While investors flee emerging markets, the Middle East and North Africa are emerging as oases

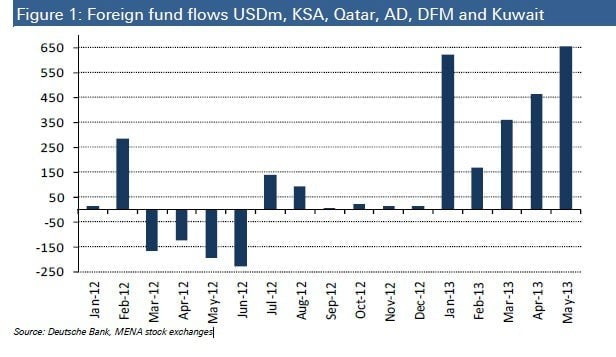

Equity markets in the Middle East and North Africa (MENA) are emerging as a hotspot for international investors. The region attracted $655 million of inflows in May—the highest monthly inflows over the past five years, according to Deutsche Bank. Year-to-date, the MENA markets have seen net inflows of $2.3 billion against an outflow of $192 million during the same period in 2012.

Equity markets in the Middle East and North Africa (MENA) are emerging as a hotspot for international investors. The region attracted $655 million of inflows in May—the highest monthly inflows over the past five years, according to Deutsche Bank. Year-to-date, the MENA markets have seen net inflows of $2.3 billion against an outflow of $192 million during the same period in 2012.

The surge in inflows into the region comes against the backdrop of foreign investors leaving emerging markets in droves. Over $3 billion was pulled out of emerging market equity funds in May, the highest since end-2011. The rout intensified in June (paywall), with almost $12 billion already redeemed so far this month. The Morgan Stanley Capital International (MSCI) emerging-market index is down close to 10% this year.

But indices in Dubai and Abu Dhabi have rallied by around 40%. Why the boost? Probably improving economic fundamentals, and an MSCI upgrade for UAE and Qatar.