Up-to-date technology can keep Millennials in finance from “going rogue”

The U.S. is in the midst of a massive demographic shift. Baby boomers are retiring and their children—tech-savvy Millennials—are a growing force in the workplace. Soon, these young professionals will become the finance leaders of tomorrow. For CFOs and businesses looking to build out their finance talent pipelines, preparing for the next generation of finance leadership begins by providing these digital natives with the next generation of advanced finance tools.

The U.S. is in the midst of a massive demographic shift. Baby boomers are retiring and their children—tech-savvy Millennials—are a growing force in the workplace. Soon, these young professionals will become the finance leaders of tomorrow. For CFOs and businesses looking to build out their finance talent pipelines, preparing for the next generation of finance leadership begins by providing these digital natives with the next generation of advanced finance tools.

The great Millennial influx

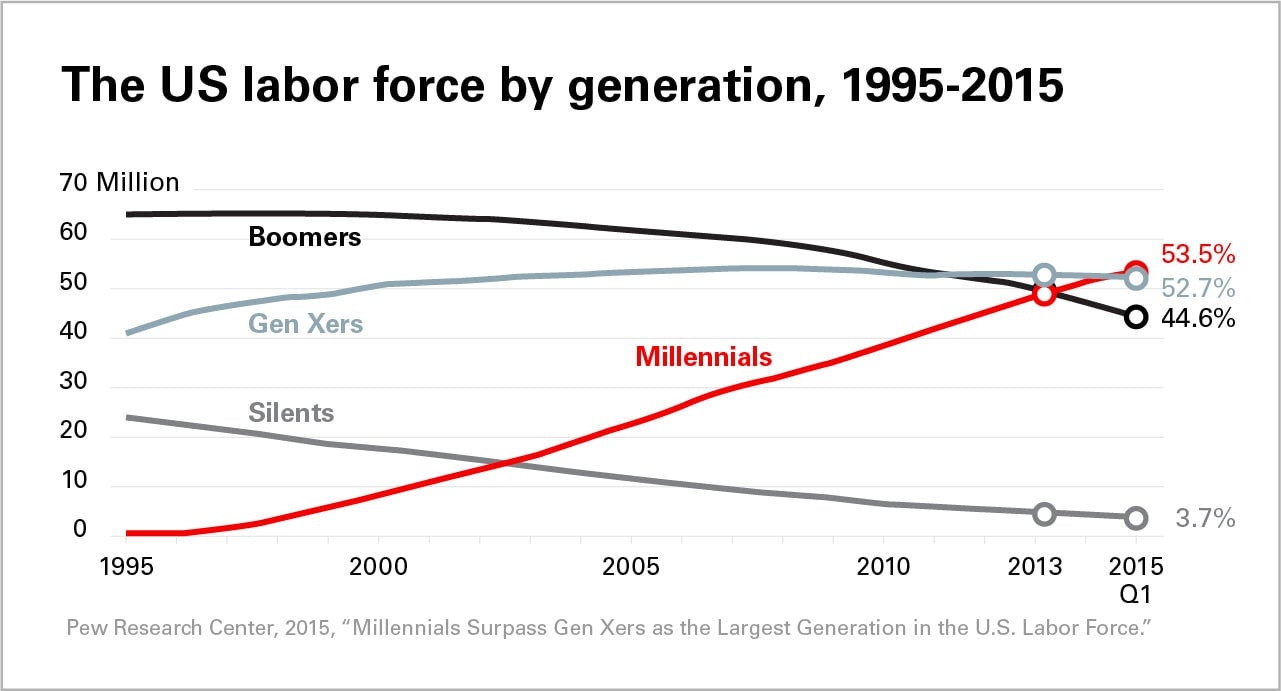

In 2015, Millennials became the largest segment of the U.S. workforce. Born after 1980, with the oldest in this generation now passing age 35, their ascendance heralds a demographic changing of the guard. Stalwart career traditionalists who were accustomed to working their way up in large corporate hierarchies—the Silent Generation and the Baby Boomers—have retired or are leaving the American workforce. Over 100 million Gen Xers and Millennials have stepped in to fill the void.

This shift signals a notable change in the finance talent landscape. Younger professionals have a much different relationship with both employment and technology than their older counterparts—a daunting prospect for finance leaders already grappling with a looming skills gap, a growing list of responsibilities, and an increasingly high profile within the organization.

New workers, new priorities

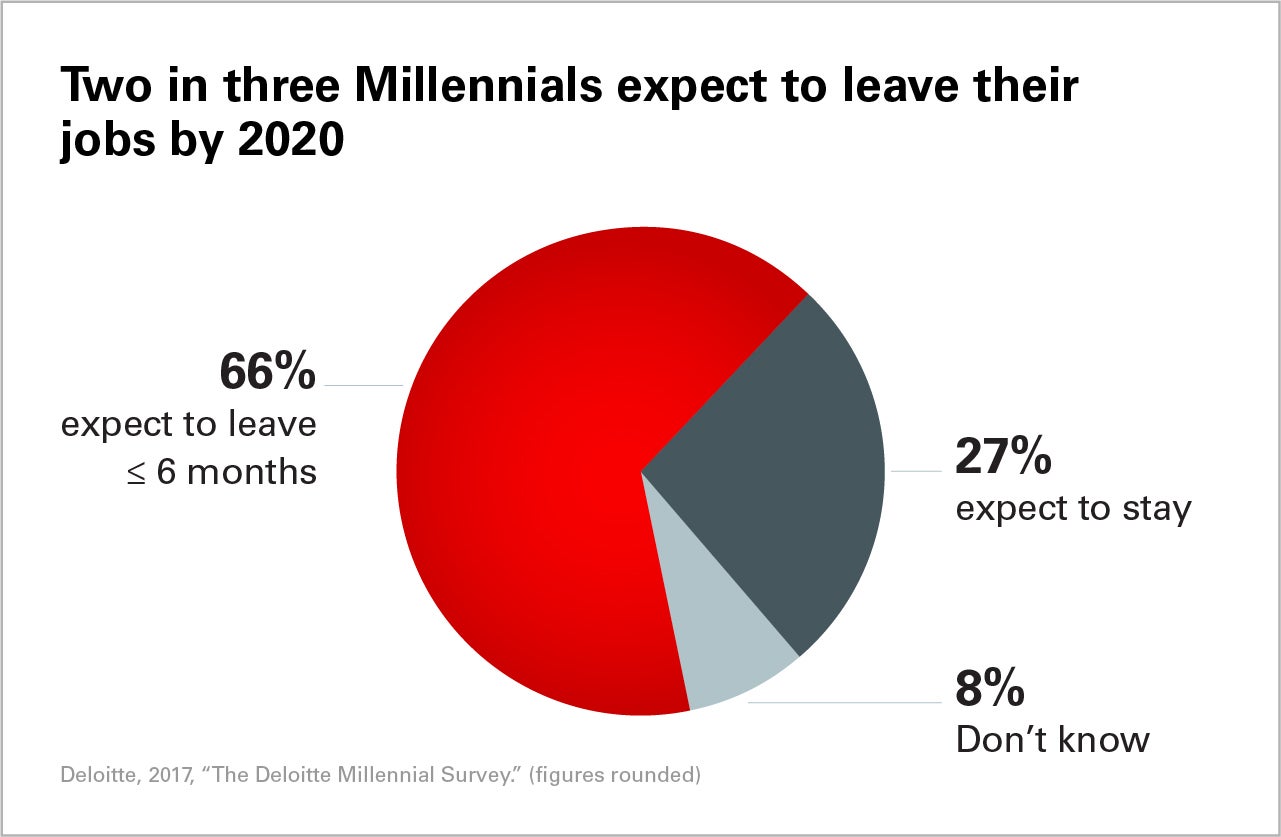

As demographics continue to shift, CFOs must contend with a labor force that no longer equates their job with personal security and no longer treats employment as a binding contract. Whereas 55% of Boomers view their job as a committed partnership with an employer, only a third of workers 35 and under share this sentiment. This attitude is reflected in Millennials’ readiness to change jobs. Gallup reports that 60% of Millennials describe themselves as open to new job opportunities, while another 2016 survey suggests that up to two in three Millennials plan to leave their jobs by 2020. In other words, the data indicate that among younger employees, building a long-term relationship with a single company is simply no longer a primary life goal.

For finance organizations facing a dearth of talented workers who can handle complex analytics and navigate complex business situations with finesse, the inability to retain key workers is troubling enough. But in their efforts to prevent the loss of skilled workers and create workplaces that will encourage Millennial employees to stay onboard, CFOs have encountered another vulnerability within the talent pipeline: outdated business technologies that fail to impress fickle, tech-savvy segments of their workforce.

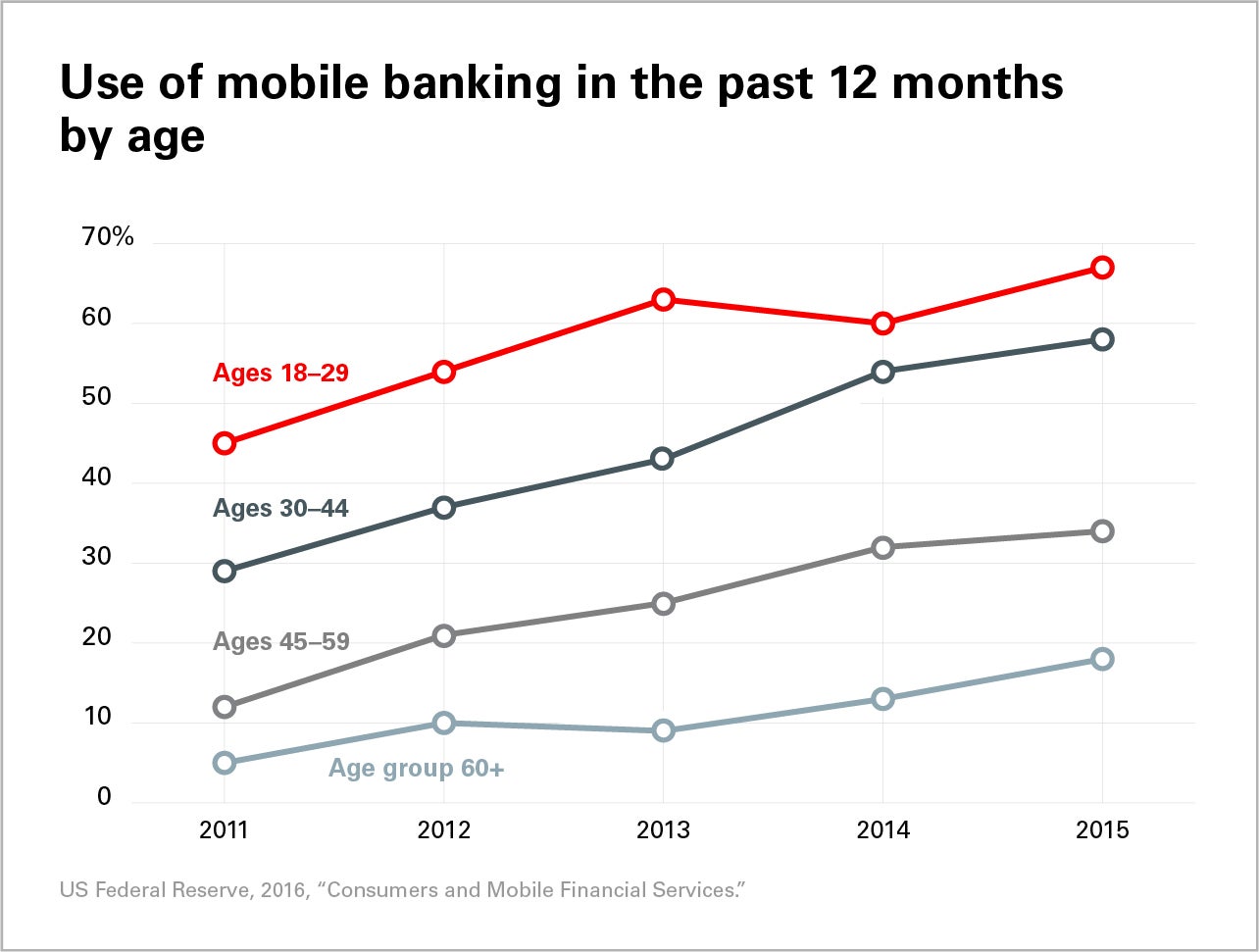

True to their reputations as digital natives, Millennial employees are more likely to rely on technology to understand and reach their personal financial objectives, using products such as Digit, a mobile savings app, and Acorns, a digital service which automatically invests spare change. With their relative ease of use and immediate access to information, such mobile applications have become almost second nature to this cohort. In 2015, nearly 70% of Millennials had used a mobile banking services within the prior 12 months.

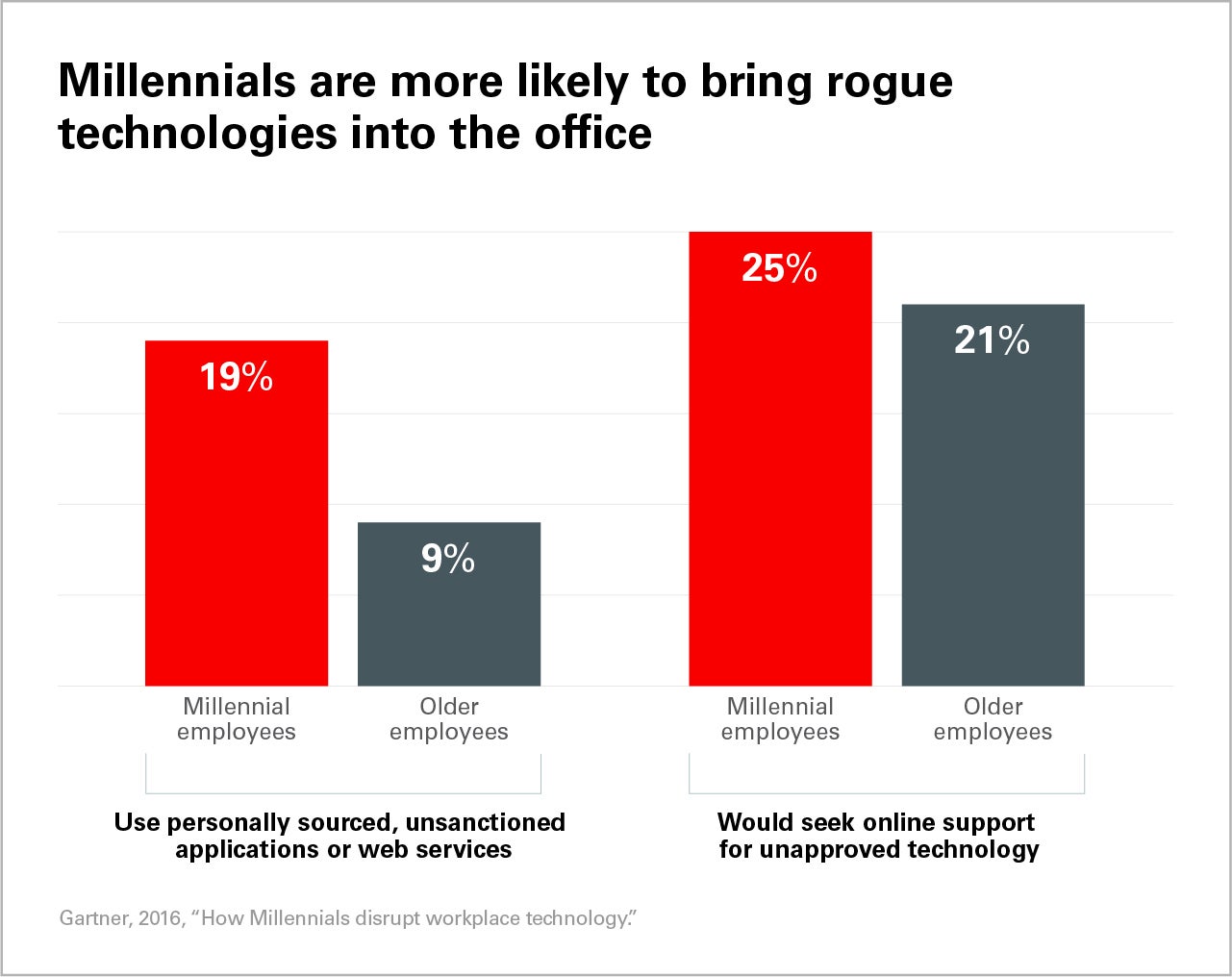

The way these tech-savvy professionals navigate their personal monetary decisions has real consequences for CFOs aiming to build out the finance talent pipeline. The Millennial employee’s world is defined by easy-to-use digital interfaces and real-time services that can be accessed anywhere, at anytime, on any device—a truth she expects to hold in the workplace as well. Employers who don’t provide the most advanced tools risk giving young workers a reason to seek greener pastures, or perhaps worse, an excuse to bring unsecured technologies into the company. Each new instance of this so-called “rogue IT” increases the chance that finance may run afoul of compliance requirements, jeopardizing teams across the business.

Meeting the needs of digital natives

The stakes are high for finance leaders addressing demographic change within their workforce. Studies suggest that retaining top talent longer than ten years begins with cultivating high employee engagement. Oracle Cloud for Finance offers CFOs the ability to provision their workforce with tools that can keep digitally-fluent employees engaged without compromising business agility or compliance.

These tools allow employees to provide not just back office reporting, but real-time strategic input, to make better data-driven decisions. And with easy-to-use solutions, a clean and intuitive user-interface, and the ability to collaborate across multiple devices, Oracle Cloud for Finance delivers a user experience familiar to tech-savvy Millennials.

With the next generation properly equipped and engaged, CFOs can turn their attention toward embracing strategic work at the front lines of the business.

Retaining a changing workforce begins with the right tools. Learn more about how Oracle Cloud for Finance gives CFOs the advanced solutions they need to prepare the next generation for the future of finance.

This article was produced on behalf of Oracle by Quartz Creative and not by the Quartz editorial staff.