Inequality can be a good thing

The growing inequality of wealth and income has become a hot topic in the last few years in the United States, attracting both moral condemnations and radical recommendations aiming at reversing it. According to the most popular quotation, the top 1% of the population of the United States controls 40% of the country’s wealth and 25% of its income.

The growing inequality of wealth and income has become a hot topic in the last few years in the United States, attracting both moral condemnations and radical recommendations aiming at reversing it. According to the most popular quotation, the top 1% of the population of the United States controls 40% of the country’s wealth and 25% of its income.

In a 2011 Vanity Fair article (Of the 1%, by the 1%, for the 1%), and in a book (The Price of Inequality), Nobel Prize winner Joseph Stiglitz recognizes that some people may shrug their shoulders arguing that what matters is not how the pie is divided but the size of the pie.

Stiglitz, however, argues that this argument is fundamentally wrong for four weak reasons, which he seems to believe are strong. First, he says, growing inequality is the flip side of something else: shrinking opportunity. Second, many of the distortions that lead to inequality—such as those associated with monopoly power and preferential tax treatment for special interests—undermine the efficiency of the economy. Third, inequality blocks the “collective actions” that are needed in a modern economy—meaning investment in infrastructure, education and technology. Fourth, because of the increased concentration of income, the majority of the population will not be able to afford an education, and this will lead to their further impoverishment, which in turn will make it harder to get educated, until, one can assume, the United States would fall into general misery.

After Stiglitz published his thoughts, the discussion of the growing inequality has tended to become a moralistic one, in which those saying that it is bad have taken the high moral ground. They portray any doubt about Stiglitz’s arguments as a defense of the people who are now in the famous 1%—many of which, like the members of other social strata, are not beyond criticism regarding the way they acquired their wealth. But, as I argue later, that is not the issue. The points are whether inequality is bad in itself, and whether Stiglitz has proven that it is. He has not, as a cursory review of his arguments demonstrates.

In the first place, growing inequality is most frequently the flip side of growing, not shrinking opportunity. In fact, inequality is the mechanism through which the market generates and spreads innovation, which in turn generates opportunities for millions of individuals. Every innovation has initially generated inequality in incomes, as their inventors exploit it commercially. The inequality, in turn, attracts new innovators, as well as imitators, rapidly spreading the initial innovation and improvements on it. In the process, they generate many new opportunities.

For example, Steve Jobs and Thomas Alva Edison actually created new inventions and enterprises for the sake of putting themselves on the best side of inequality—to make large amounts of money that would increase their income over that of the rest of the population. By being successful, they created inequality not just in their immediate neighborhood but also in the whole country. They became billionaires. Many of their colleagues in Apple and all the Edison companies (General Electric, Consolidated Edison, Commonwealth Edison) also became billionaires in the midst of a society in which just a few people are billionaires. By improving the productivity of others, however, their innovations created millions of new opportunities across nations and continents. Even people who suffer when seeing that others get rich have to recognize that seeing Jobs and Edison becoming billionaires was a small price to pay for the enormous opportunities they created in the whole world.

Stiglitz’s second argument, that many of the distortions that lead to inequality, such as monopoly power and tax privileges undermine the efficiency of the economy, is absolutely irrelevant for the discussion of inequality. It refers to bad practices that are bad independently from their impact on inequality. Certainly, some people may have arrived into the one percent group by objectionable means—like many financiers that became billionaires while bankrupting their firms and their customers, or by obtaining rents from the government. This, however, cannot be constructed into a condemnation of inequality. In fact, fiscal measures that Stiglitz himself would seem to support—like taking away income from the productive to transfer it to the nonproductive—are as negative in terms of the efficiency of the economy as the abuse of monopoly power. Some of these transfers are justifiable only in humanitarian, not economic, grounds. Some other transfers, like subsidies to the rich funded with general taxes, are not justifiable, period. Could we say that equality is bad because some of the means to attain it undermine the efficiency of the economy?

Stiglitz’s third argument is not only twisted but also as irrelevant as the second. His efforts to connect the lack of investment in infrastructure, education and technology with income inequality are far fetched to say the least. There are no reliable data on the distribution of income during the crucial 1870 to 1914 period that witnessed the industrialization of the United States. However, it is undeniable that the economic and political influence of the great barons of the epoch (J. P. Morgan, Andrew Carnegie, John D. Rockefeller, Cornelius Vanderbilt Andrew Mellon and Leland Stanford, to mention a few) was unparalleled in the history of the country. And they not only spearheaded the construction of the infrastructure of the country. They also presided over the improvement of education and health that propelled the United States to become the leading power in the world. In fact, these people funded the great expansion of the modern private universities and hospitals in the country. They were the 1% of those years. The current one percent keeps on funding these institutions. Why should they do in private (support hospitals and universities) what Stiglitz say they oppose doing as a class?

Rather than being a result of the concentration of wealth and income, the decline of investment in education and physical infrastructure seems to be attributable to the growing entitlements that plague the federal budget, which are, in turn, the result of a misguided search for equality.

Regarding the fourth argument, the sinking hole of inequality leading to less education and more inequality, it is important to note that the United States has never produced as many graduates as it does today. According to the Economist’s 2010 piece, “The Disposable Academic,” the annual production of PhDs in the United States doubled to 64,000 from 1970 to today. Moreover, the United States continues to be one of the major sources of knowledge and learning in the entire world. No country in the world has contributed what just Palo Alto has contributed to the current technological revolution, much less what California and the country as a whole have done. According to a recent article in the Spectator, philanthropy aimed at helping students is booming in the United States. Twenty-two out of the 30 best universities in the world are American.

Many people from China, India and other developing countries, visibly poorer than the average American student, come to the United States to study. Should we believe that American families, who have access to universities of all prices and generous student loans, cannot afford what the poor Chinese and Indians can, only because the distribution of income of two of the poorest countries in the world is less unequal by a tad than that of the United States? Believing that the United States will enter a vicious circle of lack of education and lower opportunity leading to less education and more poverty is, to say the least, melodramatic.

Thus, Stiglitz’s arguments do not resist the slightest confrontation with reality. Unforgivingly for an economist, he seems to ignore the role that inequality plays in generating innovation and growth and, through these, in eliminating poverty.

Actually, Stiglitz does not seem to realize three important points. First, that the real problem is not inequality but poverty. Nobody would say that there is a serious social problem in a city block where Marissa Ann Mayer (the president of Yahoo, who earned $36.6 million in the first six months in her position) lives side by side with a person who earns $200,000 per year, just because Mayer’s salary is 366 times that of her neighbor. However, a serious social problem would exist in another block where one neighbor earning $200,000 per year has a salary 366 times that of his neighbor. In that case, the other neighbor would be earning $546 per year. He would be destitute. The problem is not the inequality, which is the same in both cases, but the poverty of this other neighbor.

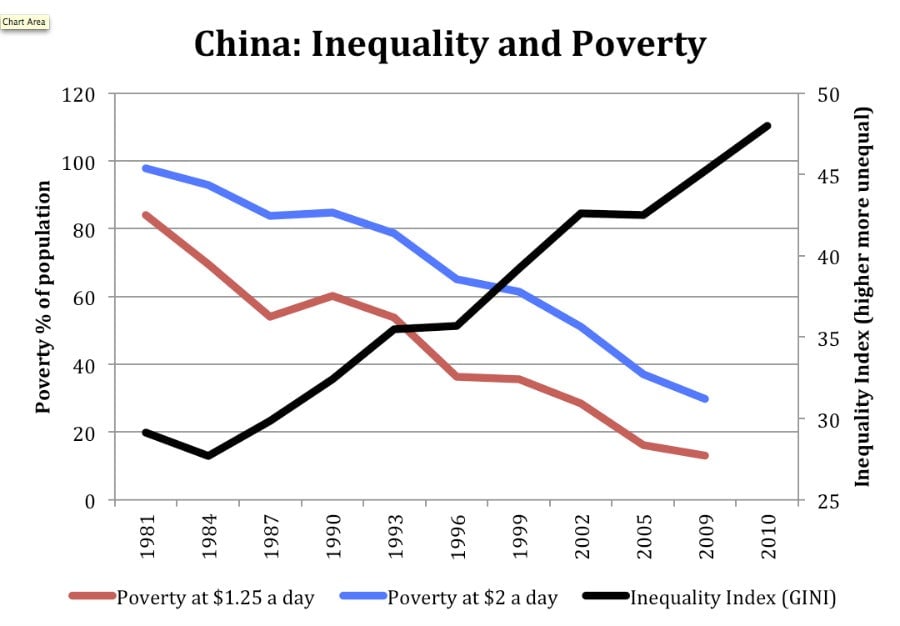

Second, Stiglitz does not seem to realize that in many cases inequality could be the price of the reduction of poverty through the mechanism we already discussed—the creation of opportunities. The attached graph shows this effect at the national level in the case of China. In 1981, China was equalitarian in income terms but also very poor. There were no incentives to improve because everybody earned the same. As the Chinese economy was liberalized, opportunities arose for many potential entrepreneurs to generate new economic activities, hire people and become rich. As they succeeded in their undertakings, inequality rose. But poverty declined, because, as they became millionaires, they created new and better employment, and new and better opportunities for other entrepreneurs.

SOURCE OF BASIC DATA: World Databank, World Bank.

In fact, one could ask Stiglitz, if there is no potential for inequality, what would be the incentive for innovations and growth?

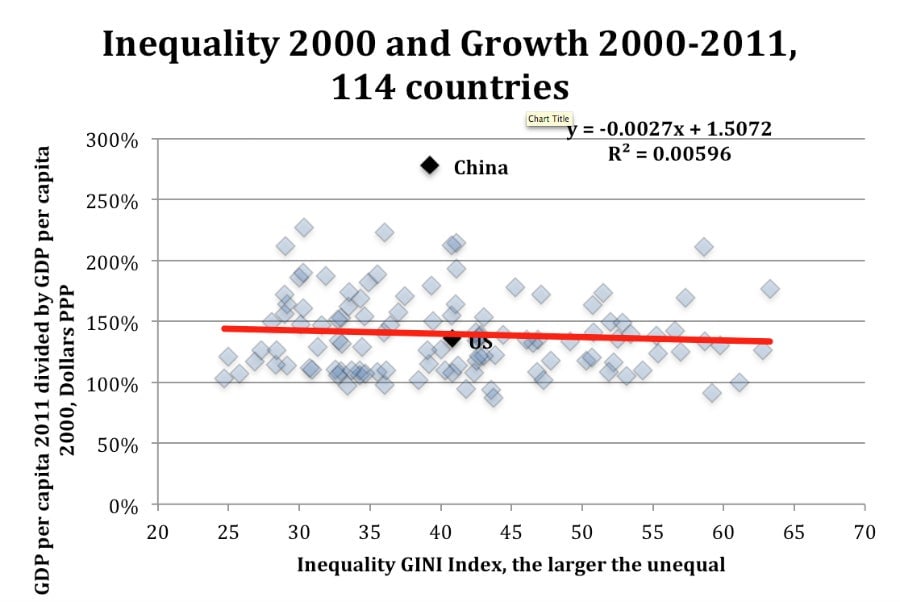

A third point that Stiglitz seems to ignore is that, if he were right regarding the sinking hole of education and inequality, development would be impossible, because people in the poor countries (like, say, Sweden and Japan were in the nineteenth century or China and Korea and Singapore in the twentieth) would asphyxiate in their own poverty without affording an education. In fact, as the next graph shows, internationally there is no relationship between inequality and growth. The graph shows the index of inequality in 2000 and the growth of GDP per capita in the next 11 years. According to Stiglitz, countries with larger inequality should not grow, especially because many of them are poor and would be trapped even more in the sinking hole. But this is not true. Some unequal countries grew faster than some less unequal, and vice versa. No clothes in this emperor.

SOURCE OF BASIC DATA: World Databank, World Bank.

More than a decade ago I noted the trend to income concentration and predicted that it would continue for many years in a book called The Triumph of the Flexible Society: The Connectivity Revolution and Resistance to Change (Praeger, 2003). I did it in the context of the strains introduced by the emergence of the knowledge society within the structures of industrial and agrarian societies. Those who are taking an advantage of this transformation are earning enormous rents. To gain from it you don’t have to be a knowledge entrepreneur but only to live in the neighborhood of one of them. California and the entire United States have benefited from Silicon Valley—even the local supermarkets. With time, this trend to concentration of income will reverse itself, as more people learn to take advantage of the economic revolution.

That is, inequality is the mechanism that will spread the benefits of the new knowledge society across the entire world. Without it, there would be no incentive to spread it, and the world would lose the most exciting opportunity to increase its wealth and reduce its poverty since the emergence of the Industrial Revolution. I repeat that this does not mean that I defend the people who have become part of the 1% by state intervention and other bad practices. That is another subject entirely.