Even age-old lead-acid batteries are a terrible market

Battery makers comprise one of the most distressed industries on the planet. One by one, US lithium-ion companies have filed for bankruptcy, among them A123, Ener1, and Valence Technology. Germany’s Daimler today said that it may sell (paywall) its unprofitable lithium-ion joint venture with Evonik Industries for $1.3 billion.

Battery makers comprise one of the most distressed industries on the planet. One by one, US lithium-ion companies have filed for bankruptcy, among them A123, Ener1, and Valence Technology. Germany’s Daimler today said that it may sell (paywall) its unprofitable lithium-ion joint venture with Evonik Industries for $1.3 billion.

The latest victim is Exide Technologies. The company’s bankruptcy filing in Delaware caps a 14-month descent in which Exide’s shares fell from $12.20 to $0.19.

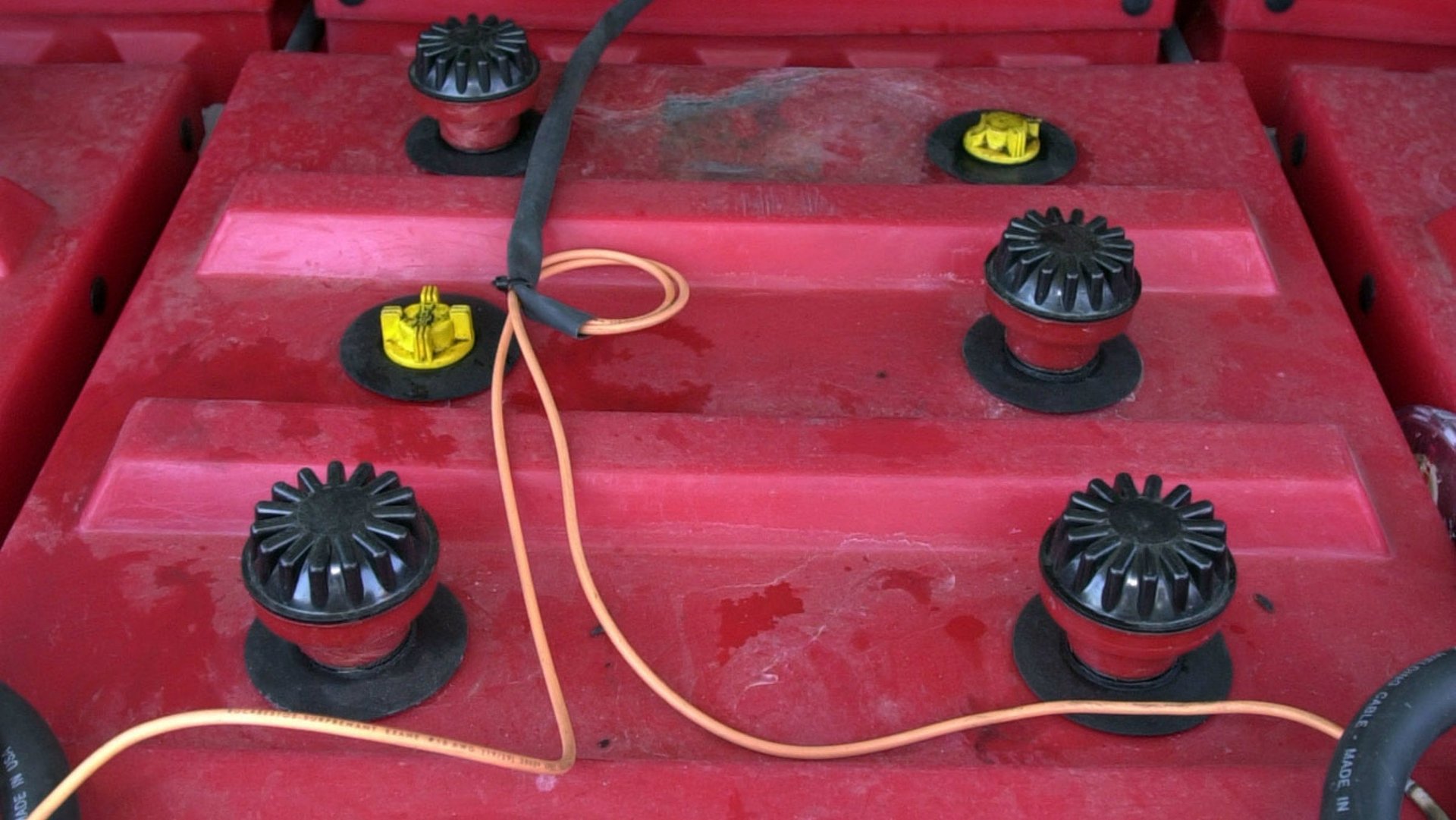

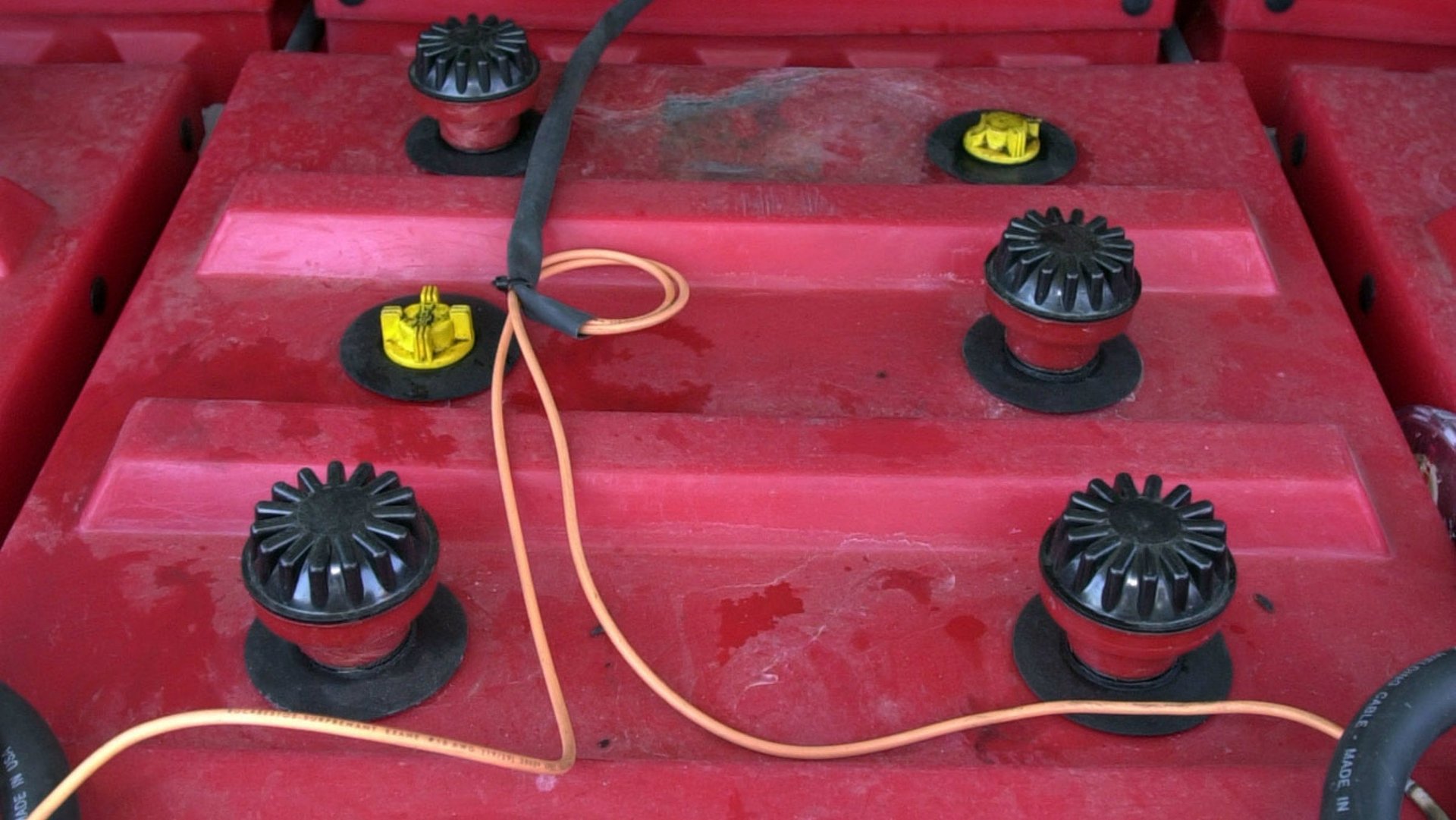

The reason most frequently advanced for all this failure is that the companies are before their time—lithium-ion technology has not yet caught up with our imaginations of an electric world. But that does not explain Exide’s demise. It is a producer not of cutting-edge lithium-ion batteries, but the number-two American maker of workhorse lead-acid batteries.

Lead-acid is old—it was invented in 1859—but it remains a big business. Exide alone sold $3.1 billion worth of them in 2012. The total global market for lead-acid batteries will be about $38 billion this year, according to Navigant Research.

What ails Exide? In its filing, the company said that competition has become more brutal than ever, forcing down prices. As an example, it cited a 2010 decision by Wal-Mart to replace Exide as its sole supplier of lead-acid batteries with Johnson Controls, the company’s main rival. That cost Exide some $160 million in annual revenue.

On top of that body blow, California ordered Exide in April of this year to close down its Vernon, California, lead recycling plant because of chronic environmental problems.

Between them, the two setbacks also eliminated a prime source of the recycled material that goes into Exide’s product—spent batteries collected by Wal-Mart, whose cores can be reused, and the recycled lead produced in Vernon.