Almost all of luxury fashion is now owned by two French families

This week, LVMH announced a $13.1 billion deal (paywall) that would consolidate control over Christian Dior, the 70-year-old Parisian fashion house. It’s merely the latest acquisition in a battle between two families that has turned the world of luxury fashion into a virtual duopoly.

This week, LVMH announced a $13.1 billion deal (paywall) that would consolidate control over Christian Dior, the 70-year-old Parisian fashion house. It’s merely the latest acquisition in a battle between two families that has turned the world of luxury fashion into a virtual duopoly.

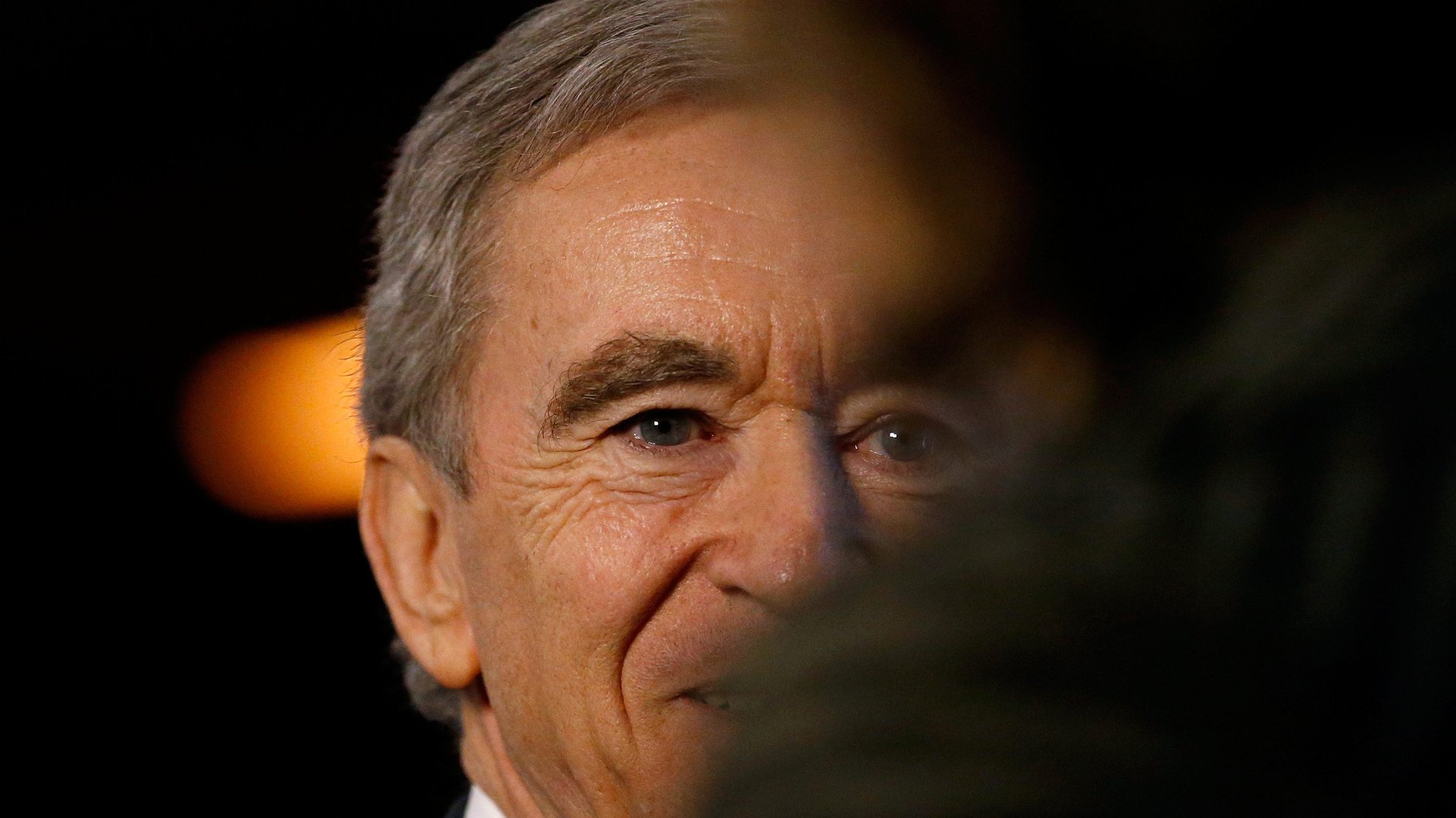

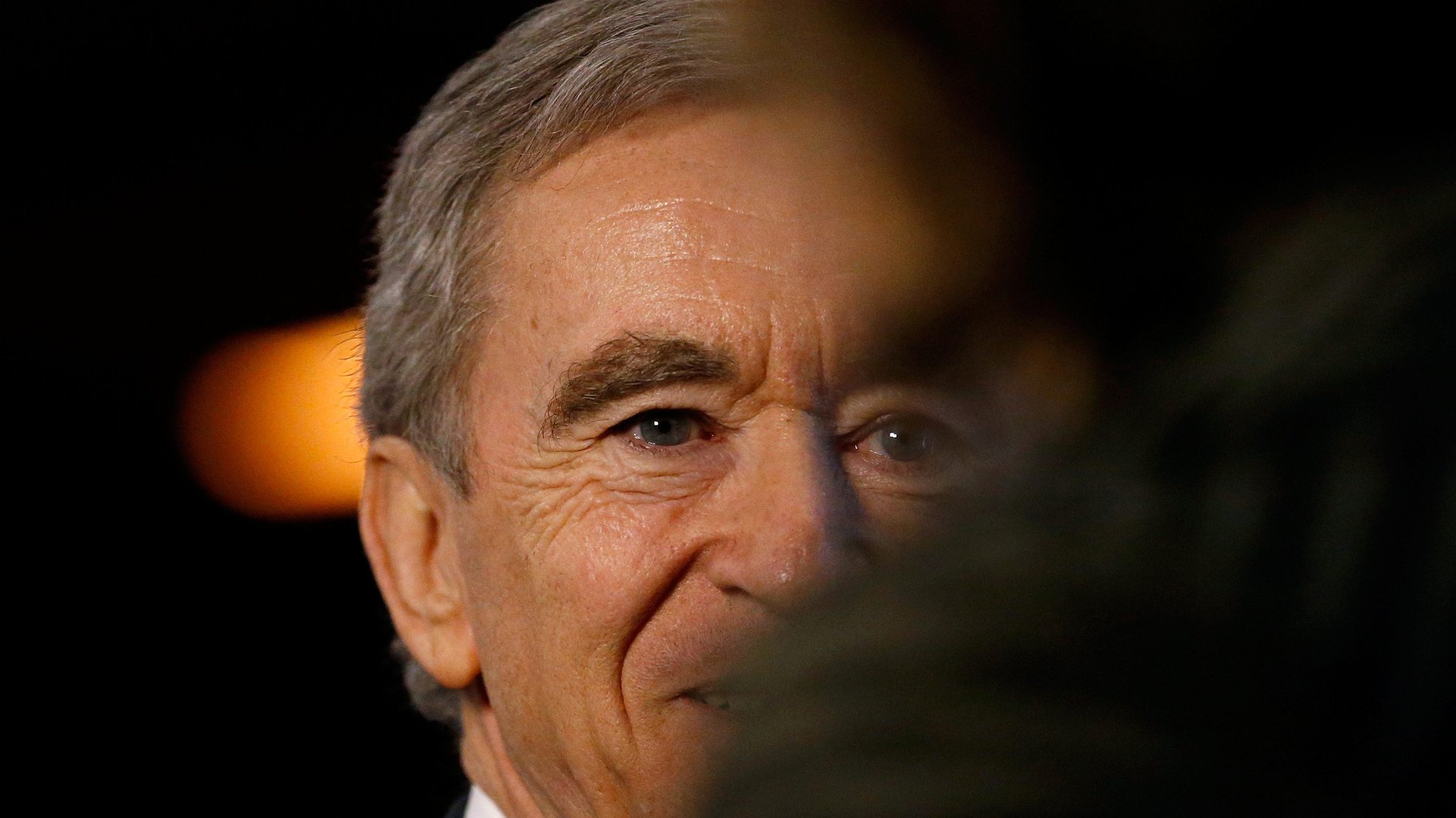

The Arnaults

The patriarch of the Arnault family, Bernard Arnault is chairman and CEO of LVMH—which stands for Louis Vuitton Moët Hennessy—the largest luxury company by revenue. He is France’s richest man and together with his family has an estimated net worth of $51.6 billion.

He was born in the industrial French town of Roubaix and began his career at Ferret-Savinel, his family’s construction company, as an engineer. In 1984, he bought Boussac, a textile group that at the time included Christian Dior (which since shifted ownership), and began to build his luxury empire. In 1989, Arnault became the majority shareholder of LVMH—formed from a merger between Moët Hennessy and Louis Vuitton in 1987 that included Moët champagne and Hennessy cognac.

The elder Arnault has been the chairman and CEO of the company since then. He is also a patron of the arts, and his benchmark project the Fondation Louis Vuitton, a $135 million center in the west of Paris designed by Frank Gehry and opened in 2014.

The oldest of his children, Delphine Arnault, 41, is executive vice president at Louis Vuitton; and her brother, Antoine, 39, is chief executive of the shoemaker Berluti and chairman of the cashmere label Loro Piana. The third of the five Arnault children, Alexandre, 24, recently (paywall) became co-CEO of the German luggage maker Rimowa. The Arnault family now overseas as empire of 70 brands, including these iconic luxury names:

- Céline (Acquired the Parisian fashion house in 1988)

- Berluti (Acquired the shoemaker in 1993)

- Kenzo (Acquired the Japanese fashion brand in 1993)

- Guerlain (Acquired the perfumer in 1994)

- Loewe (Acquired the Spanish leatherwear maker in 1996)

- Marc Jacobs (Acquired the fashion brand in 1997)

- Sephora (Acquired the cosmetics retailer in 1997)

- Thomas Pink (Acquired the fashion brand in 1999)

- Tag Heuer (Acquired the Swiss watchmaker in 1999)

- Emilio Pucci (Acquired the Italian fashion house in 2000)

- Fendi (Acquired the Italian fashion house in 2001)

- DKNY (Acquired the New York-based fashion house in 2001)

- La Samaritaine (Acquired the French department store in 2001.

- Hermès (Acquired a stake in the company in 2010, but divested in 2014)

- Bulgari (Acquired the Roman jeweler Bulgari in 2011)

- Loro Piana (Acquired the textiles maker in 2013)

- Rimowa (Acquired the German luggage maker in 2016)

- Christian Dior (Acquired in 2017)

The Pinaults

The other family that dominates fashion is headed by Francois Pinault, the self-made billionaire born in 1936 to a family of timber traders. He was a high-school dropout who built his fortune from a wood-importing business, which he then sold to invest in the luxury-goods business that was PPR and became the holding company Kering.

His biggest victory over his rival, Bernard Arnault, was the acquisition of the Gucci brand, after a public tussle for ownership. His son, François-Henri Pinault, joined the Pinault Group in 1987 and worked in several of the group’s operating companies before taking over as chairman and CEO in 2005. The family—which also owns auction house Christie’s, two Parisian department stores, four wineries, and three French publications—has a net worth of $19.5 billion.

Like his contemporary and rival, Francois Pinault is also an art collector, has a 3,000-piece art collection including works by Picasso, Mondrian and Koons—which he displays in his Palazzo Grassi contemporary art museum in Venice. He plans (paywall) to open a private museum in Paris in 2018 to display his contemporary art collection. The luxury brands the family own or control include:

- Printemps (Acquired the Parisian department store in 1992, sold in 2006)

- Chateau Latour (Acquired the Bordeaux vineyard in 1993)

- Gucci (Acquired the Italian luxury fashion brand in 1999)

- Yves Saint Laurent (Acquired the French fashion house in 1999)

- Boucheron (Acquired French jewellery house in 2000)

- Bottega Veneta (Acquired the Italian luxury goods and high fashion brand in 2001)

- Balenciaga (Acquired the Spanish fashion house in 2001)

- Stella McCartney (Signed partnership agreement in 2001)

- Alexander McQueen (Signed partnership agreement in 2001)

- Domaine d’Eugénie (Acquired the Burgundy vineyard in 2006)

- Puma (Purchased a controlling stake in the sport and lifestyle brand in 2007)

- Château-Grillet (Acquired the Rhone Valley vineyard in 2011)

- Brioni (Acquired the Italian menswear couture house in 2011)

- Qeelin: (Acquired a majority stake in the Chinese fine jewellery brand in 2012)

- Christopher Kane (Acquired a majority stake in the luxury UK designer brand in 2013)

- Pomellato (Acquired a majority stake in the Italian jewellery group in 2013)

- Araujo Estate Wines (Acquired the California estate in 2013 along with its flagship Eisele Vineyard)

- Ulysse Nardin (Acquired the Swiss luxury watch manufacturer in 2014)

- Château Siaurac (Acquired a stake in the French vineyard in 2014)

- Safilo (Finalized partnership with Italian eyewear maker and launched Kering Eyewear in 2015)