M-Pesa is pushing against a tax hike on mobile money services in Kenya

A proposed tax increase on mobile money transfers in Kenya is drawing protests from several services, including M-Pesa.

A proposed tax increase on mobile money transfers in Kenya is drawing protests from several services, including M-Pesa.

As part of a new tax proposal to raise government revenues, Kenya’s government is pushing to raise duties on mobile cash transfers by 2%. The government expects to net around $270 million in additional revenues and claims the extra income will fund a universal health care program to cover all households by 2022.

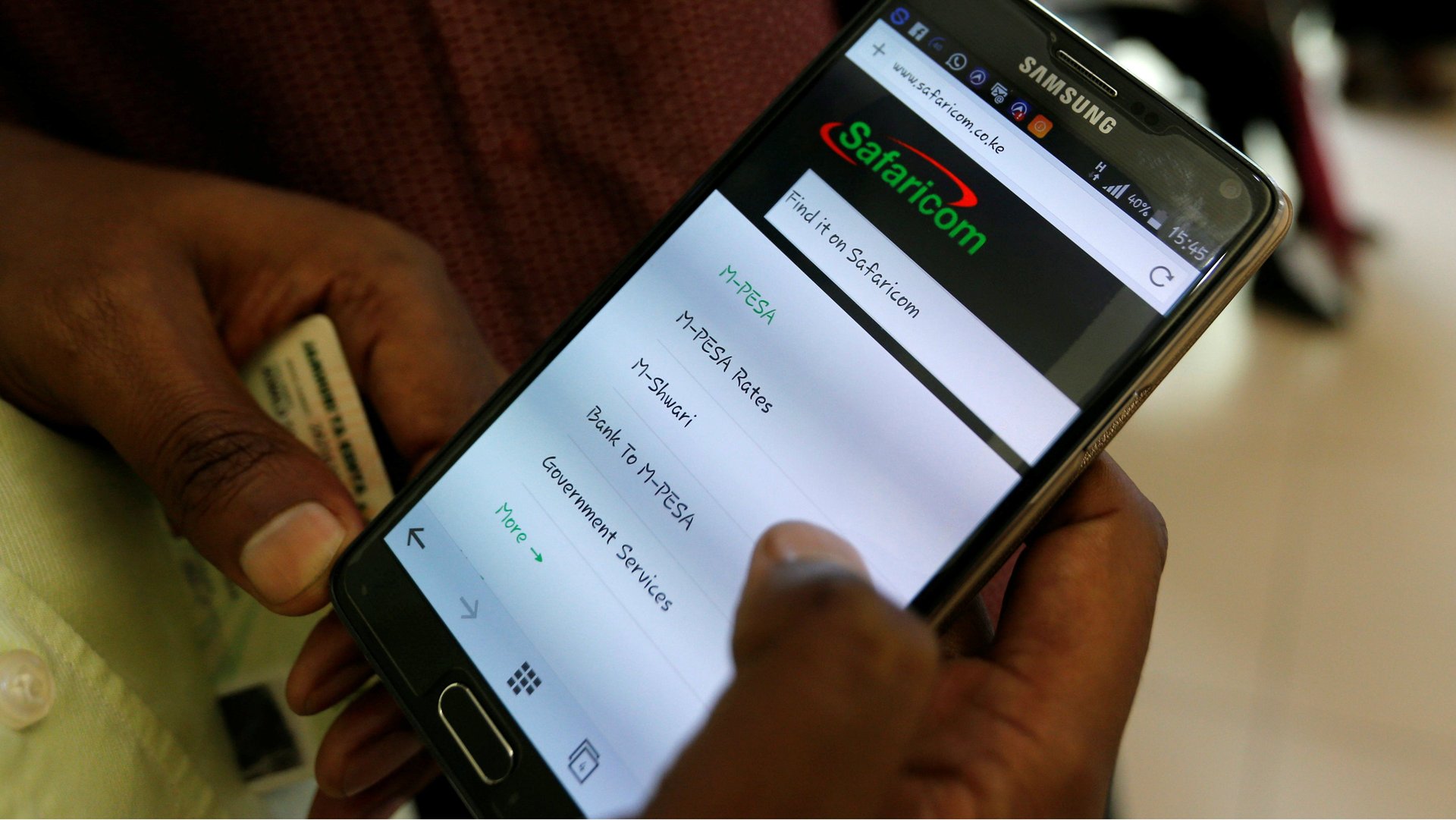

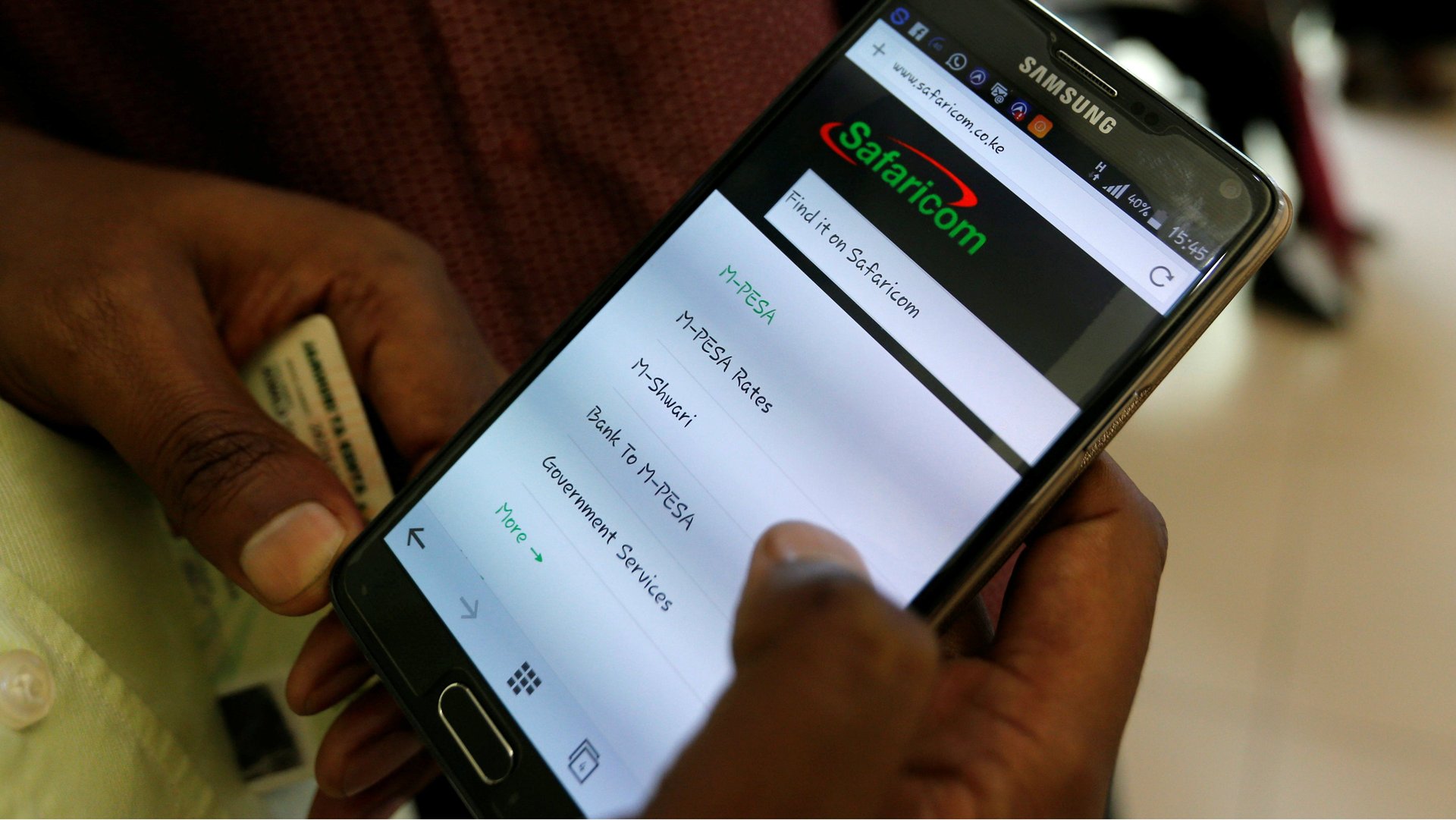

But Safaricom-owned M-Pesa says the move could take a big toll, as it will “negatively impact mobile-led transfer services and payments” and reverse the gains of financial inclusion by making it more expensive to conduct business transactions and make payments using mobile money services.

Since it was launched in 2007, M-Pesa, the largest mobile money service in the world, has become ubiquitous in the Kenya. With over 26 million users, it’s deeply entrenched in the national economy.

While the taxes are levied on the service providers, the additional costs will likely be passed on to customers, many of whom are unbanked and rely on the service for essential daily payments. It’s not the first time mobile money platforms have come under the focus of the taxman in Kenya. In 2016, the Kenya’s Revenue Authority pushed for access to private mobile money transaction records to identify possible tax cheats.

Despite the jostling with local authorities, Safaricom is doubling down on its dominance in Kenya. Over the past year, it has launched an e-commerce platform and a messaging service that allows users send and receive money while they are chatting. It also announced a collaboration with PayPal that allows global customers to transfer cash between PayPal and M-Pesa mobile wallets.