Once the world’s best performing fashion retail stock, Mulberry is faltering

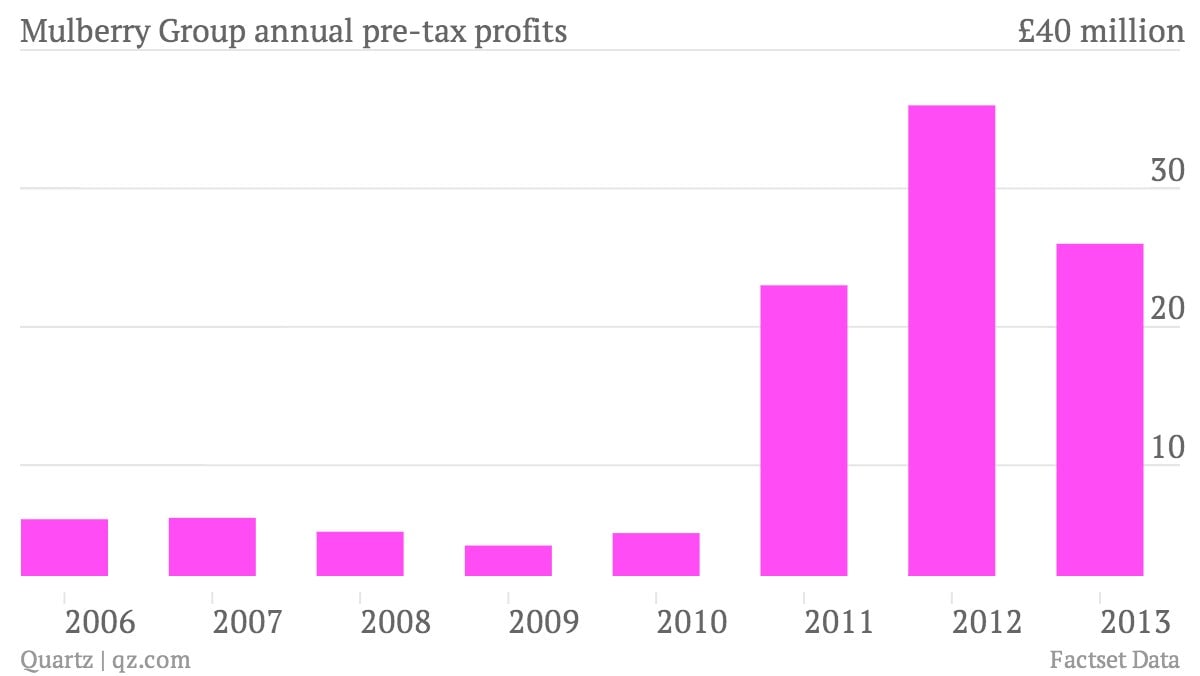

The numbers: The British luxury accessory maker’s pre-tax profits for the year fell 28% (pdf), the first time in four years, to £26 million (roughly $41 million). Shares were down 1.95%.

- The numbers: The British luxury accessory maker’s pre-tax profits for the year fell 28% (pdf), the first time in four years, to £26 million (roughly $41 million). Shares were down 1.95%.

- The takeaway: Sales outside of the UK and Europe, Mulberry’s main markets, fell compared with 2012. The company said the US and Asian markets were still proving difficult to penetrate because of “low brand awareness.” Slower wholesale orders and less traffic from Chinese tourists to Europe also contributed.

- What’s interesting: Mulberry, formerly a conservative niche brand, expanded rapidly abroad in recent years, becoming a model for small luxury companies looking to go global. Now the company, known for popularizing “affordable luxury” price points, wants to take its brand more upscale. Its prices have on average risen about 12% over the last year. But it’s a risky strategy. Over the past year, the company has issued several profit warnings. Earlier this week, its chief creative director, largely credited for exalting Mulberry’s image on the global stage, announced her resignation.