Soft skills and technology will shape the next generation of finance leaders

Thanks to advances in technology and burgeoning emerging markets, doing business today is a connected, global affair. This complex business environment poses a huge challenge for the finance function. Finance leaders increasingly find themselves embedded directly into lines of business, providing not just analytical heft, but strategic insight at the forefront of decision making processes. This trend is expected to continue—by 2020 cross-functional integrated teams will deliver 80% of traditional finance services within the enterprise.

Thanks to advances in technology and burgeoning emerging markets, doing business today is a connected, global affair. This complex business environment poses a huge challenge for the finance function. Finance leaders increasingly find themselves embedded directly into lines of business, providing not just analytical heft, but strategic insight at the forefront of decision making processes. This trend is expected to continue—by 2020 cross-functional integrated teams will deliver 80% of traditional finance services within the enterprise.

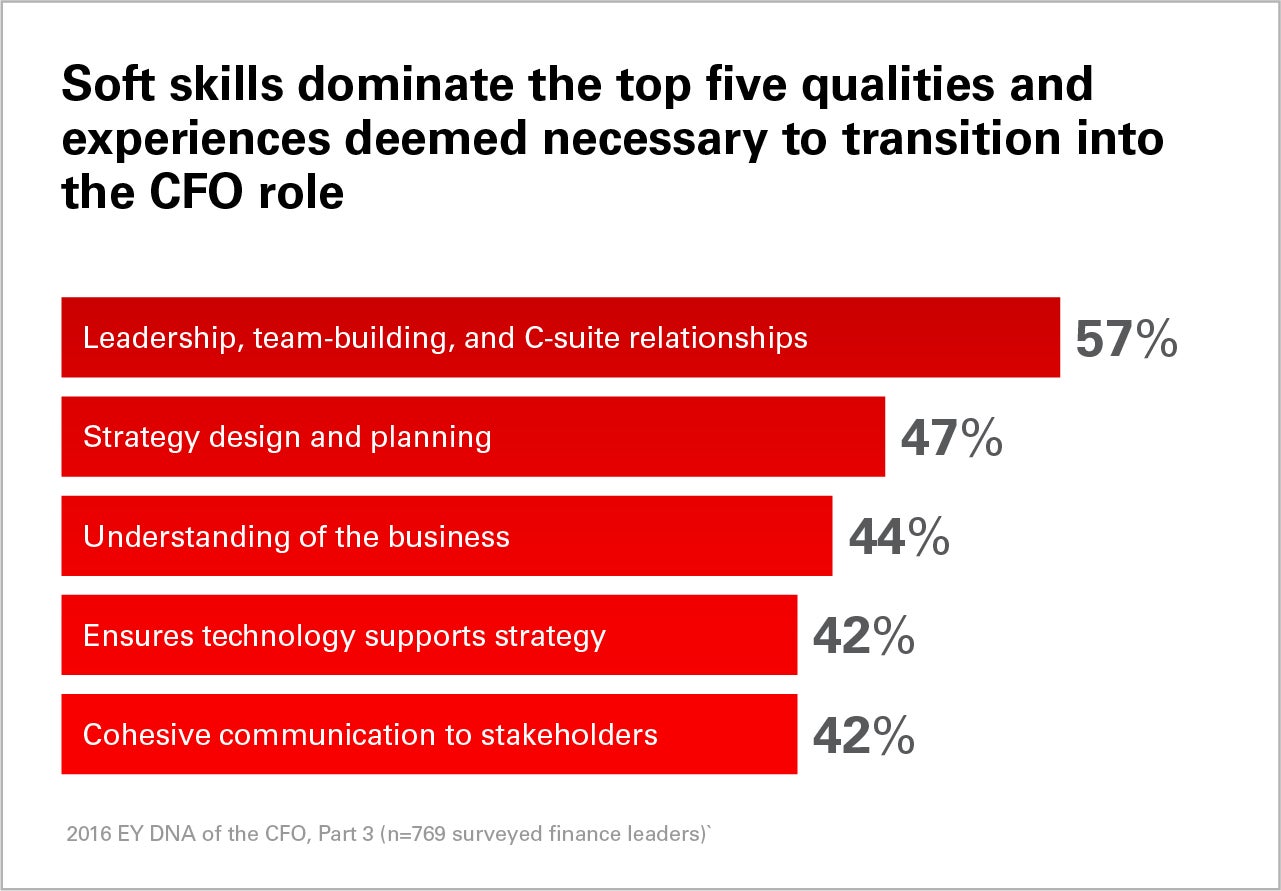

The shift will require cultivating new skills—such as collaboration, communication, and data analysis—not traditionally associated with the finance function. Bridging this gap will entail fostering capabilities that embrace both human and technological capital.

The emerging skills gap

Sometimes described as “bean counters,” finance professionals of the past were back office analysts focused on quantifying the business’s bottom line through tasks like report generation and balance reconciliation. But just as business operations have evolved, so too have analytical needs. In a world where the decisions of individual business units have the potential to impact global performance, number crunching alone no longer cuts it. Emerging finance leaders not only need the ability to analyze data, but the ability to distill information from across the company into actionable insights—like new revenue growth opportunities.

Beyond extracting findings from vast troves of corporate data, these workers must also be able to communicate and elevate their findings for a wider audience in order to mobilize strategic decision making. Doing so requires collaboration, communication, and nuanced relationship building. In short, today’s finance leaders need both quantitative chops and boardroom credibility. But such a combination is rare in a field that has historically elevated numerical deftness over soft skills.

The human factor

This situation has not gone unnoticed by current executive leaders. When surveyed about the finance function’s ability to cope with disruptive forces driving new business needs, CEOs saw CFOs falling short. In one survey for example, 97% of CEOs reported attracting and retaining top-notch finance talent as one of the most important factors in improving the finance organization, yet only 33% gave their CFOs a passing grade in talent management. Little wonder, then, that in 2016, 70% of finance executives cited developing human capital as their primary concern.

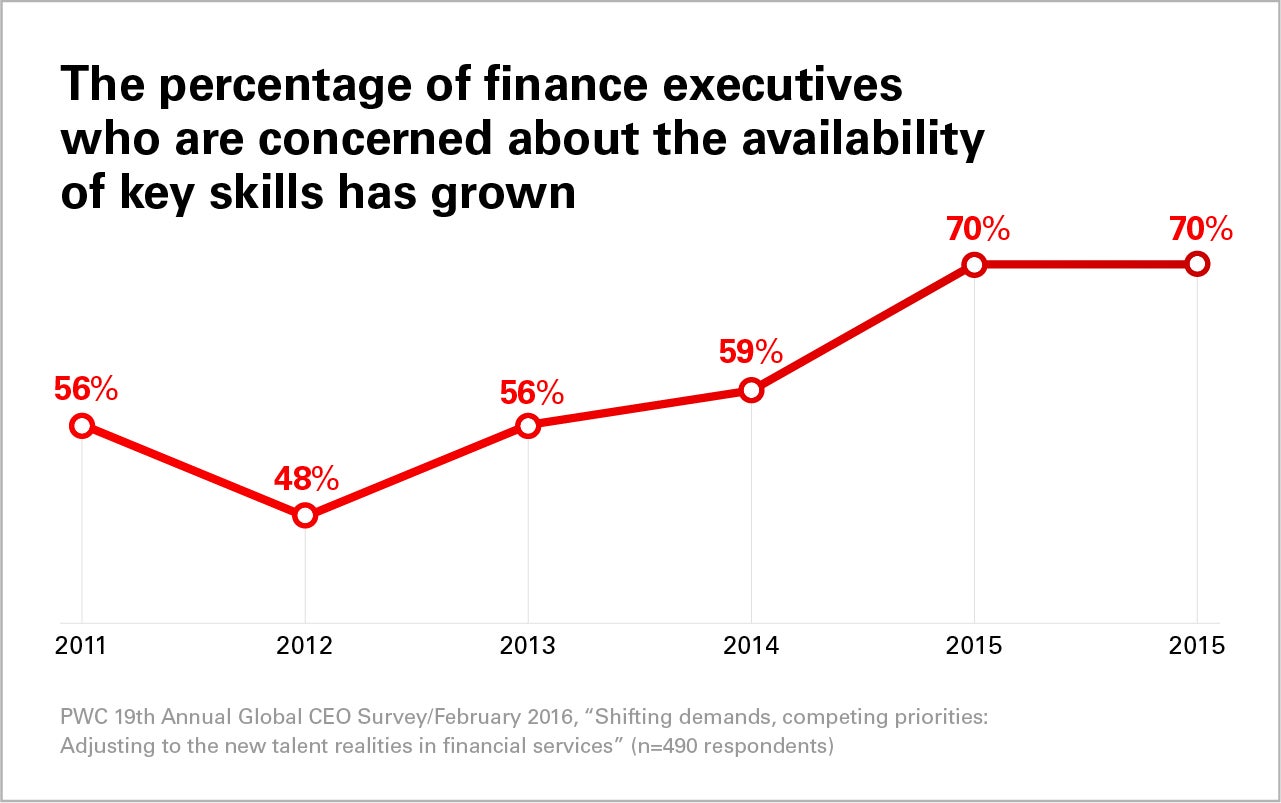

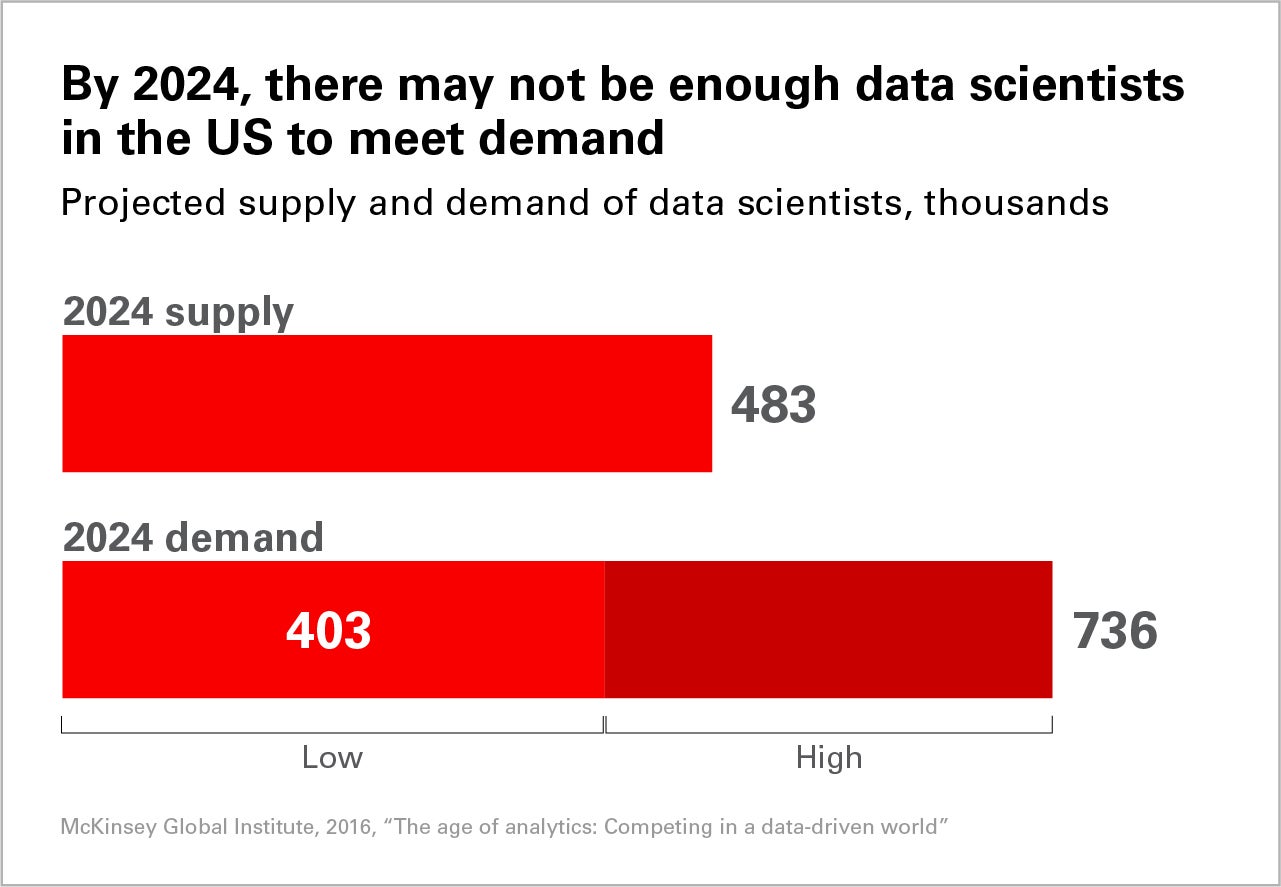

Solving this challenge remains easier said than done. Anxiety about the availability of key talent continues to grow—in the last five years, the percentage of finance executives expressing concerns about finding the right talent has grown nearly 15%. These worries are not entirely unfounded. The supply of talent that bridges this gap remains limited and in high demand.

For those who do possess the requisite hard and soft skills, the job market is theirs for the taking. Sophisticated data scientists alone—often young millennials—can command six-figure salaries. And should companies fail to engage them or align with their values, these valuable workers won’t hesitate to take their abilities elsewhere. To address the situation, CFOs have begun to assess their talent pipelines, turning their attention toward developing and retaining their internal workforce. Many have also focused on enhancing compensation packages—in 2016, 63% implemented plans to raise salaries in order to retain key talent.

Bridging the gap with technology

For CFOs truly looking to stay agile and competitive however, investing in human capital is only the first step. Technology must also be part of the solution if they hope to build capabilities that will sustain their organizations and engage and empower employees in the future.

Traditionally, the finance function has relied upon disparate legacy technologies spread over multiple business domains. But in a world where companies have expanded operations and have made strides toward reducing internal hierarchy, these older systems are no longer a viable option. Data doesn’t flow properly, hindering everything from supply chain visibility to market analyses. This fragmentation makes these systems inflexible, time consuming, and difficult to use—a liability for financial leaders who must deliver strategic input to the C-Suite and be prepared to scale operations with growth.

Out-of-date or cumbersome technology makes it difficult to attract and retain top talent—especially Millennials. As the first generation to truly be called digital natives, these workers are 2.5 times more likely to be early adopters of technology. They want flexible tools with clean interfaces and open channels for communication. And if they don’t find what they need in the office, they’ll either source these tools on their own or move-on to a company that will. This is a risky situation for companies facing a talent market short on supply and a business landscape where security is paramount.

Oracle Cloud for Finance offers forward-looking CFOs an unparalleled package of services that can empower modern financial insights and help build the soft skills their teams will need to stay adaptable in the coming years. The solution works seamlessly to centralize and consolidate information across functions and systems, enhancing business processes across the organization. And with its integrated and multi-dimensional, yet simple-to-use interface, talented workers can quickly drill down into data, cast a wide analytical net across all relevant business units, and configure the system to suit their business requirements.

Perhaps most importantly, Oracle Cloud for Finance offers the advanced technological tools sophisticated employees demand. Collaboration is embedded into many levels of process, making it easy for leaders to promote the communications and team building critical to modern finance’s success. The cloud also offers applications that work seamlessly across most devices, enabling talented teams to be productive whether they are in the office or visiting customers.

With the right capabilities in place, future finance organizations will be at the forefront of building strategic consensus and insight.

Learn more

about how Oracle Cloud for Finance can simplify and optimize processes and help bridge the looming skills gap.

This article was produced on behalf of Oracle by Quartz Creative and not by the Quartz editorial staff.