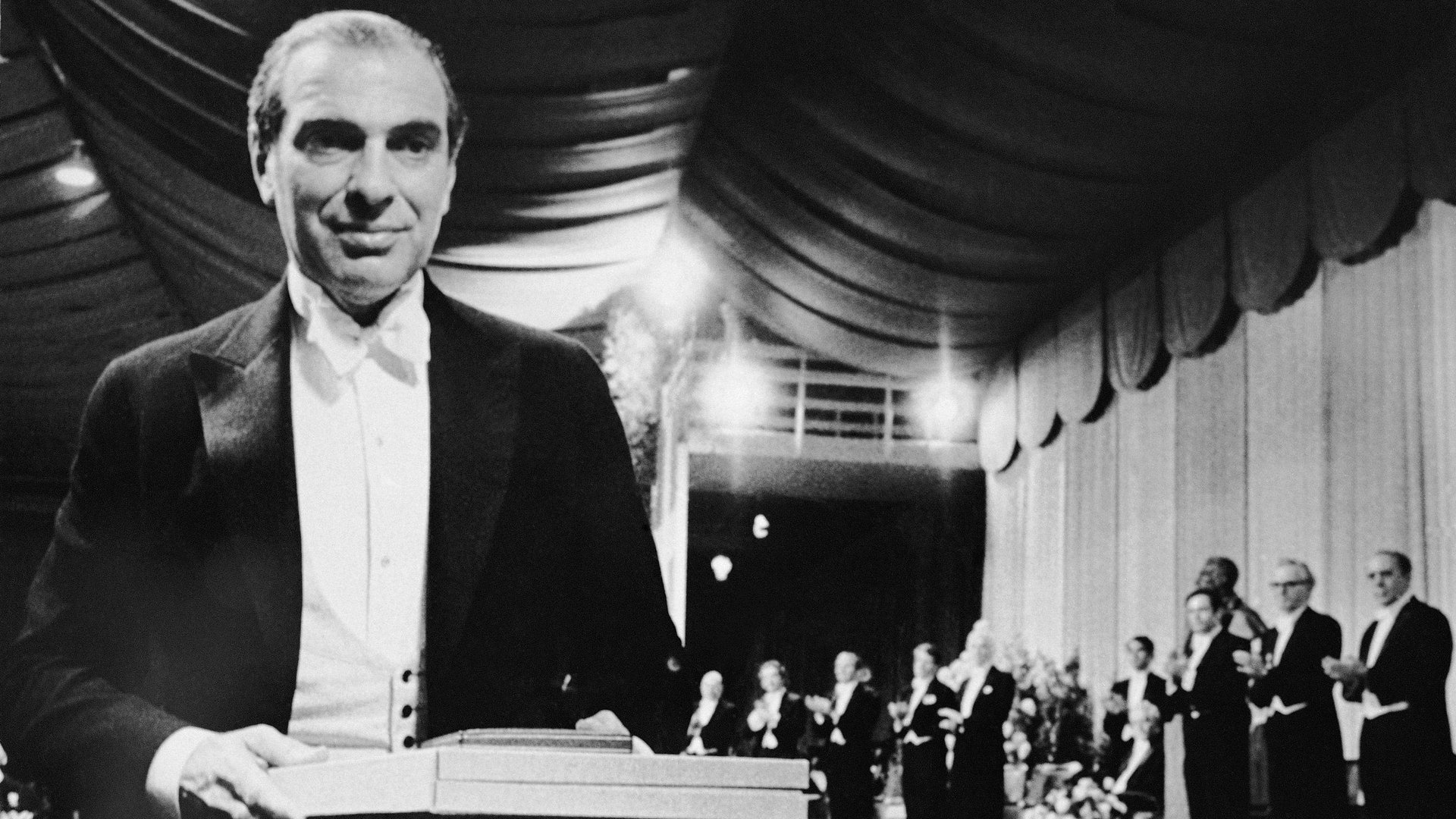

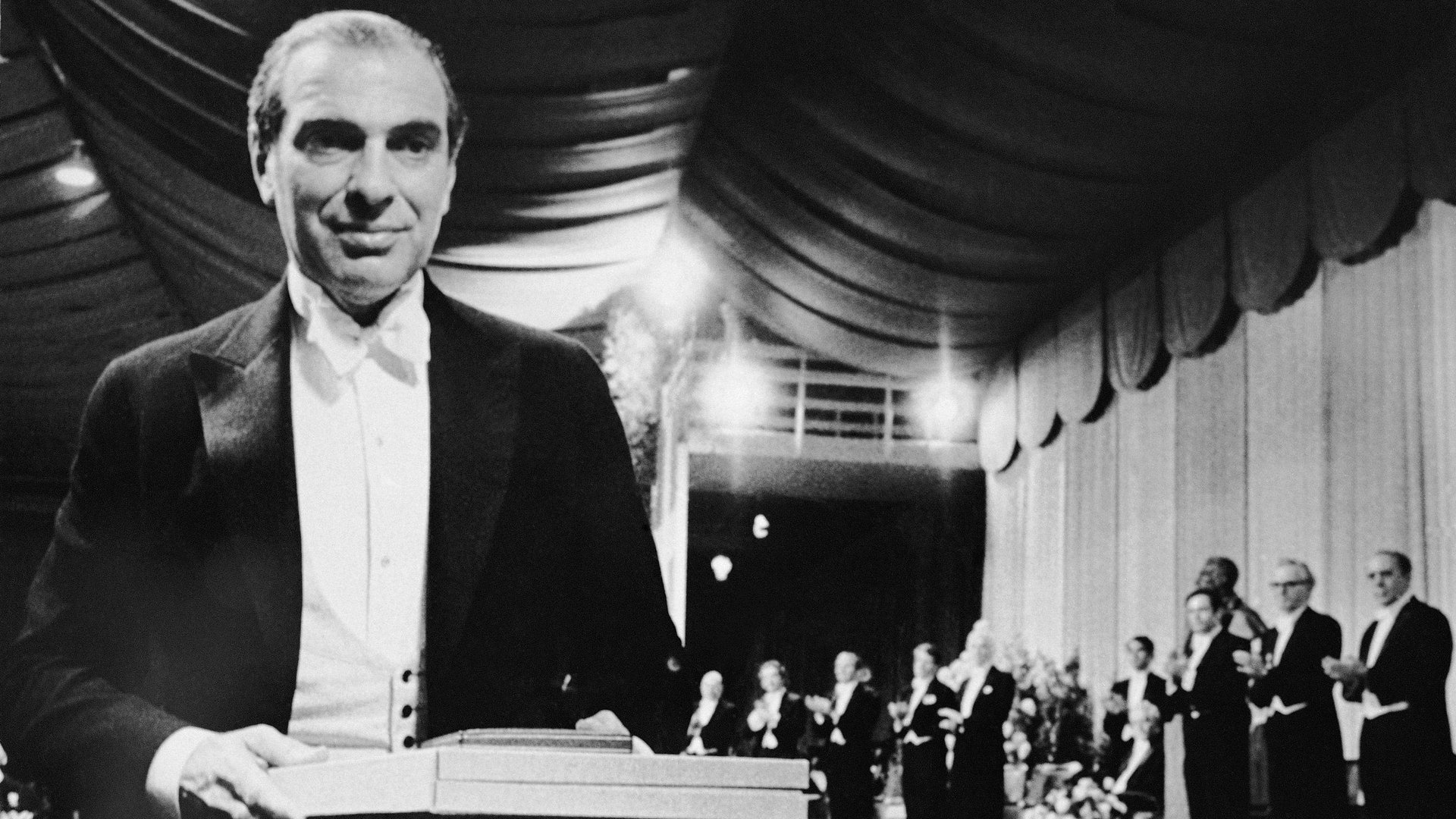

Kenneth Arrow, whose profound theories changed modern economics, has died at age 95

Economist Kenneth Arrow died yesterday at age 95. He was one of the most influential economists in modern history.

Economist Kenneth Arrow died yesterday at age 95. He was one of the most influential economists in modern history.

Arrow spent most of his career at Stanford, and at 51 he became the youngest recipient of the Nobel prize in economics, in 1972 (during a stint at Harvard). His theories crop up in all areas of the field, from micro and macroeconomics to labor and health economics, finance, and beyond. These days, economists tend to focus on applied work and stick closely to their field of specialty. It takes a particularly brilliant mind to be a great theorist, especially one whose work has so many applications.

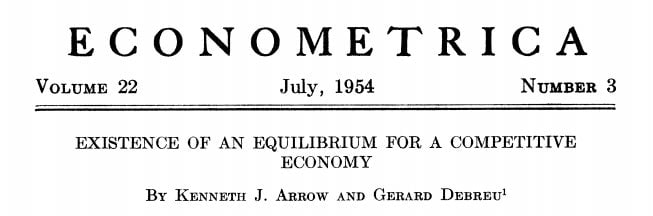

The practical applications of his work are wide ranging. Significantly, many of them stem from the most abstract, stylized model you can imagine. Among Arrow’s many contributions to the economics, but one of the most powerful was the “general equilibrium” theory (pdf). This describes how the whole economy is impacted by a change in one variable. It was a radical departure from the partial-equilibrium approach, where you focus on how a change in price, for example, impacts just one part of the economy. Partial equilibrium models are much easier to understand, but limited, because the economy is so interconnected.

Arrow, along with Gerard Debreu, expanded the traditional models that only allowed for one transaction between a buyer a seller. Theirs allowed for multiple transactions, now and in the future. What’s more, in the future conditions are uncertain, which makes decisions in the present more complicated. This may sound somewhat obvious, but describing this in a robust economic model transformed the field.

The Arrow-Debreu model was highly stylized: the world had only two people, existed for two periods, had competitive markets, and faced a narrow range of outcomes. Still, it helped economists appreciate how time and risk influence the economy. This provided the intellectual foundations for modern finance.

Arrow’s work offers valuable lessons that are sometimes forgotten. It is tempting to judge an economic plan without thinking through all the ways it could impact the economy—or be impacted by other events—both today and in a highly uncertain future. We might assume building a new bridge will create new jobs and generate economic growth, but a wide range of things might happen that will impact the value of the project, like the price of concrete, oil, or labor.

Arrow’s work provided the intellectual framework within which to think about these decisions, and to this day reminds us that even small choices touch all parts of the economy in ways that aren’t so easy to predict.