The evolving role of the CFO could help teams build gender diversity

The finance function is changing, and so is its workforce. Technological advances, globalization, and an increasing reliance on big data analytics are shifting the skill sets required of finance employees. No longer are hard-nosed accounting chops enough; today’s financial leaders must be just as good with people, strategy, and critical thinking as they are with numbers.

The finance function is changing, and so is its workforce. Technological advances, globalization, and an increasing reliance on big data analytics are shifting the skill sets required of finance employees. No longer are hard-nosed accounting chops enough; today’s financial leaders must be just as good with people, strategy, and critical thinking as they are with numbers.

Companies, anxious to know they’re building a workforce that’s prepared for the evolving financial landscape, are taking a hard look at their talent pool. What they’re finding is now, more than ever, gender diversity is key to cultivating a successful business.

The state of the workplace

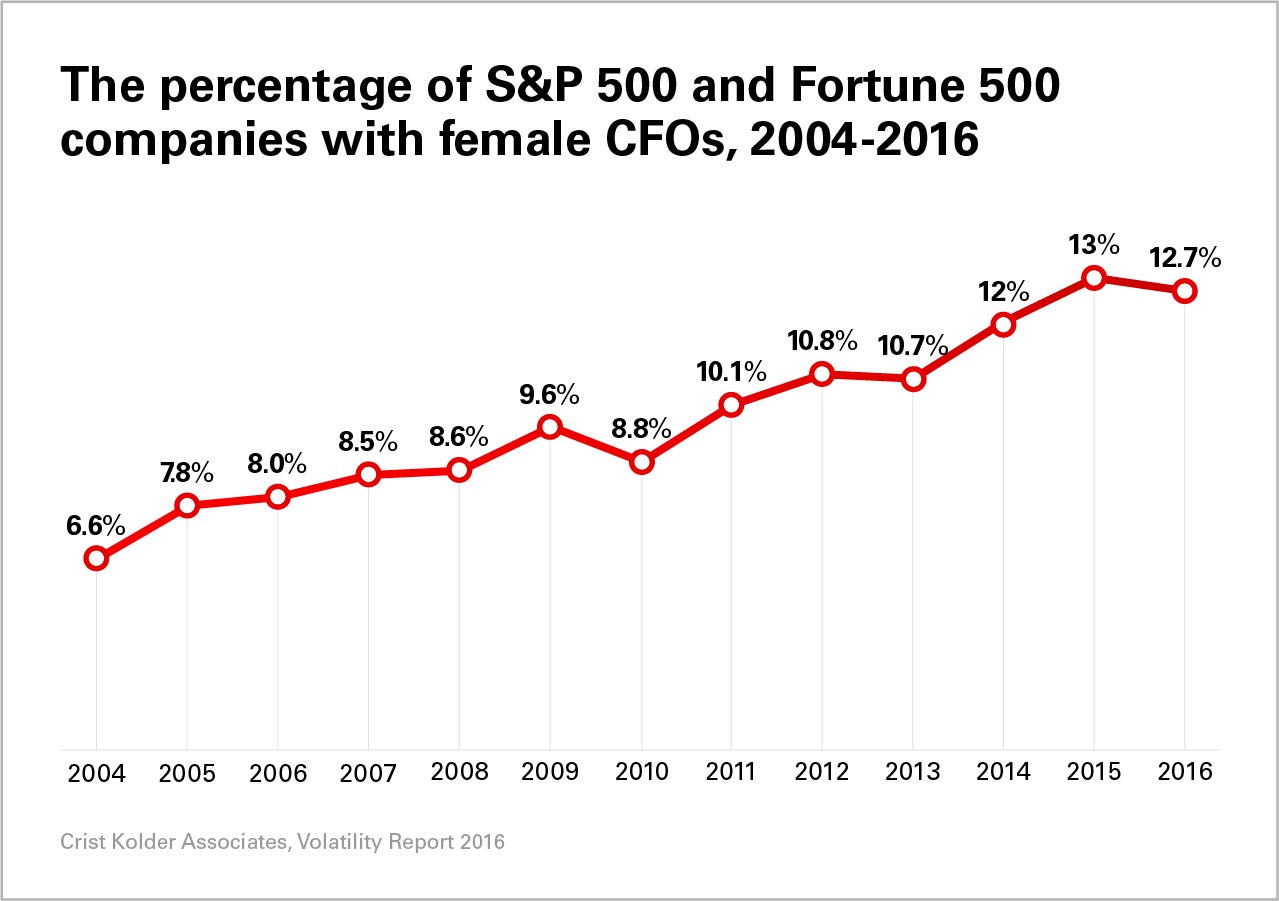

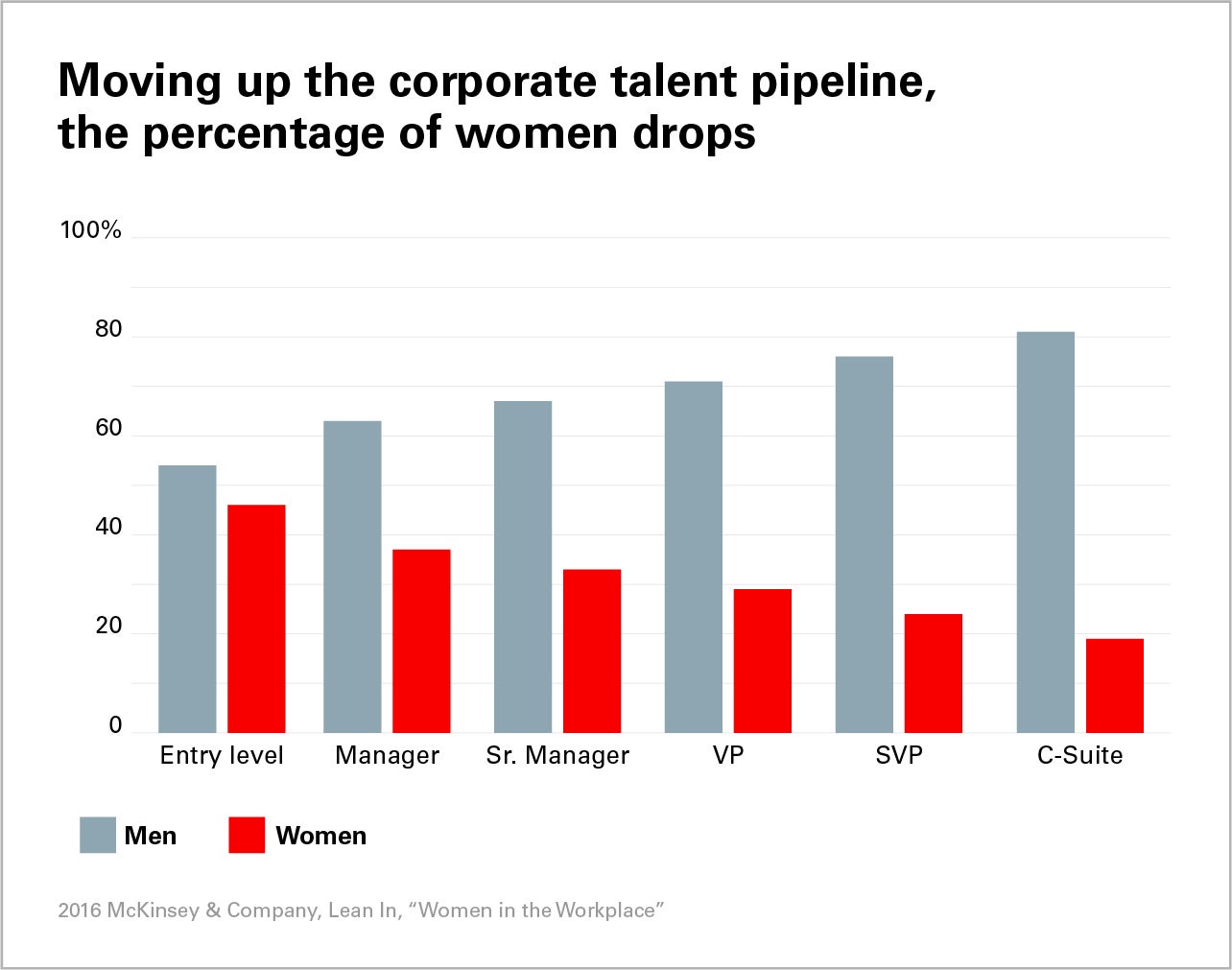

This sentiment is at odds with the reality of the corporate world. Though more women than ever are going to business school and then joining the workforce, numbers show that there’s still a long way to go before gender parity is reached. Consider that while women hold 46% of entry level positions in the business world, they account for just 19% of C-suite jobs. The difference is even more striking within the finance organization. Though the number of female CFOs has increased in the last decade, they now hold only 13% of CFO roles within Fortune 500 or S&P 500 companies.

The challenges women face as they seek to advance in the workplace begin early in their careers. Compared with male peers, women in business often lack mentorship, executive exposure, and opportunities for upward mobility. More concretely, for every 100 women promoted to management, 130 men are promoted, stunting female advancement. As employees begin to start families, lack of flexibility and poorly defined career tracks further hamper ambitious women who might otherwise excel in leadership positions, draining corporate talent pipelines of precious talent.

Real impact

Beyond social costs, gender diversity (or lack thereof) impacts the business. One study found that companies with one or more women on their board delivered higher average returns on equity and higher average growth. Another demonstrated that gender-diverse companies are 15% more likely to outperform the national average. Even at the team level, gender diversity adds value. A Harvard study found that teams with lower percentages of women had lower sales and profits than those with a balanced gender ratio.

From a more nuanced perspective, a more diverse workplace leads to employee and customer satisfaction, making it easier to attract and retain top talent. One study found that women foster more collaborative and inclusive teams, which in turn create a deeper sense of camaraderie, job satisfaction, and empowerment within their organizations. Gender diverse teams may also result in 22% lower turnover rates.

As the role of the finance organization changes rapidly, pivoting away from back-office number crunching toward strategic analysis and insight, these are the qualities that are becoming more important. Today’s finance teams need employees capable of deep insights and cross-table conversations—a rare combination of skills. Expanding efforts to pull women toward finance leadership may ultimately make for a more robust pipeline and help to close this looming skills gap.

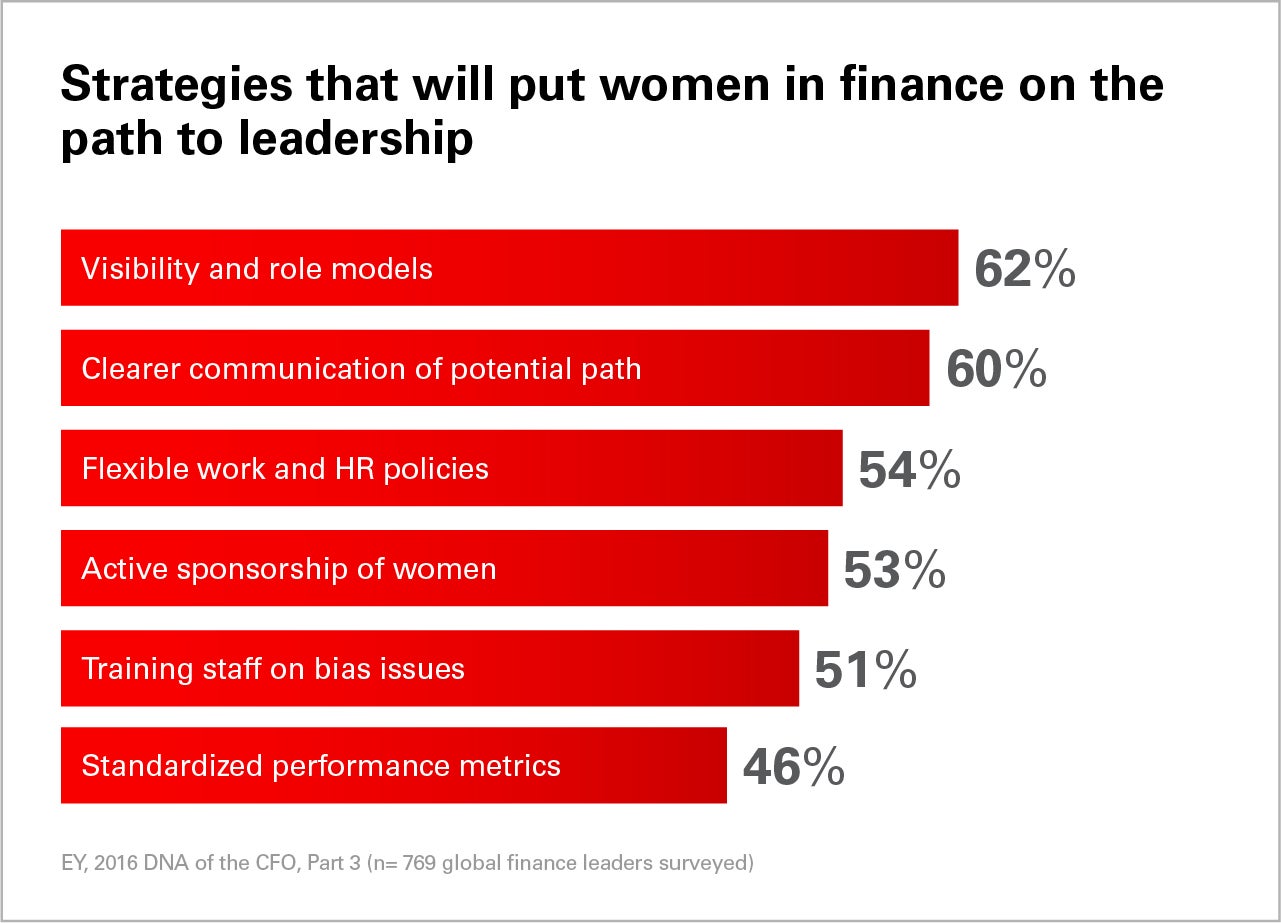

Many companies are working to rectify their long-standing gender diversity issues with internal programs that help mentor and promote women in the workplace. Some already have deeply entrenched gender diversity initiatives to increase the number of women in leadership positions. These internal programs are an important aspect of bridging the gender gap in business, but they require more than one-off initiatives to create a sustainable shift in corporate culture. Finance teams looking to change must adopt a multi-pronged approach that embraces everything from clearer lines of communication to active efforts to identify and groom talented women.

Supporting sustainable change with technology

This is no easy task. But aligning technological tools with the business’ emerging priorities can help finance executives focus less on back-office tasks and more on building a team skilled at analytical thinking and collaboration. Enterprise software like Oracle Cloud for Finance enables finance teams to maximize that potential by streamlining everyday tasks, clearing up room for CFOs to focus on more strategic tasks, like training and mentorship initiatives that can pull new and diverse talent into the finance function and further develop the team’s skills.

By both automating transactional processes in finance and by providing embedded collaboration tools throughout the business, Oracle Finance Cloud empowers teams to develop and share complex analyses and foster new, powerful communication channels across the company.

But having communication channels isn’t enough; organizations that include people from a variety of backgrounds benefit from a range of perspectives. Further, while finance’s new, more collaborative and strategic role helps to elevate the profile of the finance function, it also provides the women on the finance team more organizational exposure—which can help them advance through the leadership ranks.

Learn more

about how Oracle Cloud for Finance frees finance leaders to spend less time worrying about technology and more time building out teams that will propel their business into the future.

This article was produced on behalf of Oracle by Quartz Creative and not by the Quartz editorial staff.