Utility startups are making the electric grid work more like the internet

In the glory days of the electricity grid, utilities burned mainly fossil fuels at big, centrally located operations and transmitted the resulting power to businesses and consumers at highly regulated rates opaque to most users. Their main mission was reliability: keep the juice flowing, no matter what.

In the glory days of the electricity grid, utilities burned mainly fossil fuels at big, centrally located operations and transmitted the resulting power to businesses and consumers at highly regulated rates opaque to most users. Their main mission was reliability: keep the juice flowing, no matter what.

If one built the electrical grid today, one would reverse almost every aspect of that design. Solar and wind power generation is so affordable now that many consumers can be producers as well as consumers, one reason why investments in solar, wind, and storage comprised the majority of new money flowing into US energy infrastructure in 2016. Just as important, intelligent algorithms can now trade electricity to procure and deliver the cheapest power in real-time (such as this solar microgrid in Brooklyn).

As producers and consumers start to act like a network, the electrical system is beginning to resemble the internet. Silicon Valley is jumping at the opportunity by entering the highly-regulated energy market as lumbering incumbent utilities struggle to keep pace.

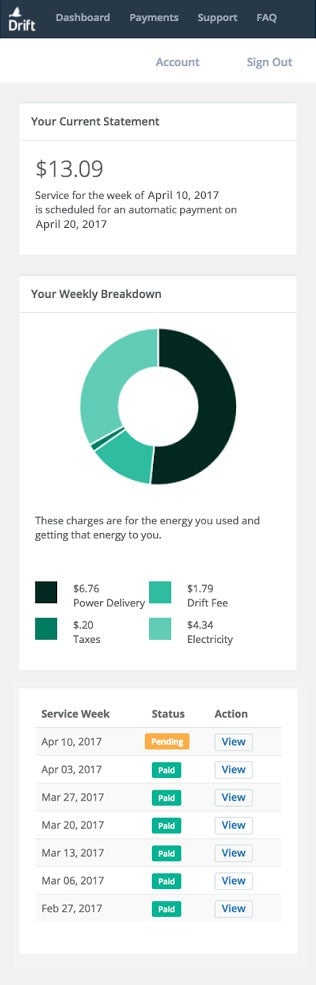

On May 31, Drift launched one of New York’s newest utility and electricity retailers. The team of self-described “software engineers and athletes,” registered as an utility and energy services company under state and federal authorities. is buying, trading and selling energy. By putting electricity management and trading under one roof, it claims it can optimize for price rather than just reliability.

“We make the [electricity] supply chain one platform,” says Drift co-founder and CEO Greg Robinson. “We flip the priority list over from what a utility does…[which] is to keep lights on. It seems after 135 years, we should be beyond that.”

The company, which has raised $2.1 million from firms including First Round Capital, Silicon Valley Angels, and Lerer Hippeau, has built a peer-to-peer electricity trading system. In a small beta program earlier this year, Drift bought electricity from producers such as upstate New York dams, as well as large buildings in New York City that can spare extra power, and delivered it to commercial and residential customers at prices sometimes lower than the spot wholesale market.

It uses machine learning algorithms to detect unexpected correlations for more granular forecasts of power usage by customers. The algorithms, Robinson says, have tied electricity demand patterns to everything from internet search terms and soccer games to aging infrastructure, micro-climates, zoning, and social behavior.

Drift has transacted “tens of thousands of dollars” worth of electricity, delivering cost savings between 10% and 20%, according to the company. By tapping a larger peer-to-peer energy trading market, it expects to see grow those savings. Drift charges its customers a flat fee — about $5 per month — for the service.

At the moment, costs can be high because most people still pay spot prices for electricity in states with deregulated electricity markets. Utilities must schedule electricity from wholesale producers at least a day head of time, using predictions of energy demand, and then customers buy at given prices. Since predictions are never perfect, prices can fluctuate and unexpected spikes in price during the year can dramatically drive up the cost of electricity.

Robinson says Drift taps its network of energy users who can curtail electricity use such as large buildings and industrial facilities, and be paid for it. It then sells this electricity to its residential customers at a discount relative to the wholesale market. Traditional utilities can do this as well, but their mandate is to preserve the overall stability of the grid, not find the lowest price for customers.

For now, the process is manual: Building managers are alerted by text message to lower their energy use. As sensors and automated appliances enter the market, Drift plans to allow residential customers to respond to demand events and trade automatically on the energy market. Drift also claims it can unlock more savings by automating all the “red tape” and bureaucracy now built into utilities’ business model.

We have, of course, seen similar promises before and it did not always end well. Deregulation of New York’s electricity markets in the 1990s unleashed a host of unsavory actors who fleeced thousands of people through deceptive marketing techniques on their utility bills.

Clean tech also proved to be a financial Waterloo for Silicon Valley. In 2007, prominent Silicon Valley venture capitalist John Doerr proclaimed green technologies would be “bigger than the Internet,” and invested accordingly. Five years later, the cleantech sector was in liquidation mode. By 2011, MIT found (pdf) that almost all of the 150 renewable energy start-ups Silicon Valley had backed in the previous decade had shut down or were unraveling. From its 2008 height of $5 billion, VC cleantech investments fell to just $2 billion per year where it has remained.

But since then, the technology has evolved and regulators have cracked down hard on bad actors who cheat customers. Clean tech money today is going to software, not hardware. MIT argues that investing in capital-intensive companies that build solar panels or research new battery chemistries doesn’t fit a venture capital model that expects returns within 10 years or less. Instead, VCs should target areas where software can unlock new efficiencies. Drift will is about to test that thesis.