Exports buoy European manufacturing, but deflationary pressure looms

May data on manufacturing business activity for a slew of countries in Europe are out, and they’re surprisingly upbeat. At a 15-month high of 48.3, the overall euro zone purchasing managers’ index (PMI) suggests that the pace of deterioration of business conditions is slowing throughout the region.

May data on manufacturing business activity for a slew of countries in Europe are out, and they’re surprisingly upbeat. At a 15-month high of 48.3, the overall euro zone purchasing managers’ index (PMI) suggests that the pace of deterioration of business conditions is slowing throughout the region.

Q2 euro zone GDP is still likely come in at around -0.2%, (pdf) says Markit chief economist Chris Williamson. But the PMI data relieves some of the pressure on the European Central Bank to expand monetary easing at its next meeting on Thursday. “Although the euro area manufacturing economy continued to contract in May, it is reassuring to see the rate of decline ease to such a marked extent,” said Williamson. ”The sector still seems some way off stabilizing, however, and therefore remains a drag on the economy.” Also worth noting: nearly all countries surveyed slashed prices, a sign of deflationary pressure. Here’s a visual roundup of what you need to know:

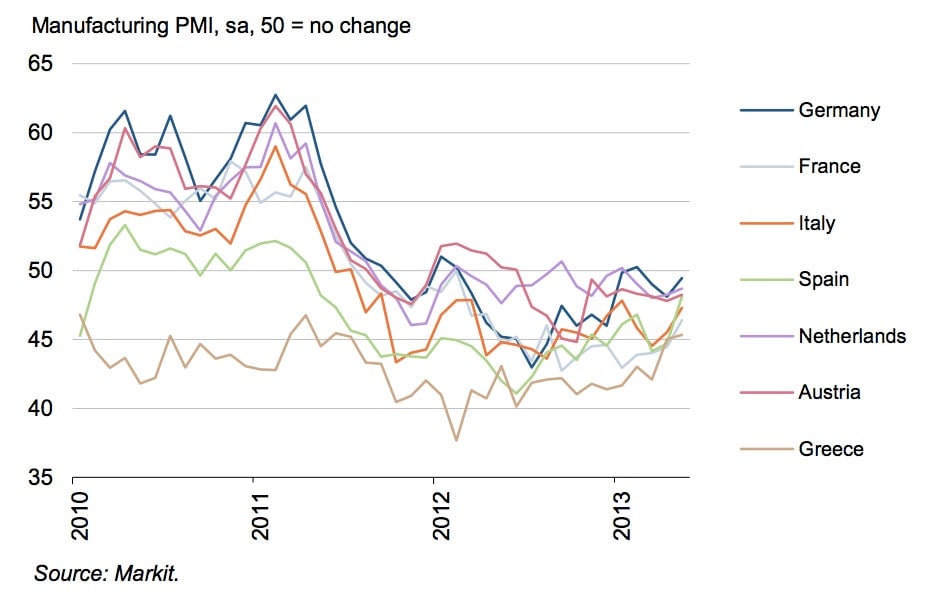

Germany wasn’t the only country contributing to the improvement; countries across the board saw gains:

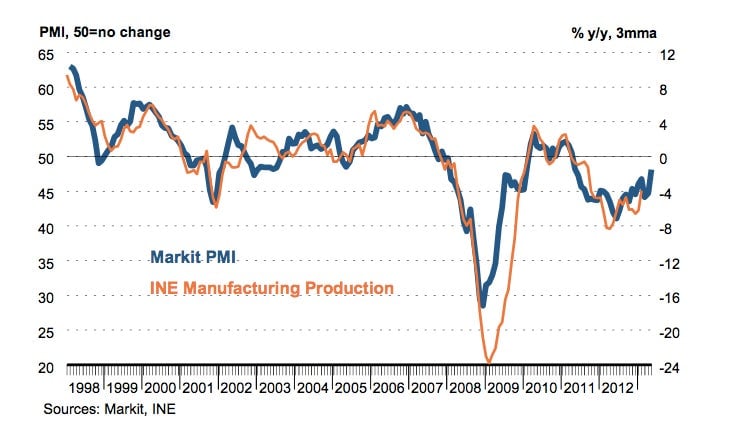

In fact, Spain’s PMI hit a two-year high of 48.1, as new export orders picked up for the first time in three months (pdf):

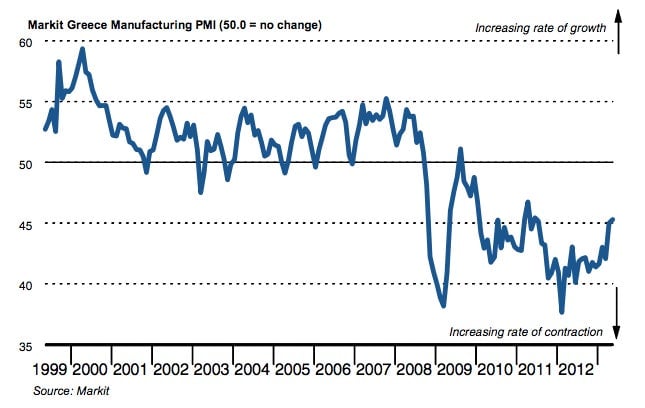

At a 23-month high, Greece’s PMI did nearly as well, as the rate of contraction in export orders slowed (pdf):

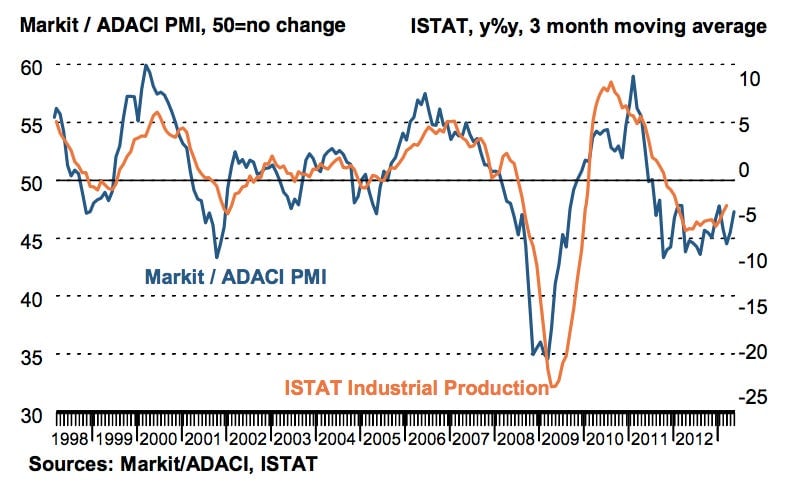

Italy also improved thanks to an uptick in demand from foreign markets (pdf):

In France, the manufacturing downturn eased, but its PMI is still declining rapidly due to a crippling combination of deflation and unemployment (pdf):

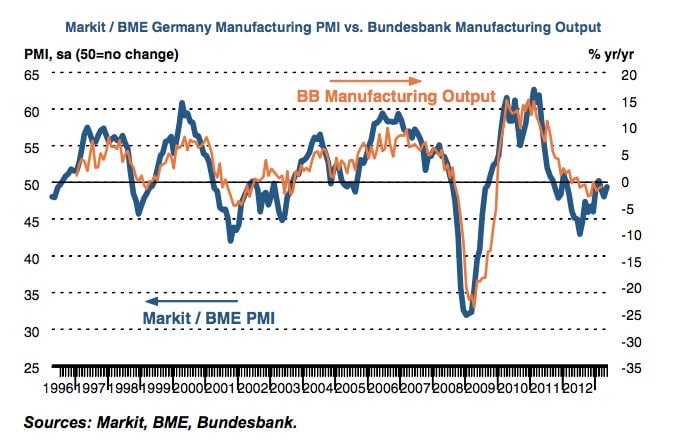

Germany, meanwhile, saw “a pronounced change of momentum in May, as output and new orders both expanded for the first time in three months,” (pdf) according to Markit’s Tim Moore:

“Conditions remain fragile”

(pdf) in the Netherlands, wrote Markit economist Jack Kennedy, though a small increase in export sales stabilized output:

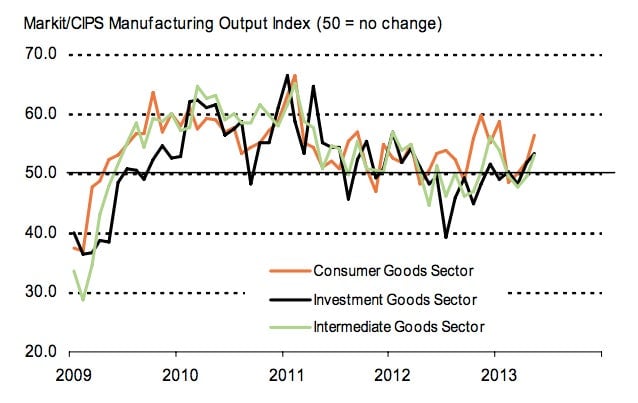

Outside the euro zone, UK manufacturing continued its recovery, as a pickup in both domestic demand and overseas orders (pdf) boosted all three segments: