Threat of capital controls looms over Thailand as it loses “currency war”

Thai finance minister Kittiratt Na-Ranong said today that government officials are working on new rules (paywall) meant to stem the flood of capital into the country, particularly into short-term government bonds. New regulations could also force investors to hedge some baht-denominated investments.

Thai finance minister Kittiratt Na-Ranong said today that government officials are working on new rules (paywall) meant to stem the flood of capital into the country, particularly into short-term government bonds. New regulations could also force investors to hedge some baht-denominated investments.

As the world’s largest central banks–the US Federal Reserve, the Bank of England, and the Bank of Japan–push investors towards riskier assets, smaller economies get flooded with cash, which pushes up the value of their currencies and makes their exports less competitive. The monetary balance in a place like Thailand, where exports account for about 60% of the economy, is far more precarious than it is in larger countries.

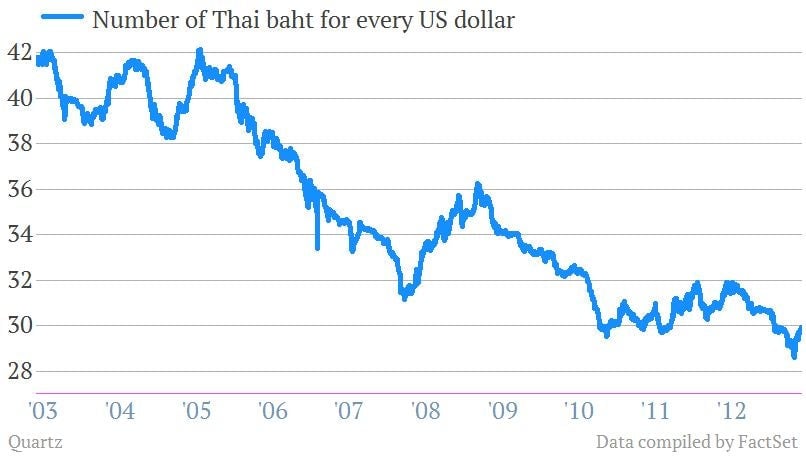

Thai producers have felt threatened by a 6% rise in baht against the dollar (which has since moderated). By contrast, the US dollar has risen nearly 20% against the Japanese yen, with little effect on the US economy. Thai exports fell 0.1% in the first quarter of 2013 compared with the previous quarter, and the economy contracted 2.2%. By contrast, in the fourth quarter of 2012, exports had grown 3.0% over the previous quarter, and the economy had grown 2.8%. (All those figures are seasonally adjusted.)

Usually a central bank can stymie such a flood of cash by cutting interest rates. That makes credit cheaper, releasing cash from the banking system into the economy, and thus lowers the value of the currency, counteracting the effect of the capital inflows. That’s what some analysts believe Thailand’s Monetary Policy Committee might do when it meets on May 29. But the Thai economy is still growing rapidly, and too much cheap credit could overheat it. That’s why Thailand might have to resort to more drastic measures.

Kittirat didn’t go as far as to call the new policies “capital controls,” which would explicitly restrict flows of money in and out of the country. But this wouldn’t be the first time Thailand has resorted to capital controls to slacken the appreciating baht. In 2006, the government tried to force investments to remain in the country for a year. In 2010, it instituted a withholding tax on government bonds. Neither attempt was successful.