The CFO’s new role: Strategic co-pilot

The chief financial officer has always been the backbone of a corporation, steadfastly leading the financial workhorses who make spreadsheets, send invoices, and parse data. Traditionally, CFOs have monitored a company’s financial health from their back-office perch, but that’s quickly changing. As technology pushes big data to the fore and automation begins to creep into almost every aspect of a business, the role of the CFO is shifting from that of bean counter to strategic partner.

The chief financial officer has always been the backbone of a corporation, steadfastly leading the financial workhorses who make spreadsheets, send invoices, and parse data. Traditionally, CFOs have monitored a company’s financial health from their back-office perch, but that’s quickly changing. As technology pushes big data to the fore and automation begins to creep into almost every aspect of a business, the role of the CFO is shifting from that of bean counter to strategic partner.

Changing times, changing roles

It makes sense. Companies are changing the structure of their organizations, flattening hierarchy across the enterprise to gain more visibility into operations and markets and thrusting financial leaders into positions with more responsibility and reach. Gone are the days when the most forward-looking task that fell to the CFO was setting the budget; today, much more is required of them. As Donald Anderson, Oracle’s Director of Organization Development Consulting observes, organizations have pushed finance leaders to move away from just monitoring the business’s “rear-view mirror” in order to become strategic “co-pilots.”

He notes that these individuals must be capable of asking and answering critical questions that will propel the business forward—a difficult task that requires financial expertise, business acumen, and interpersonal skills. By tackling questions like, “what is our best path forward for growth?” and “what kinds of talent do we need to stay competitive?” the role of the CFO has morphed into something more akin to the role of the COO, who has traditionally handled the more operational aspects of a company.

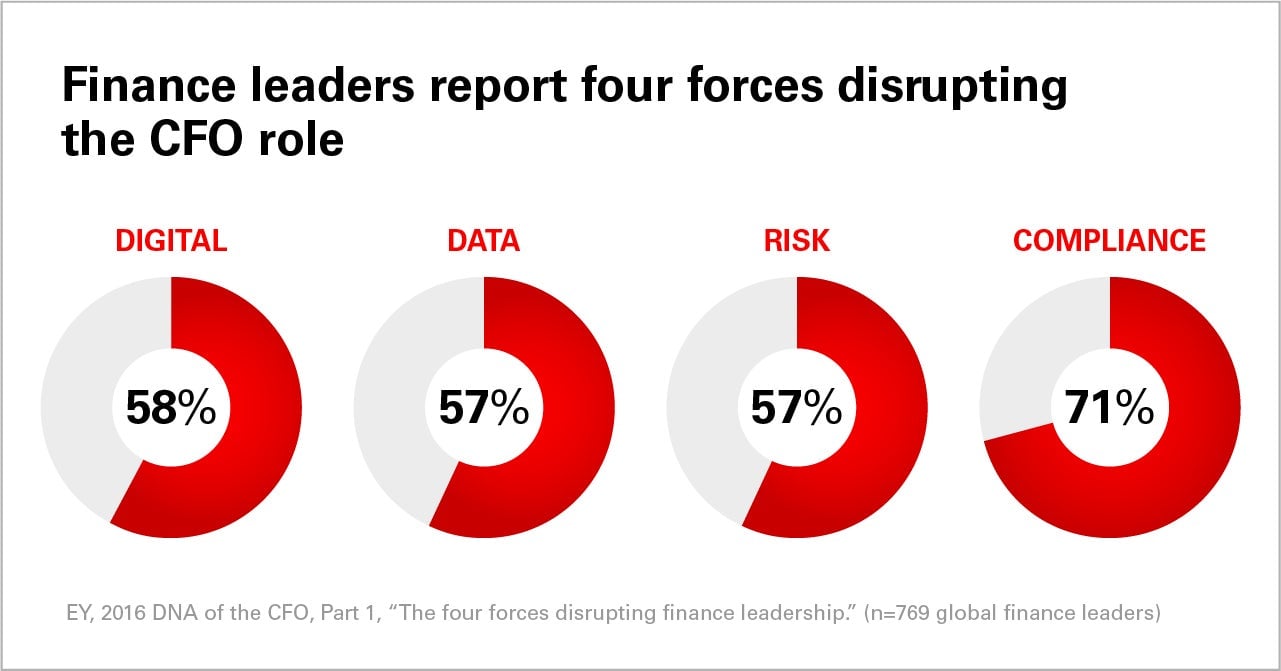

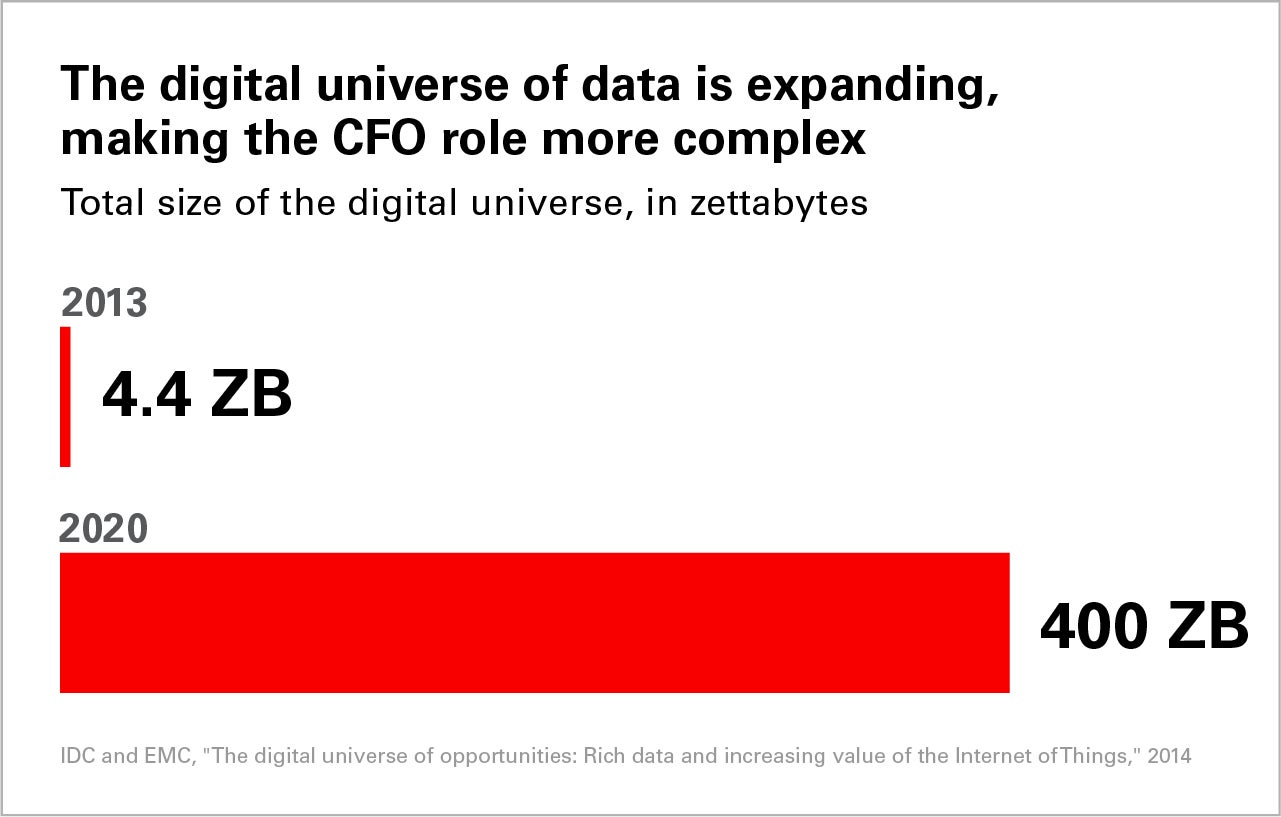

Technology and the CFO role

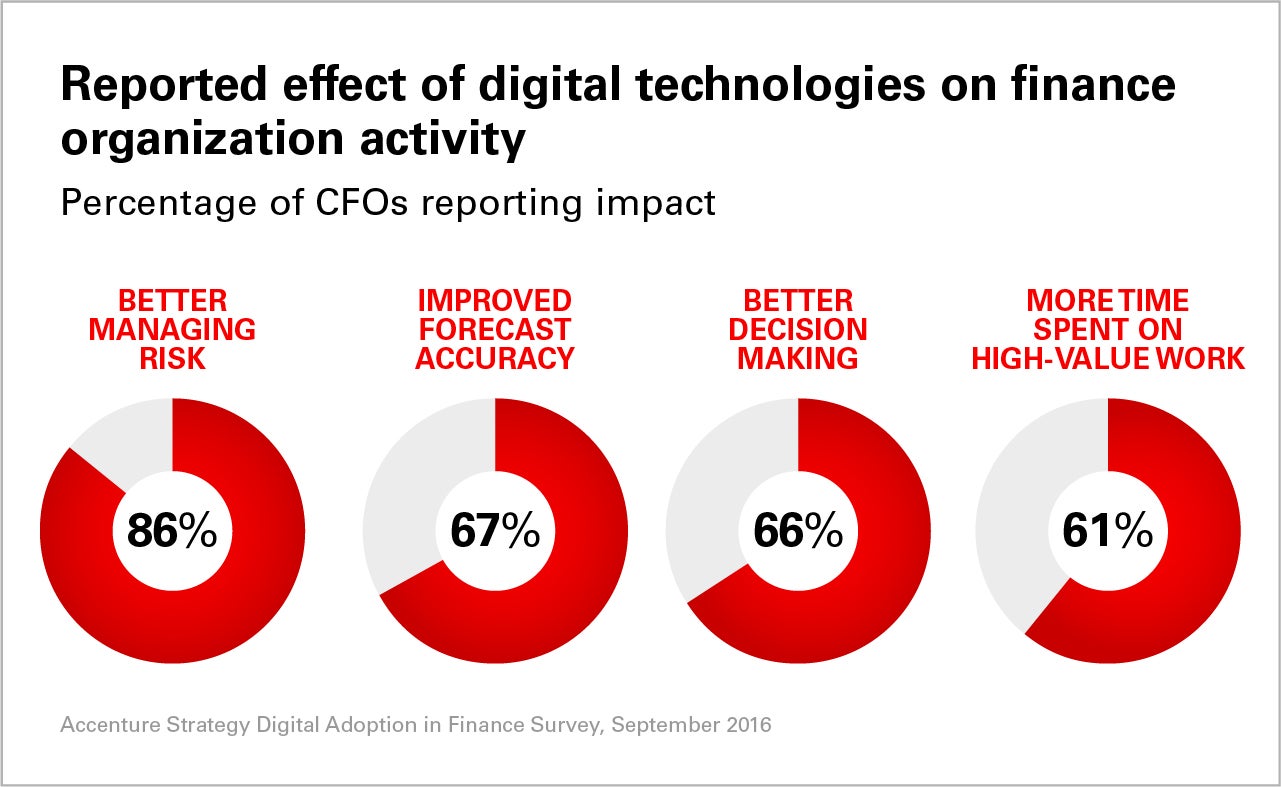

Technology has played an instrumental role in elevating the CFO. Leaders in the finance function are increasingly adopting tools like cloud services, mobile devices, and analytics applications, which in turn have positively impacted their teams. CFOs that have embraced these and other digital innovations report being able to better manage risk and improve forecast accuracy. Perhaps most importantly, 61% say their finance teams are spending more time on high-value work, which stands to further extend the financial organization’s exposure across the business.

This is all the more important as financial teams look to be more nimble in a rapidly globalizing economy. Anderson notes that in today’s business environment, there’s no longer such a thing as “a perfect moment to act.” Instead, brief opportunities and threats continuously emerge and disappear. And finance leaders must be ready to adapt in any circumstance. CFOs are taking note: 41% of CFOs said they didn’t expect or plan for Brexit, the impact of which has rippled throughout the financial world. Since that event, 47% of finance leaders are factoring more data sources into their analyses to help them with predictive analytics that can help them prepare for future unexpected events.

Tools and talent

The obvious benefits of technology—uncovering patterns and insights from large data sets, clearing the way for more critical and analytical thinking—are fairly straightforward. But offsetting daily tasks to technology also has the benefit of building teams with more diverse skill sets and helping to foster the next generation of CFOs. When asked, 66% of finance leaders say they believe the success of their organization depends on recruiting from diverse talent pools. As the financial function’s reach stretches across new lines of business, its leaders will need to be well versed in collaboration, communication, consumer focus, and business strategy.

Anderson explains that internal training programs can help build diverse pools of talent. The key, he notes, is creating opportunities for future leaders to engage with multiple employees across multiple levels of the organization. At Oracle, for instance, the company provides a rotational program for promising finance talent to round out their backgrounds. More broadly, the company offers training programs for employees hoping to learn the nuances of business partnership before transitioning into leadership roles. Appetite for these programs has been strong—Anderson reports that more than 80% of finance organization employees have chosen to participate in these programs thus far.

ERP and EPM as strategic enablers

Technology can help CFOs make a smooth transition into their new strategic role. Enterprise resource planning (ERP) and enterprise performance management (EPM)—the integrated software applications that help to consolidate tasks like accounting, financial planning and analysis (FP&A), and compliance—provide the means for more connection and collaboration across lines of business. In fact, 70% of CFOs say ERP plays an important role in enabling them to do their job efficiently and effectively.

This includes solutions like Oracle Cloud for Finance, a diverse suite of cloud-based software applications that manages everything from accounting, project management, and procurement to financial planning and analysis, revenue recognition, risk management, governance, and compliance. With an intuitive design, Oracle Cloud for Finance delivers the functionality, analytics, security, and collaboration tools CFOs need to run their business—from daily operational reporting to long-term strategic planning. Insight is delivered through role-based dashboards, enabling the right people to make the right decision at the right time.

Oracle Finance Cloud technology also provides real-time data accumulation and monitoring capabilities, resulting in a consistent source of data that gives the CFO a more holistic view of the company’s standing. As the role of the CFO becomes increasingly tied to both the monetary and strategic direction of the business, technologies like cloud-based ERP and EPM will allow them to drill into the data and glean insights that will benefit the company for years to come.

Learn more

about how Oracle Cloud for Finance provides forward-looking CFOs with the comprehensive solutions their teams need to thrive in the strategic spotlight.

This article was produced on behalf of Oracle by Quartz Creative and not by the Quartz editorial staff.