Why northern Europe is home to surprisingly large “shadow economies”

It’s easy to look at southern Europe and see why workers might choose to do informal work without paying taxes. With record unemployment and steep barriers to entry to some professions (e.g. taxi guilds in Italy), it’s often easier for both would-be employers and would-be employees to skip the paperwork and exchange goods and services under the table. So it’s not surprising that about 20-25% of GDP in Spain, Italy, Portugal, and Greece is probably earned in the “shadow economy,” according to a new study by the Institute of Economic Affairs (pdf).

It’s easy to look at southern Europe and see why workers might choose to do informal work without paying taxes. With record unemployment and steep barriers to entry to some professions (e.g. taxi guilds in Italy), it’s often easier for both would-be employers and would-be employees to skip the paperwork and exchange goods and services under the table. So it’s not surprising that about 20-25% of GDP in Spain, Italy, Portugal, and Greece is probably earned in the “shadow economy,” according to a new study by the Institute of Economic Affairs (pdf).

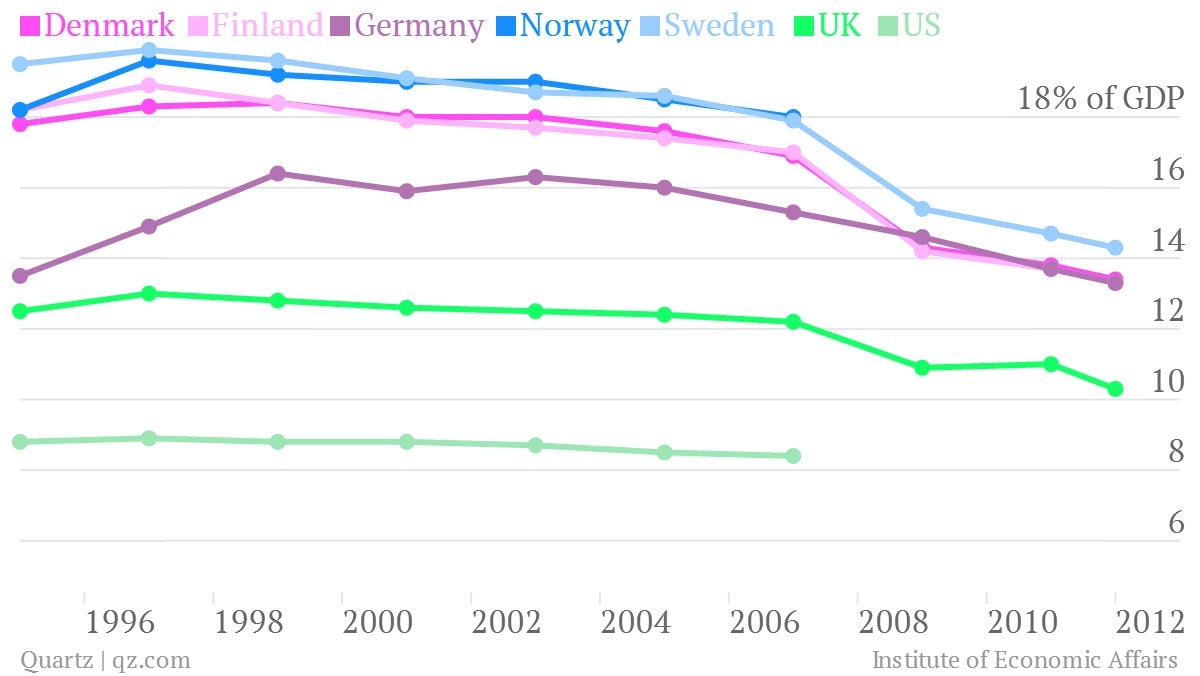

But northern Europe–particularly Nordic countries–boasts shadow economies not that much smaller: about 14% of GDP in 2012, even if that is lower than it used to be. And we’re not talking about full-blown criminal activity like smuggling or drug-dealing; these are simply estimates of goods and services exchanged that aren’t reported.

About half of Danes said they’d paid for undocumented labor in the previous year in a confidential survey, and a full 80% said they would be comfortable doing so. Around 50% of German construction workers have done shadow work. In 2007–the last year for which data for all of the following countries is available–the undocumented trade accounted for 18% of GDP in Norway, 17.9% in Sweden, 17.0% in Finland, and 15.3% of GDP in Germany. By contrast, the shadow economy accounted for 12.2% and 8.4% of UK and US GDP that year, respectively.

So why all this off-the-books activity in northern Europe, where workers enjoy low overall unemployment rates and a bunch of social benefits? It’s especially surprising when you consider that those benefits are so good that everyone wants a job, so there’s virtually no incentive for an individual to work entirely off the books. In Nordic countries, “although the unemployed constitute 4 per cent of the surveyed population, they conduct just 3 per cent of all undeclared work and receive just 2 per cent of all undeclared income,” the study’s authors, Friedrich Schneider and Colin C. Williams, write.

However, those benefits come with a price tag. Once you have health and social security from the state, working more won’t get you more health and social security. But it will mean you pay a higher rate of tax as your income rises. So you have an incentive not to declare all your income.

Thus, Schneider and Williams posit, “the unemployed benefit less from undeclared work than those in declared employment, meaning that undeclared work reinforces, rather than reduces, the inequalities produced by the formal economy.” They attribute the fact that the shadow economy has been shrinking as a share of GDP in many countries to decreased regulation and, in countries such as Sweden, lower tax rates.

But it’s a problem that they see happening in much of Europe: high and progressive tax rates and universal benefits eliminate the incentives to earn more documented income. EU-wide, they estimate that if a single-earner couple were to increase their income from one third to two thirds of the median wage, they’d lose about 58% of the increase in income to taxes.