Donald Trump’s global supply chain problem, in one chart

President-elect Donald Trump has articulated a simple plan to help create jobs in the US: Use tariffs to punish foreign governments who adopt unfair trading practices like currency manipulation, and to force US firms to import less.

President-elect Donald Trump has articulated a simple plan to help create jobs in the US: Use tariffs to punish foreign governments who adopt unfair trading practices like currency manipulation, and to force US firms to import less.

“Our original Constitution did not even have an income tax,” Trump said in Pennsylvania in June 2016. ”Instead, it had tariffs—emphasizing taxation of foreign, not domestic, production…today, 240 years after the Revolution, we have turned things completely upside-down. We tax and regulate and restrict our companies to death, then we allow foreign countries that cheat to export their goods to us tax-free.”

But is this actually how trade works today? It turns out the reality is a little more complicated. We do tax the subsidiaries of foreign firm doing business in the US. But what’s much more significant is that America’s biggest exporters and biggest importers are often found in the same firms.

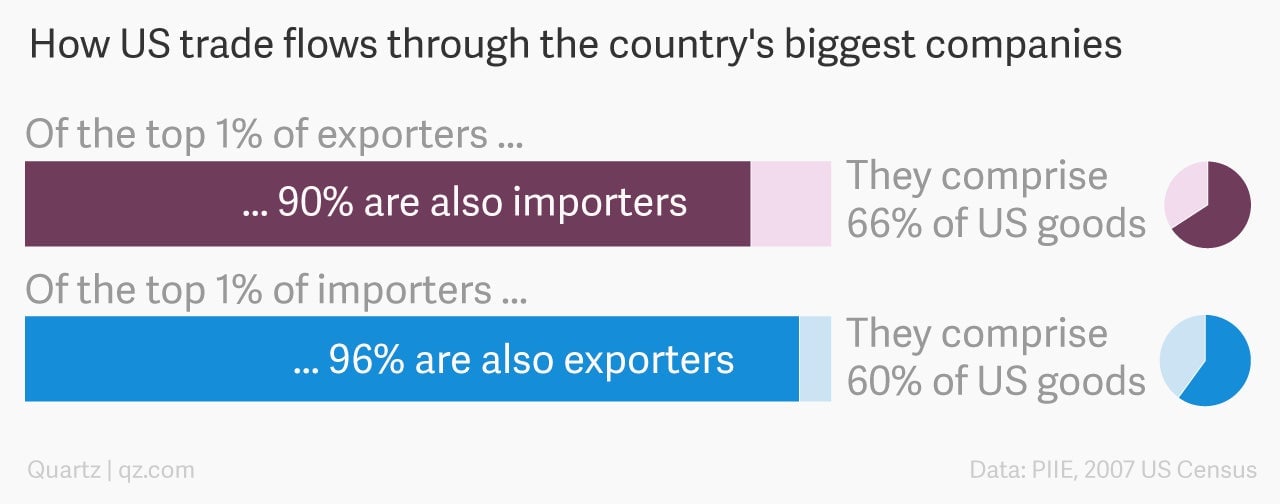

J. Bradford Jensen, an economist at the Peterson Institute for International Economics, analyzed US census data from 2007 to assess how firms behaved at the peak of US trading power. He found that the top 1% of importers and exporters—representing 66% of all imports and 60% of all exports, respectively—were often the same companies.

In fact, it turns out 53% of biggest importers are also the biggest exporters. And of the biggest exporters, 36% are also among the top importers. That means it’s very hard for government policy to punish imports while boosting exports. The two go hand in hand.

Economists suggest this is because of how trade affects businesses. Only the most competitive firms can be exporters, because foreign buyers aren’t going to look abroad for goods that are lower quality or more expensive than they can get at home. And one way firms become competitive is by building a global supply chain that brings them raw materials or components at a low cost that are then finished in the US.

One example is the manufacturing supply chain that has sprung up at the US-Mexican border; another might be the crude oil imported to the US to be refined. That’s one reason that Koch Industries, the politically influential petroleum conglomerate, has expressed skepticism about a Republican plan to increase import taxes. Certainly Donald Trump is familiar with the concept of becoming more competitive through imports, since many of his and his families’ branded consumer goods are manufactured abroad.

All together, what these data show is that attempts to drive up exports by punishing imports may not be the smartest way to give US companies an advantage on the world market, at least in the near-term.