The most normal thing about the US is its interest rates

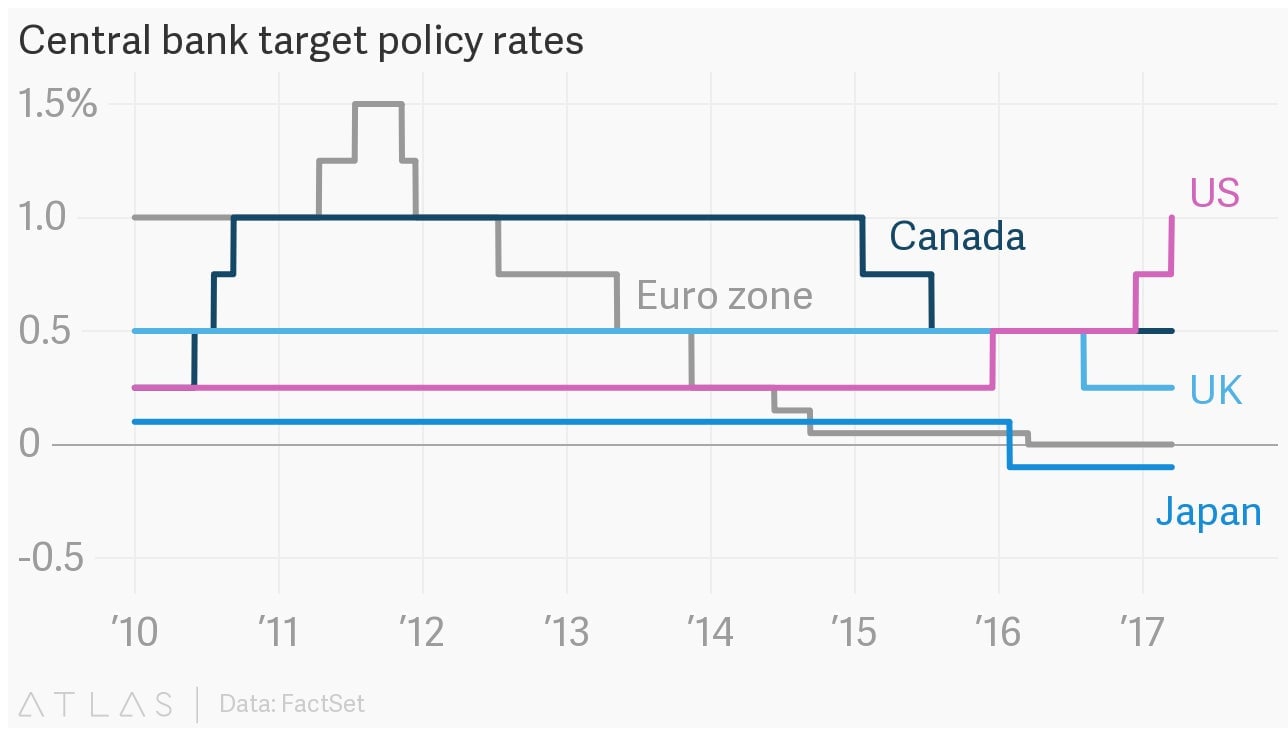

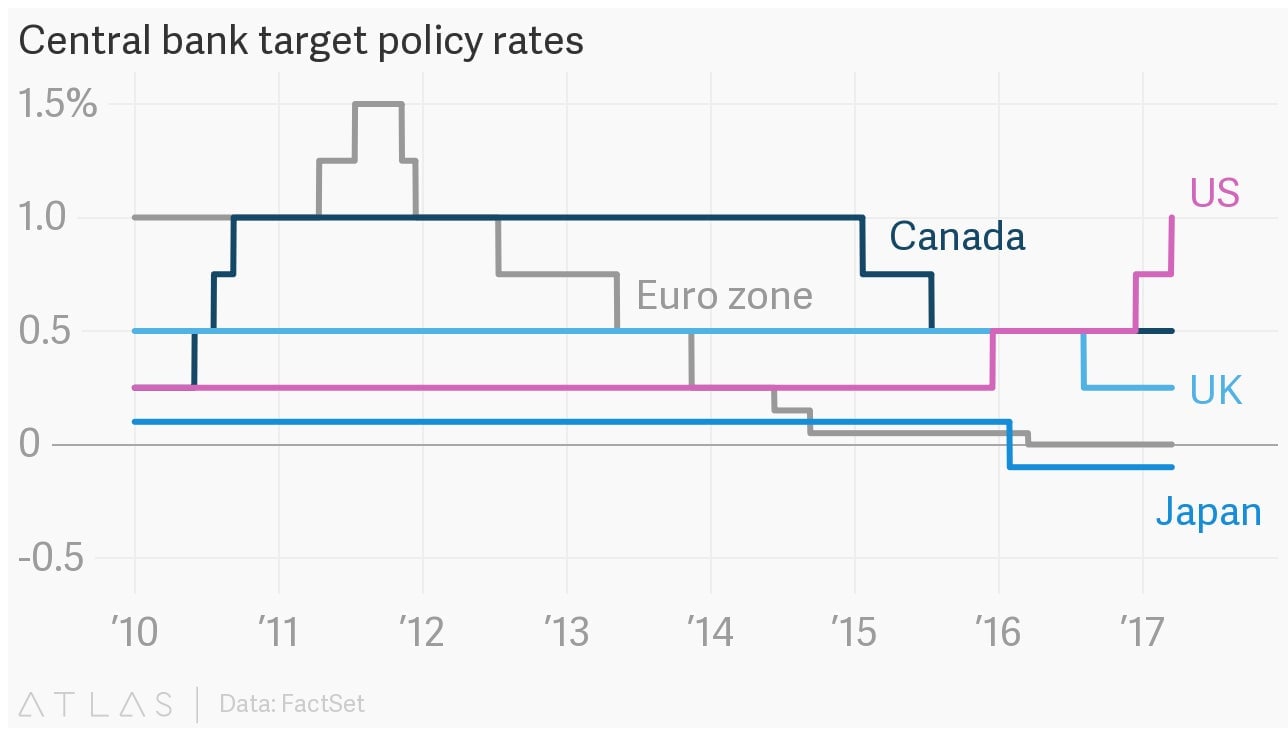

The US Federal Reserve has hiked interest rates three times in a little over a year. Other major banks have either sat on their hands or cut benchmark rates to just above, or indeed below, zero. For now, the long-awaited “normalization” of interest rates is largely an American phenomenon:

The US Federal Reserve has hiked interest rates three times in a little over a year. Other major banks have either sat on their hands or cut benchmark rates to just above, or indeed below, zero. For now, the long-awaited “normalization” of interest rates is largely an American phenomenon:

Although many expected the Fed to be even more aggressive, there is little doubt that more hikes are on the way. That’s bad news for US bond investors—prices fall when yields rise—but they’ve had a good run. A 30-year bull market is nothing to sniff at.

Investors are now particularly anxious about long-dated bonds. A steeper yield curve, in which the spread between short-term and long-term rates grows wider, usually accompanies a pick-up in economic growth and inflation. The Fed’s economic outlook isn’t nearly as bullish as Donald Trump’s, but if the president follows through on some of his more aggressive spending and protectionist promises, inflation, at least, could accelerate and bring about more rate hikes.

Regardless, the separation between long-term rates in the US and elsewhere is significant, especially since Trump took office:

In their full, interactive glory, see for yourself how the level and shape of yield curves in the US, Germany, Japan, and the UK have changed in recent years with the sliders below. One of these things is not like the others: