Greg Mankiw needs to update his econ textbook for the 21st century

“It is worth noting that addressing the issue of rising inequality necessarily involves not just economics but also a healthy dose of political philosophy. We economists must recognize not only the limits of what we know about inequality’s causes, but also the limits on the ability of our discipline to prescribe policy responses. Economists who discuss policy responses to increasing inequality are often playing the role of amateur political philosopher. Given the topic, that is perhaps inevitable. But it is useful to keep when we are writing as economists and when we are venturing beyond the boundaries of our professional expertise [separate].” – N. Gregory Mankiw

“It is worth noting that addressing the issue of rising inequality necessarily involves not just economics but also a healthy dose of political philosophy. We economists must recognize not only the limits of what we know about inequality’s causes, but also the limits on the ability of our discipline to prescribe policy responses. Economists who discuss policy responses to increasing inequality are often playing the role of amateur political philosopher. Given the topic, that is perhaps inevitable. But it is useful to keep when we are writing as economists and when we are venturing beyond the boundaries of our professional expertise [separate].” – N. Gregory Mankiw

The Mankiw quote above comes from his recent paper with the provocative title “Defending the One Percent.” In it he seeks to challenge the political left’s arguments in favor of more redistributive policies and the need for a new philosophical framework for the debate.

Although I disagree with many of Mankiw’s points, I think it is worth starting at where we both agree. He writes:

“If the growing incomes of the rich are to be a focus of public policy, it must be because income inequality is a problem in and of itself.”

This seems fair. If inequality is itself damaging then we must first make the case for why this is from both an economic and a social perspective. If, however, inequality is a product of underlying economic trends—a symptom and not the condition—then targeting it may do very little to alleviate the social ills that campaigners are seeking to address.

So let’s start by setting out the case against inequality. Mankiw cites Joseph Stiglitz’s book The Price of Inequality but swiftly dismisses the arguments presented. Below are some of Stiglitz’ central points as spelt out in his New York Times article earlier this year:

- Middle class income growth has become too weak to support the growth of consumer spending that developed countries (and particularly the US) have seen in the past as they spend a higher proportion of their incomes than the rich.

- Stagnating middle class incomes mean they cannot invest in their future through further education of themselves and their children or business investment.

- The fact that capital gains are taxed at a lower rate than incomes means the government is receiving less in tax revenues, leading to lower public investment in necessary infrastructure.

- Inequality is associated with more severe boom-and-bust cycles.

Although Stiglitz clearly believes that growing inequality should be the focus of public policy, not everybody agrees with his arguments. Paul Krugman, for example, points out that the trend before the crisis was of falling household saving during a period of rising inequality and he also queries whether inequality really does lead to falling government tax receipts. As he points out, much though the arguments against inequality may appeal “economics is not a morality play”.

It’s supply and demand, stupid!

Let us then assume for a second that it is possible to have a society with full employment that also exhibits high levels of inequality. Assuming this is the case the question becomes, despite the significant rise in inequality over recent decades, why is the US still not achieving full employment?

For his explanation of rising inequality Mankiw uses the work of Claudia Goldin and Lawrence Katz (2008) in their book The Race between Education and Technology as his starting point. He says:

“Goldin and Katz argue that skill-based technological change continually increases the demand for skilled labor. By itself, this force tends to increase the earnings gap between skilled and unskilled workers, thereby increasing inequality. Society can offset the effect of this demand shift by increasing the supply of skilled labor at an even faster pace, as it did in the 1950s and 1960s. In this case, the earnings gap need not rise and, indeed, can even decline, as in fact occurred. But when the pace of educational advance slows down, as it did in the 1970s, the increasing demand for skilled labor will naturally cause inequality to rise. The story of rising inequality, therefore, is not primarily about politics and rent-seeking but rather about supply and demand.”

If Goldin and Katz are correct that inequality reflects a shift in labor markets in favor of high-skilled workers at the cost of the low skilled this may also explain why we have failed to gain full employment. After all it would simply be a case of mismatch between skill-sets required for the jobs being offered and the skills base of those seeking work.

The minority of the population who have those skills will therefore not only gain employment more easily but will also have significant wage bargaining power, increasing the gap between them and the rest. So the answer, as Tony Blair famously put it, could well be education, education, education.

That is also the conclusion of David Autor, MIT Department of Economics and National Bureau of Economic Research, in his 2010 paper “The Polarization of Job Opportunities in the U.S. Labor Market.” In essence, Autor claims that there is a growing rift between rising wages for those with college degrees and stagnating or declining wages for those without—potentially reflecting a lack of supply of the former.

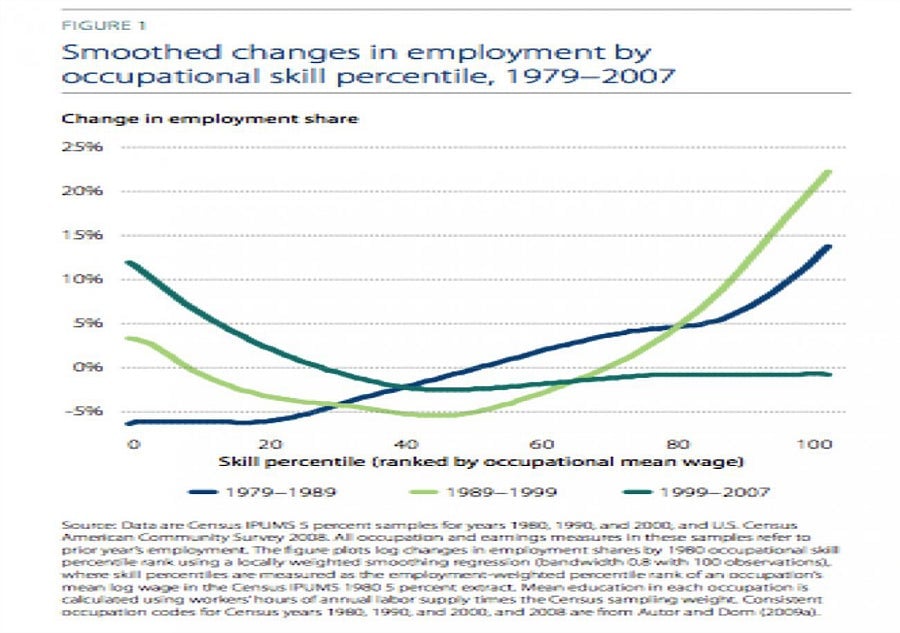

Two things, however, are striking in his analysis and do not sit comfortably with the supply/demand thesis. The first is the chart below:

While the distribution in the periods 1979-1989 and 1989-1999 show employment growth by occupation was almost uniformly rising in occupational skill, the share of employment in the period 1999-2007 is clearly weighted towards low skilled jobs. This sits uncomfortably with a theory of a high-skilled economy.

Moreover, the other striking fact is that the “major proximate cause of the growing college/high school earnings gap is not steeply rising college wages but rapidly declining wages for the less educated”. That is, the polarisation was not predominantly driven by college graduates’ ability to bargain for high wages but by a combination of technological change, offshoring, de-unionization, and a falling minimum wage eroding the pay and conditions of lower-skilled workers.

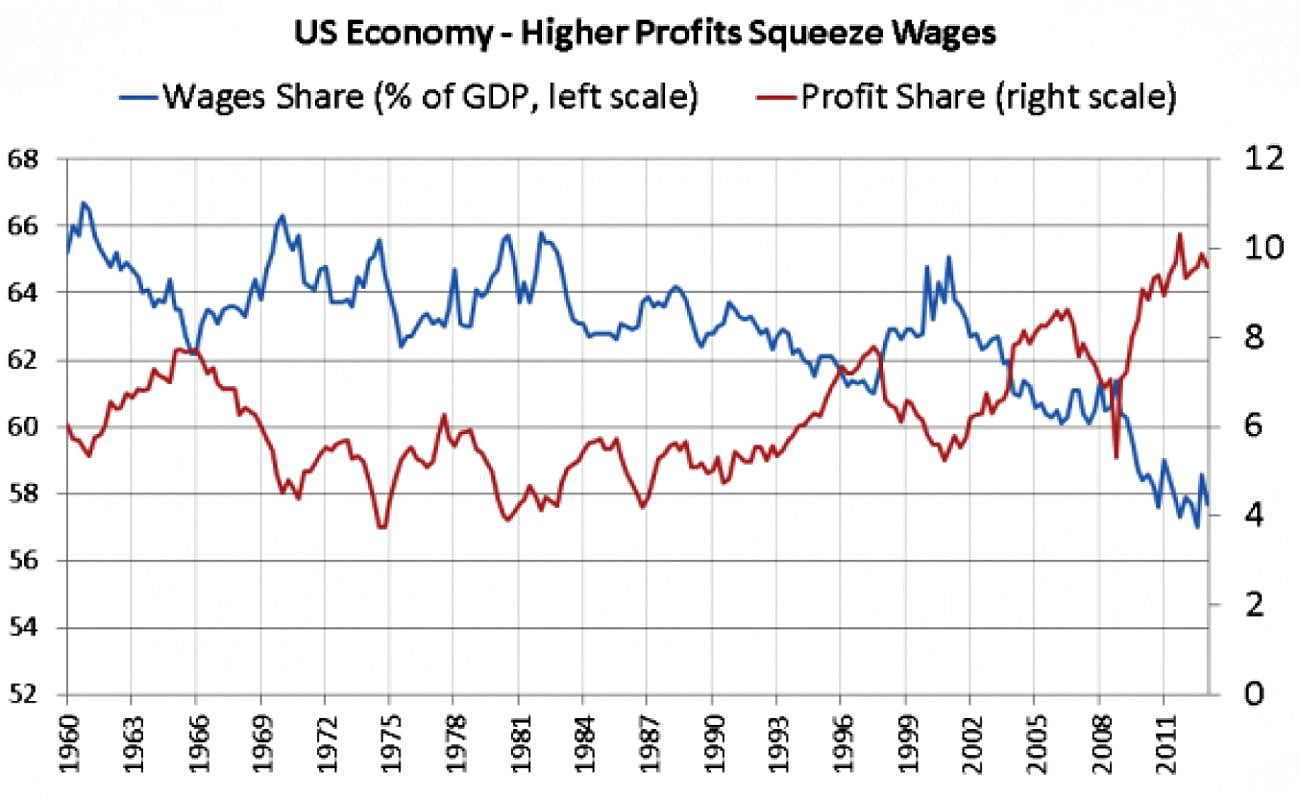

This trend may also help to explain labour’s falling share of output over that same period:

Defending the Indefensible

So we appear to have a self-fulfilling cycle here. If middle-income households are seeing their disposable incomes squeezed then, as Stiglitz points out, they will be less able to afford the education that would allow them to take advantage of the opportunities presented by a high-skilled labour market. In effect they become trapped as a toxic combination of falling living standards and narrowing opportunities push them towards lower paid, less secure work and drive up inequality.

Furthermore, if the trend since 1999 has continued with a far greater number of low-skilled jobs created than high skilled then spending the money they do have on a college or college-equivalent education could be a severe risk. It might allow them to compete for jobs but even assuming a level playing field (which is far from guaranteed) the financial cost may in many cases prove too much of a burden on already strained budgets.

Again I find myself in agreement with Mankiw when he says: “the appropriate policy response is to address the root cause” of inequality. If it is being driven in large part by a combination of worsening work conditions for low-skilled employees and a lack of supply of college graduates then both of these do suggest some additional redistribution of resources will be necessary to achieve full employment.

Here Mankiw parries:

“Yet this redistribution is hard to accomplish, because the government is assumed to be unable to observe productivity W; instead, it observes only income WL, the product of productivity and effort. If it redistributes income too much, high productivity individuals will start to act as if they are low productivity individuals. Public policymakers are thus forced to forgo the first-best egalitarian outcome for a second-best incentive-compatible solution. Like a government armed with Okun’s leaky bucket, the Mirrleesian social planner redistributes to some degree but also allows some inequality to remain.”

Taken at face value this seems accurate—taxation should not be punitive, even if its aims are progressive. Yet it should be noted that if the average federal income tax rate paid by the top 1% of earners was increased from 22.4% (as it was in 2007) to 43.5%, raising an additional 3% of GDP, it would still leave them with an after-tax income share more than twice as high as in 1970.

Changing the tax rate to account for growing inequality in order to meet the market’s demand for skilled labour does not seem overly punitive. This is particularly the case if the growing divergence in incomes has been in large part caused by the removal of labour’s traditional protection and the consequent weakening of low-skilled workers’ bargaining power.

One possibility would be the replacement of these regulatory protections with something like a basic income, which would make labor market flexibility consistent with a basic level of financial security. If, instead, politicians decide not to act a return to something close to full employment is likely to remain a distant dream.