China has too much US government debt, so it’s gearing up to buy real estate instead

China has $3.4 trillion in foreign currency reserves, and they appear to be burning a hole in the central bank’s proverbial pocket. Or at least that’s what you might conclude from the fact that the State Administration of Foreign Exchange (SAFE), the steward of China’s foreign reserves, just quietly opened a new office in New York.

China has $3.4 trillion in foreign currency reserves, and they appear to be burning a hole in the central bank’s proverbial pocket. Or at least that’s what you might conclude from the fact that the State Administration of Foreign Exchange (SAFE), the steward of China’s foreign reserves, just quietly opened a new office in New York.

Getting out of Treasurys

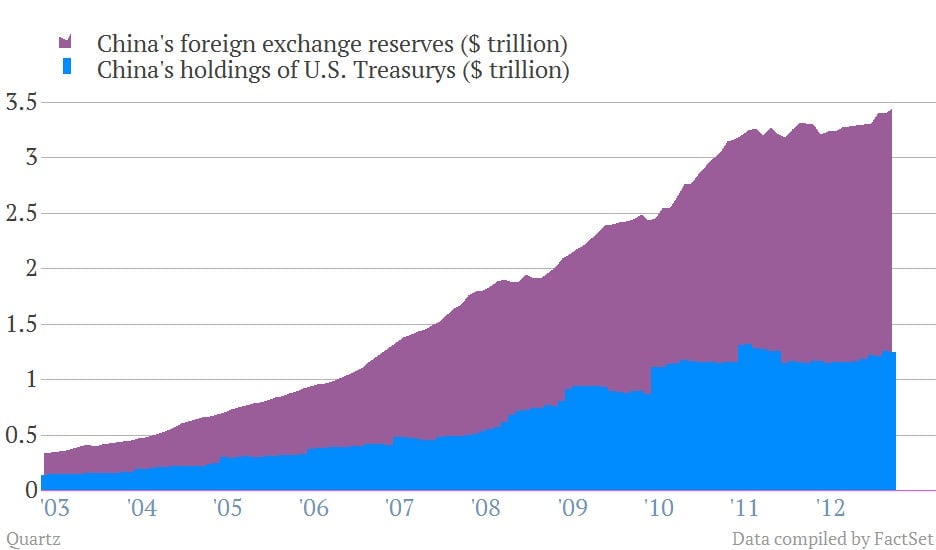

Actually, SAFE already has an office in New York. But that one’s for buying US Treasurys, in which more than $1 trillion in reserves are parked. As the Wall Street Journal reports (paywall), SAFE is worried that when the Federal Reserve eventually scales back its program of quantitative easing—i.e., buying safe assets like government bonds—their value will fall. Here’s China’s investment in US government debt as a rough proportion of its total reserves:

As you can see, that blue part has been leveling off for a while now—in fact, China slipped behind Japan as the biggest foreign investor in US government debt in March. But all the same, SAFE holds a not-insubstantial 7%-8% of outstanding US government debt, and if it starts selling it, that could deal a blow to demand, especially if the Fed starts retreating too.

What will SAFE buy instead?

The WSJ reports that the new operation will focus on investing in real estate, private equity and other US assets. SAFE has recently been diversifying into Japanese stocks and European assets. It also just bought $1.6 billion worth of property and utilities (link in Chinese) in London and Manchester. In the past, SAFE also bought stakes in Australia-New Zealand Bank, BP and Total, reported ChinaStakes in 2010.

And it’s not exactly a stranger to the US market. SAFE has been shoveling cash into US hedge funds and investment firms like BlackRock and Bridgewater Associates since as early as 2005, said ChinaStakes. But Derek Scissors, an economist at the Heritage Foundation in Washington DC, estimates SAFE’s non-bond investments in US assets to be $4.5 billion, paltry compared to the $567 billion SAFE currently manages, according to SWF Institute. With this new office, that investment share could grow a lot.

Wait, does this mean China won’t be the “US’s banker” any more?

Um, it never was.

That’s because China has to invest in Treasurys. In order to make exports cheaper and to transfer wealth toward businesses and the state, the Chinese government has suppressed the yuan’s value. But it also kept its capital account closed, in order to avoid the likes of George Soros or other menaces to Asian currency values. The only way to pull off both has been to suck up dollars used to buy Chinese goods or invest in Chinese assets.

Do that for a decade or so, et voila—$3.4 trillion! It’s not as wonderful as it sounds, though. It’s proven hard to protect the value of those holdings, and one of the only markets big, safe and liquid enough has been US Treasurys. This latest development really just means SAFE has exhausted the possibilities of that option.