New analysis proves Trump’s tweets attacking companies are mostly just distractions

When now-US president Donald Trump took aim at Boeing on Twitter in December, the internet gasped collectively and the plane manufacturer’s share price fell 1%.

When now-US president Donald Trump took aim at Boeing on Twitter in December, the internet gasped collectively and the plane manufacturer’s share price fell 1%.

In the following weeks, he went on to subject companies including Lockheed Martin, General Motors, and Toyota to withering tweets. Their shares fell following his blasts. And CEOs throughout the US have assembled crisis plans to deal with the nightmare possibility of a mean Trump tweet.

But a new analysis of stock-market data shows that the president’s Twitter attacks have had no lasting impact on his corporate targets’ share prices.

For this analysis, Quartz turned to Joe Sutherland, a senior quantitative analyst at Prattle, a firm that specializes in assessing the impact of market-moving language. Sutherland ran the numbers for us—and it turns out Trump’s complaining tweets may cause short-term noise, but no long-term market signal.

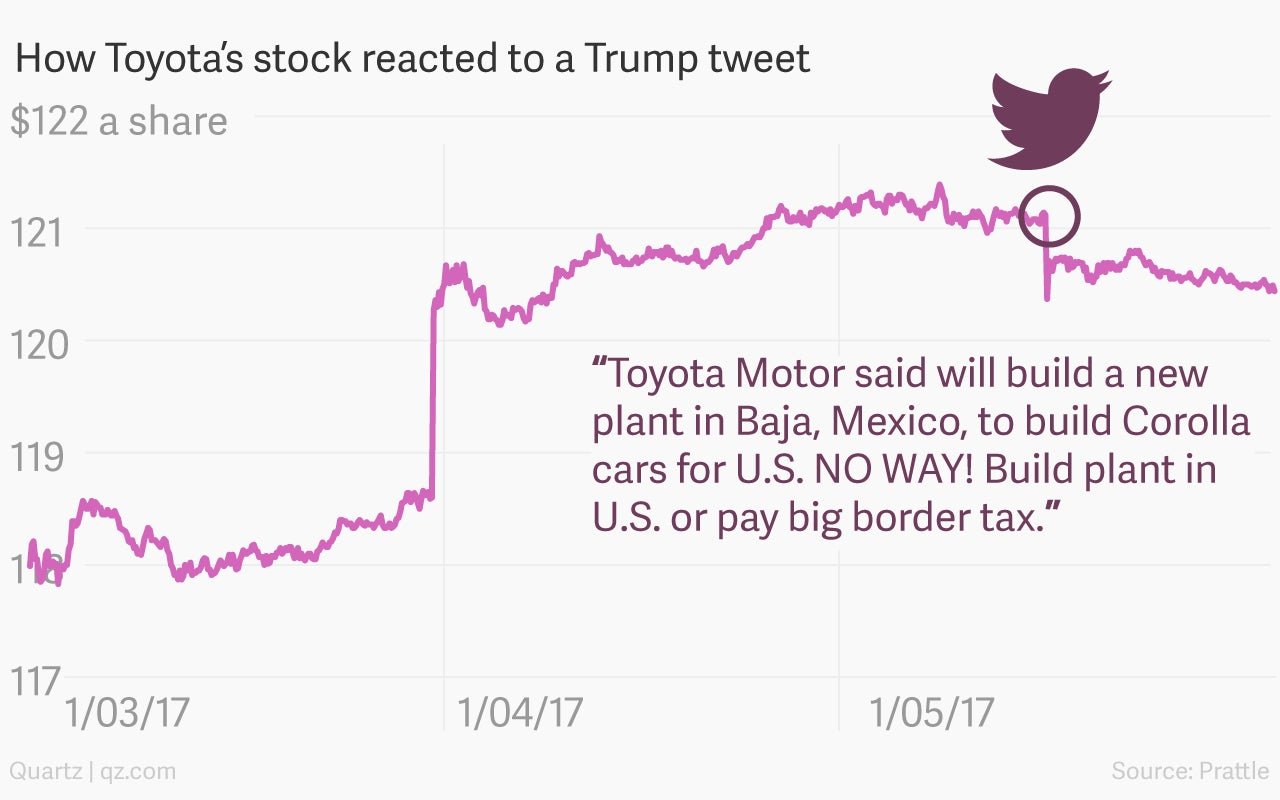

Here’s how that pattern looks. After president Trump threatened Toyota with tariffs, the stock took a hit, then resumed its trajectory. Trading had been relatively flat prior to the tweet, and it continued on that way.

And here’s how a favorable mention of Fiat-Chrysler played out.

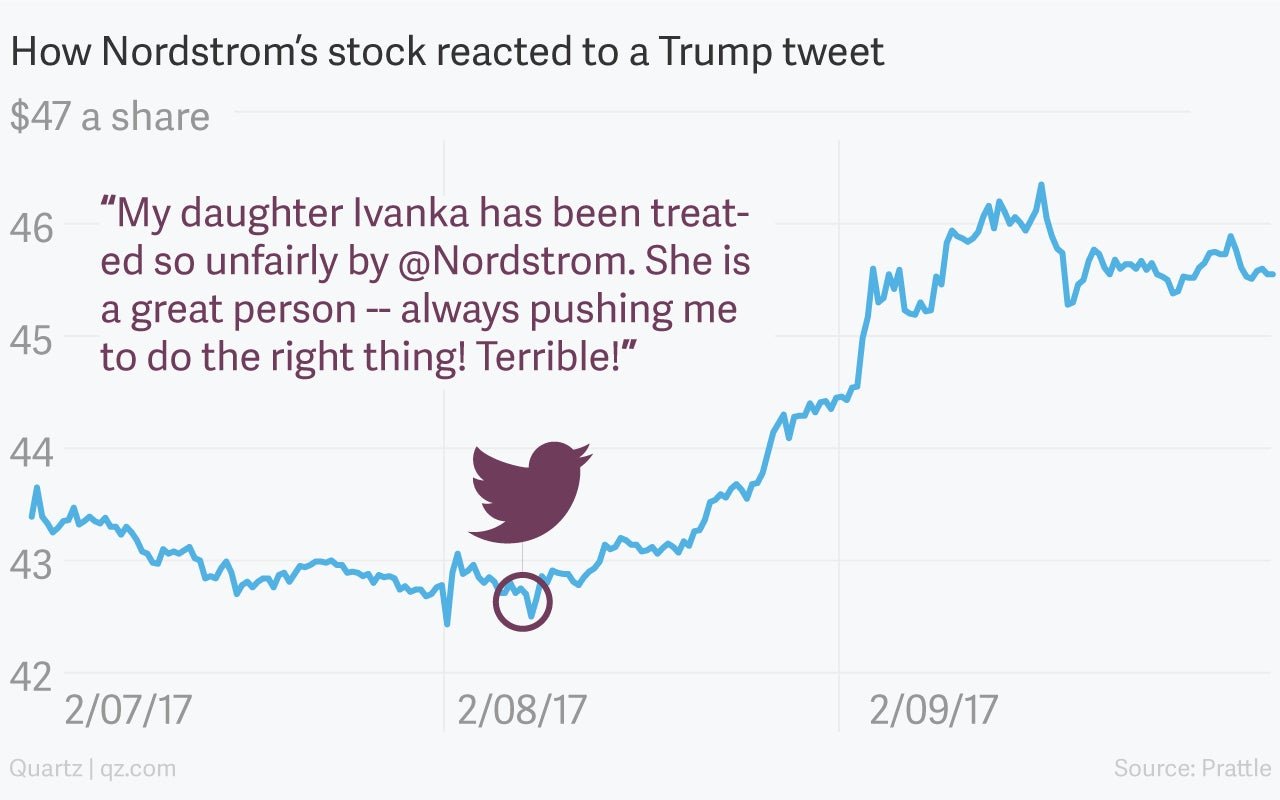

In the case of Trump’s Feb. 8 tweet raging against Nordstrom for dropping his daughter’s clothing line, the retailer’s shares ticked down and then recovered within four minutes. The market, essentially blinked and yawned.

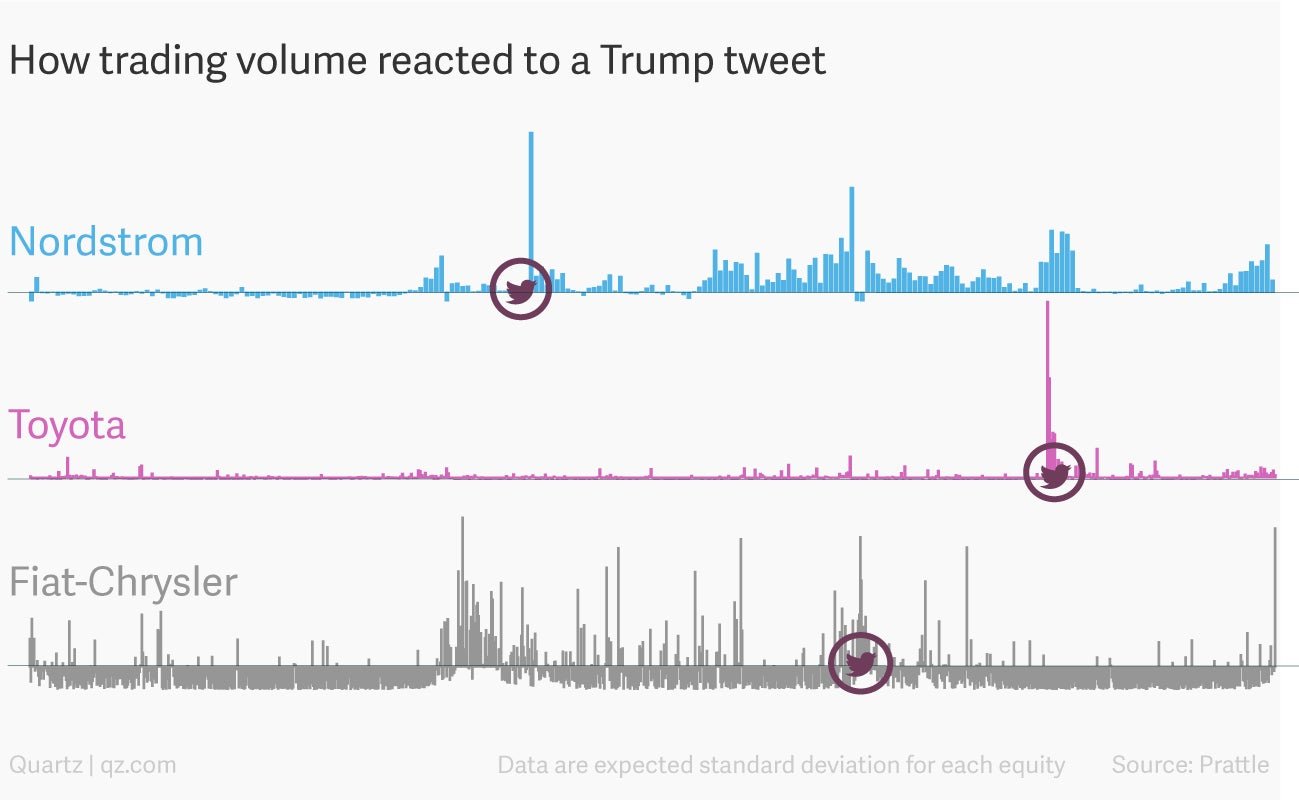

Of course, no one really knows what moves the market. When Zayn Malik quit One Direction the Dow slid one percent. Correlation? To prove that something out of the ordinary is happening, Sutherland looked for significant statistical variation in the expected standard deviation of the share prices. What he found is that the volume of trading increases massively in the hour after the tweet, but the share price doesn’t change that much.

Prattle’s theory is “after a tweet, traders (or bots) make snap judgments on opposite trading ideas, causing high volume with low volatility and no real change in the close price.”

You can see that pattern here, in the charts. Tweeting at Nordstrom and Toyota causes a momentary spike in trading volume. The Fiat-Chrysler tweet is essentially a blip indistinct from all the other blips.

Looking at a 20-day period around each tweet, Sutherland found that the share price returns still remain somewhere around average. And some of the companies’ shares actually even finished the day of the critical tweets flat, as with Boeing, or higher, as with Nordstrom, which rose more than 4%.

That’s not to say that the tweets couldn’t bring other non-share-price pressures to bear on companies, leading them to try to placate Trump or his supporters.

But in terms of the stock market, it’s fair to say the president’s tweets about companies aren’t worth their CEOs losing any more sleep over.