spike in 2009, it parallels the much-derided cash-for-clunkers government stimulus program, which gave car owners a tax incentive to trade in older, less-efficient cars.)

But demographics are catching up with car-makers: Younger Americans drive less than previous generations, while car-crazy baby boomers are aging their way off the road. Higher gas prices have also curbed car driving, which has in turn helped reduce carbon emissions.

Analysts don’t think we’ve reached peak car just yet, however. Most expect that if the economy really gets going, the number will beat its 2007 high as more people find new jobs and better pay. Car companies expect the recovering housing market to boost pick-up truck sales this year, just as they did in 2006 and 2007.

But the long-term trend for cars in advanced economies is slow growth, and carmakers are rethinking the market. The next big thing? Companies like Ford are all about mobility.