Someday, you may use bitcoin without even knowing it

Bitcoin backers have big dreams—dreams of reinventing the financial system based around a currency not issued by governments and not subject to the whims of central banks. But the cryptocurrency’s volatility over the last few months has raised questions about whether most people would want to depend upon it to pay for goods and services.

Bitcoin backers have big dreams—dreams of reinventing the financial system based around a currency not issued by governments and not subject to the whims of central banks. But the cryptocurrency’s volatility over the last few months has raised questions about whether most people would want to depend upon it to pay for goods and services.

Despite the wealth of bitcoin-related startups entering the market, even bitcoin’s most avid supporters admit that its volatility might not subside anytime soon. But that might not matter. After all, bitcoin isn’t really a tool for normal consumers; while it may be used by companies to exchange money and avoid transaction costs, there’s little reason for small-time consumers ever to use bitcoins directly.

Why you shouldn’t own bitcoins

The beauty of bitcoin is its independence from the traditional financial system—the fact that transactions once made are irreversible and can be untraceable. That’s also a huge drawback for most normal, law-abiding people in stable economies. “Bitcoin is basically based on mistrust rather than trust,” said Reuters columnist Felix Salmon, at a Quartz conference on bitcoin on May 22 (pictured above). “If you look at the way people use currency in the real world, then they like the ability of banks to hold their money for them.”

That’s because banks offer clients a variety of protections—they allow clients to contest transactions, monitor for fraud, and will assume some losses if a client’s identity is stolen or account is hacked. Governments monitor banking activity and guarantee deposits. And in stable economies, the vast majority of people trust that their government will make good on its debts and that the cash in their wallets today will be worth about as much as it will tomorrow.

“The first people that are going to use it are the ones that are pushed out of the other monetary system,” said Charlie Shrem, the CEO of startup BitInstant, at the event. Hence the proliferation of businesses like Silk Road, which allowed people to purchase drugs online using bitcoin, and the popularity of bitcoin in places like Cyprus and Argentina.

Put simply, owning bitcoin might make sense for people deeply suspicious of the government or banking system, engaging in illicit activity (whether rebelling against an unjust regime or buying illegal goods), speculating on the currency itself, but it probably doesn’t not for anyone else.

Beyond barter

But bitcoin isn’t just a currency, a medium of exchange between two parties. It’s also a payment system. The code behind bitcoin spells out the way in which the virtual currency can be moved from one pseudonymous account to another and creates a log of every transaction ever conducted. Although you need a bitcoin exchange to help you find buyers or sellers of the currency—and you pay a small fee to use that service—the transfer itself is irreversible, unhackable, and free.

That payment system dimension gives bitcoin a whole new layer of value. Transactions, particularly between different traditional currencies, are expensive. Both banks and wire service companies like Western Union charge hefty fees to move money between one account and another.

Bitcoin could offer a far cheaper and easier way of doing that. And neither consumers nor companies would have to hold on to any sum of bitcoin for more than seconds or minutes, making volatility less worrisome. They’d simply buy bitcoins with traditional currency on one end, move them from account to account, and sell them on the other end, converting bitcoins back into a traditional currency.

That’s one goal of BitInstant, a platform that aims to cut down transaction fees for people moving money. BitInstant’s Shrem wants to make bitcoin a means of exchange accessible to, say, someone working in the US sending money to their family in Ukraine.

This isn’t to say that other payment systems couldn’t respond by cutting costs and streamlining processes, just that bitcoin is a competitor to the methods of moving money that exist today.

The bitcoin transaction revolution is still a ways off

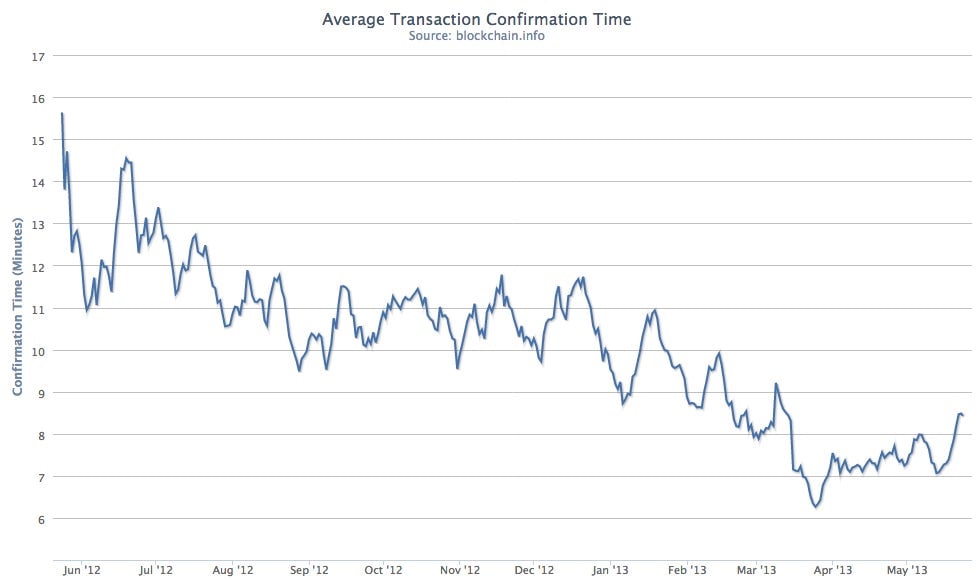

For the bitcoin payment system to function as a fast and reliable alternative to traditional banks and wire services, though, the architecture of its exchange will require upgrades. Some 80% of trade in bitcoins now takes place on Mt.Gox, a bitcoin exchange that many in the industry consider to be backwards, glitchy, and poorly run. But alternatives to the old system are coming. New bitcoin startups like Coinsetter promise trading in microseconds rather than minutes or hours, and promise more protection against hackers.

For now, bitcoin extremists will probably continue to push two conclusions: its supporters will still see bitcoin one day solving the world’s financial instabilities, while skeptics will argue that it is doomed to failure. But the reality lies somewhere in between.