Bitcoin lovers: This is what it looks like when the US wants to destroy a currency

There’s a big difference between bringing down a currency and simply trying to regulate it.

There’s a big difference between bringing down a currency and simply trying to regulate it.

Today a top US financial crime official said digital currencies like bitcoin shouldn’t fear government plans to regulate them like regular old financial institutions.

“Administrators or exchangers of virtual currencies have registration requirements and a broad range of [anti-money-laundering] program, recordkeeping, and reporting responsibilities. Those offering virtual currencies must comply with these regulatory requirements, and if they do so, they have nothing to fear from Treasury,” said Jennifer Shasky Calvery, director of the Treasury’s Financial Crimes Enforcement Network, or FinCen, in prepared remarks for a conference on the virtual economy.

They probably shouldn’t, even though government-skeptic digital currency fans may not believe it. We’ve said the same before, but to make the point clearer, let’s look at what the US does when it really wants to destroy a currency.

Last week, the Treasury announced a new package of sanctions targeting Iran’s currency, the rial. The US has decided to make the country’s currency “useless” as a way to squeeze its economy and squelch its nuclear program. (Whether economic sanctions actually influence Iran’s plans is unclear).

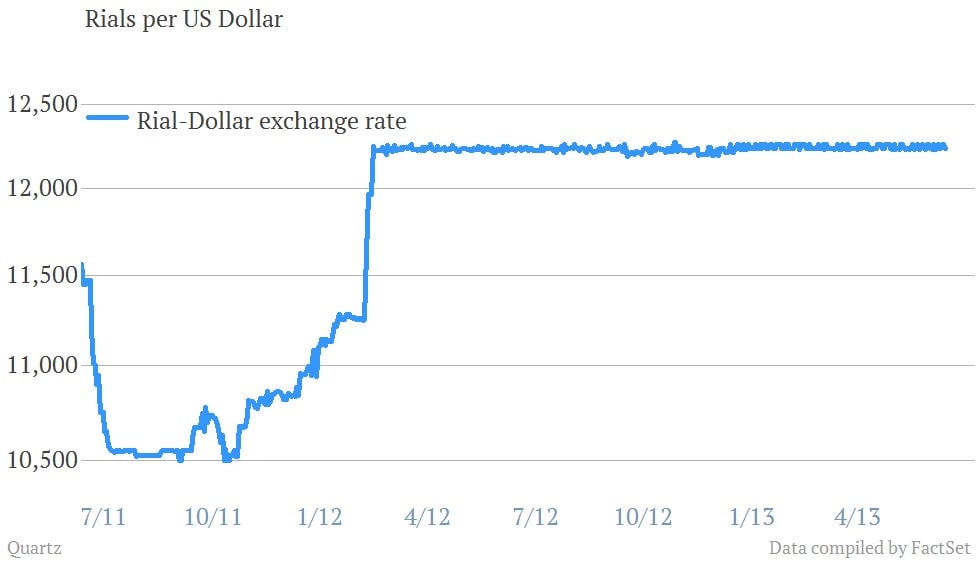

The value of the rial has already been dropping for the past two years, due to an international sanctions regime that has slowed trade with the country and caused prices to rise. With fewer US dollars entering the country, the price of the dollar relative to the rial has risen sharply:

In an attempt to reverse the trend, Iran has sought to control the official rial-dollar exchange rate. The unofficial exchange rate for dollars on the black market is as high as 36,000 rials.

But the United States still isn’t satisfied. US President Barack Obama announced on June 3 that any institutions merely holding the Iranian currency or making large transactions in it would be unable to do business or hold assets in the United States. Since most global financial institutions want to maintain their US business, it essentially makes the rial illegal, at least in the West.

Now, compare those draconian policies to what the government is asking of bitcoin and other virtual currencies: Keep track of who your customers are and whether they are trying to perform illegal transactions. That’s not so bad, is it?