Nvidia is unstoppable—until somebody invents a better AI chip

Nvidia stock is soaring, up more than 14% in after-hours trading, beating Wall Street’s expectations for its first quarter.

Nvidia stock is soaring, up more than 14% in after-hours trading, beating Wall Street’s expectations for its first quarter.

The graphics processing unit (GPU) company announced its first quarter earnings today with revenue of $1.94 billion, a 48% gain year over year. While gaming drives most of the company’s sales, its largest area of growth over the past year was selling GPUs that power the artificial intelligence and graphics processing in datacenters. That sector of business saw 186% growth year over year, just a dip below last quarter’s 205% growth.

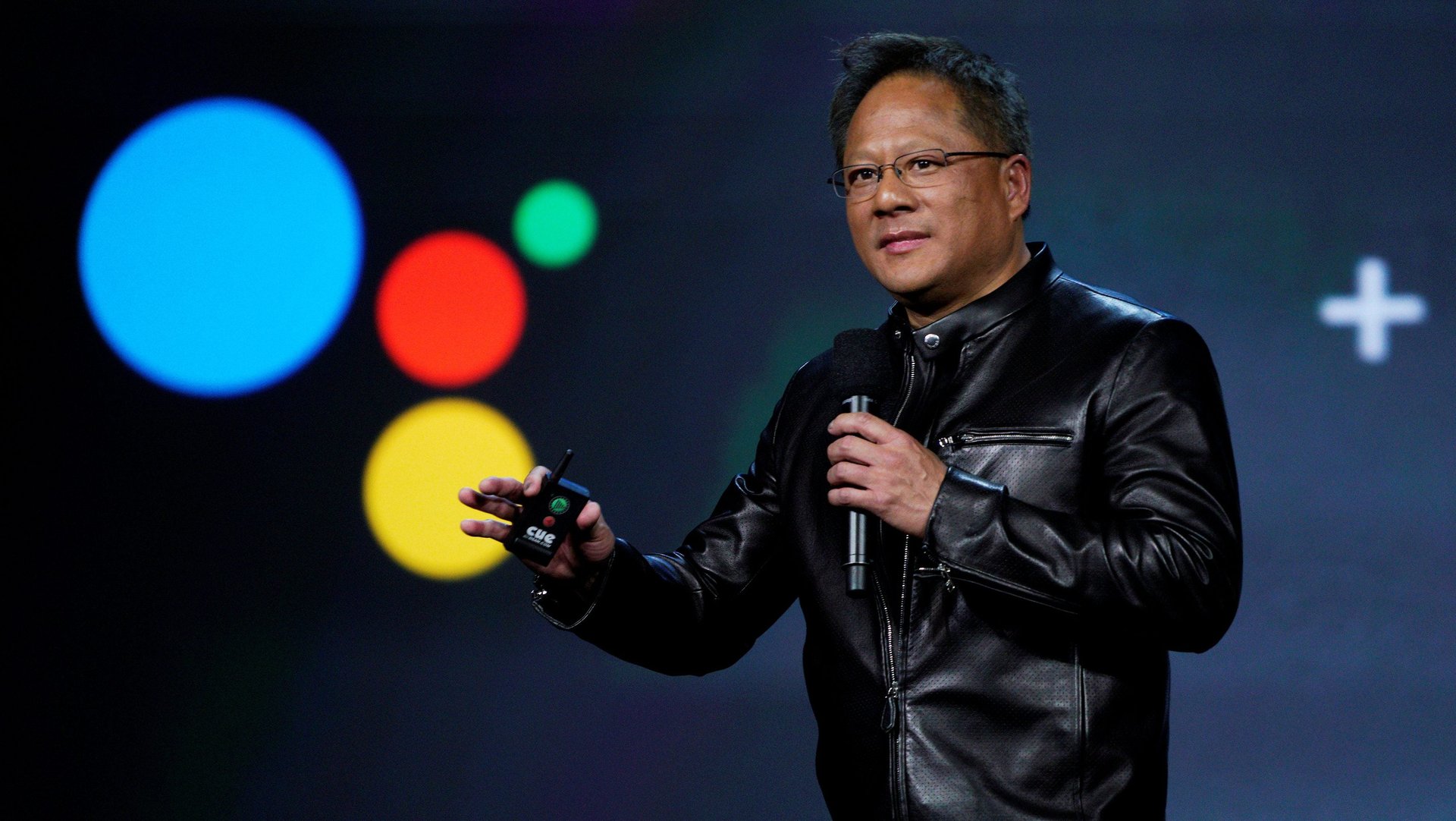

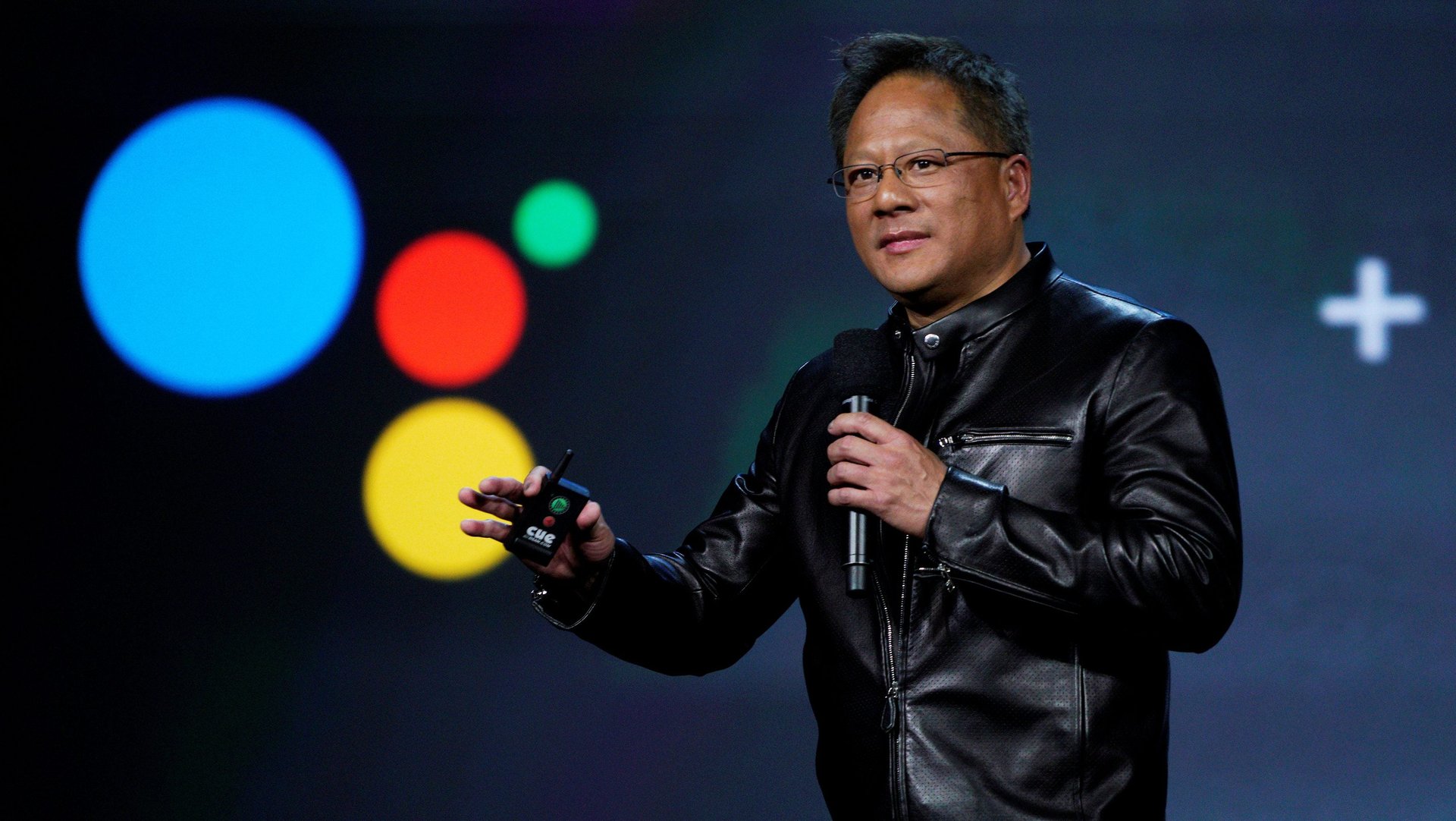

Nvidia has built itself into a leader in this space, selling enterprise GPUs to Google, Microsoft, Amazon, IBM, Tencent, and Baidu. But at least half of that list (Google, Microsoft, and IBM) are working on chips that are custom-built to be better at artificial intelligence tasks than GPUs or any other competing hardware. The others are also undoubtedly searching for more efficient ways of powering AI, already an industry-wide technology.

Just last month, Google published a blog post opining on the value of their custom chip, the tensor processing unit. The company claimed its technology ran 15 to 30 times faster than comparably GPUs from the time of initial development (2015), while using 30 to 80 times less energy. The company has since built new versions of the chip, but haven’t released more current stats. Though Google is still buying GPUs as it works out how to build and scale its own hardware, the paper shows that Nvidia’s current position as a leader in AI hardware doesn’t ensure future success in the space.

Nvidia has also pushed heavily to enter the automotive space, setting itself up for growth in a area that holds technology relationships for longer than the typical Silicon Valley company. Most recently, it has partnered with Bosch to build an entire computer system for autonomous cars. Nvidia CEO Jen-Hsun Huang said in March that the company’s hardware would be able to completely drive a car, 100% of the time, by the end of 2018.