Six months later, the “Trump trade” is over

“I think our dollar is getting too strong, and partially that’s my fault because people have confidence in me.”

“I think our dollar is getting too strong, and partially that’s my fault because people have confidence in me.”

—Donald J. Trump, April 2017

Within a month of Donald Trump boasting about markets having too much confidence in him, the dollar had erased all the gains it made after the president’s momentous election victory in November.

To be fair, currency traders were never as pumped by Trump as stock traders were. Trump’s pledge to cut taxes, spend big on infrastructure, and slash regulation sent stock markets surging to record highs—the “Trump trade,” as it came to be known.

The dollar rose along with stocks, at first. Before too long, though, traders started to question if Trump could achieve any of his policy goals. The White House has been mired in scandal and infighting from day one; even two interest rate hikes by the Fed couldn’t sustain the dollar’s value.

Last week, it looked like the stock markets were also starting to lose faith in Trump. The S&P 500 and Dow indexes dropped almost 2% on May 17—their worst day in eight months—after a memo by the former director of the FBI alleged that Trump was trying to influence an investigation into his campaign’s relationship with Russia.

Stocks haven’t tumbled like the dollar has, but they have traded in a relatively tight range over the past two months:

Was last week’s blip a sign that equity investors have only recently realized that bullish forecasts based on Trump’s promised reforms may be problematic? Is this the end of the Trump trade?

No. Analysts at Goldman Sachs, JPMorgan, and BlackRock all say that the Trump trade was already over, well before the recent wobble.

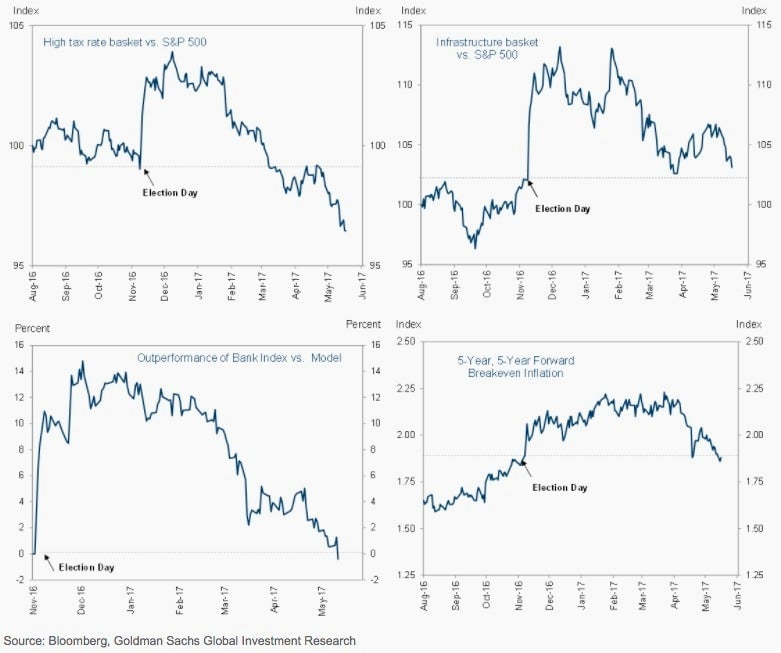

Economists at Goldman Sachs have once again lowered their expectations for US fiscal policy changes in the next year, and note that market expectations are even lower. The four charts below show that traders no longer expect much, if any, tax reform, infrastructure spending, or deregulation any time soon.

The top two charts show the relative performance of a basket of high-tax stocks (left) and infrastructure stocks (right) versus the S&P 500 index. Immediately after Trump’s election victory, these stocks gained more than others on expectations of favorable policy changes, specifically plans to slash the corporate tax rate and spend $1 trillion on infrastructure. In March, this outperformance began to wane as traders began to doubt Trump could deliver on his promises following a failed first attempt to pass a health care bill.

The lower left-hand chart uses a Goldman Sachs model as a benchmark to show how the outperformance of bank stocks after the election has been erased in the past few months. The lower right-hand chart, finally, shows a measure of bond market inflation expectations—called a five-year, five-year forward inflation rate—returning to its pre-election level. Trump’s aggressive policies were expected to stoke inflation after years of subdued price growth in developed countries. The fall in this rate “suggests that the market may have now mostly priced out expectations of the broader macroeconomic effects of the Trump agenda as well,” Goldman analyst Alec Phillips wrote.

Bottom-up vs. top-down

So if the Trump trade is over, why is the S&P 500 still 12% higher than it was before the election? The index closed at a new record high yesterday, after all.

Trump inherited not only a strong US economy, but also a strengthening global economy. The best set of quarterly corporate earnings in more than five years is a major factor pushing the stock market higher.

According to Mike Bell, a global market strategist at JPMorgan Asset Management, the market has already given up hope of US fiscal stimulus because “most people are skeptical that it’s going to be delivered.” What matters now are earnings, he said.

Large US companies are benefitting from a weaker dollar because it boosts the value of overseas earnings. According to Bespoke Investment Group, the stocks that generate the majority of their revenues outside the US have returned more to investors in the past six months than more domestically focused firms. Trump’s “America First” rhetoric initially inspired investors to bet on smaller, US-focused companies.

Look out below

The dollar could have further to fall, as investors increasingly eye juicier returns outside of the US. After market-friendly centrist Emmanuel Macron, a former investment banker, won the French presidential election, traders are focusing on the increasingly positive economic story in Europe in particular. Investors have been loading up on the euro and other European assets in recent weeks.

And now, with drastically lowered expectations for a US fiscal boost, stocks have little to lose if Trump’s proposed reforms continue to falter, but plenty to gain if he unexpectedly fulfills some of his pledges. Analysts at the BlackRock Investment Institute, part of the world’s largest asset manager, said last week that the “Trump equity trade” is over but “reflation trades” are still on, as the US economy grows slightly above trend.

Last week’s short-lived burst of panic shows how little impact Trump’s volatile administration is having on markets these days. To see what it looks like when investors really factor political instability into their financial forecasts, turn to Brazil.