A close look at interest rates shows some scary trends in China’s growing debt load

In May, the weakening economy meant that China’s “Big Four” state-owned commercial banks issued fewer loans than in April—208 billion yuan ($34 billion), compared with 245.5 billion yuan the previous month. That number was also 20% down on the year.

In May, the weakening economy meant that China’s “Big Four” state-owned commercial banks issued fewer loans than in April—208 billion yuan ($34 billion), compared with 245.5 billion yuan the previous month. That number was also 20% down on the year.

And yet, as Caijing reports, interest rates rose on 50% of new loans (link in Chinese), while only 15% of loans were issued at lower rates. That’s odd because lower loan volume implies lower demand, which would typically force banks to offer cheaper rates. So even though demand for credit is falling, for some reason businesses are evidently willing to pay higher rates.

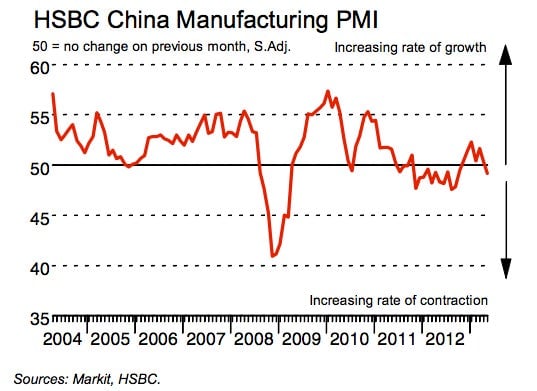

Given the recent slowing of economic activity, it’s not that surprising that many businesses would put expansion plans (and demand for credit) on hold. For instance, the HSBC manufacturing purchasing managers’ index, which measures business activity, hit an eight-month low in May (pdf) due to a drop-off in new business orders. Even the official PMI, which reflects activity for larger companies, reported flat growth in new orders:

Bankers who spoke to Caijing mainly attributed the decline in overall lending to ”the lack of improvement in the economy,” which has made it harder to generate returns and, therefore, riskier to take on loans. Bear in mind that the Big Four Chinese banks are likely to boast China’s more fiscally prudent businesses as their customers. It stands to reason, then, that the businesses paying higher interest rates really need those loans. The simple explanation for why they’d accept higher rates is that they need cash to keep paying off their own bad debts.

FT Alphaville highlights how China’s debt-service ratio, the proportion of income spent on interest and premium on loans, is now a shocking 29.9% of the GDP. As Société Générale explains, 11.1% of that is going to pay off interest rates, while 18.6% goes toward premiums. (Also of note: SocGen’s Wei Yao was assuming a corporate debt ratio of 145-150% of GDP. Last week, Junheng Li of JL Warren Capital told Quartz it could be as high as 200%.)

That would mean that something like 23 billion yuan in May loans went to covering interest payments. In other words, that money is doing absolutely nothing to generate economic activity. No wonder China’s output is declining: nearly one-third of its economy is going to waste.

What’s worse, if those companies paying off interest with new loans were the same ones that accepted higher rates, that debt service ratio will keep climbing.