A US multinational avoided South African taxes worth twice Johannesburg’s social housing budget

Without knowing it, you’ve probably flown on an airplane owned by Aircastle Limited.

Without knowing it, you’ve probably flown on an airplane owned by Aircastle Limited.

The US-based company, which trades on the New York Stock Exchange and is valued at $1.6 billion, leases aircraft to the likes of United, American Airlines, British Airways, easyJet, and KLM.

A surprisingly hefty chunk of Aircastle’s business comes from a deal with South African Airways. Between 2011 and 2014, it made $53 million from leasing planes to the state-owned company. Aircastle also legally avoided paying taxes to the South African government by routing that cash to the tax haven of Mauritius, according to confidential financial statements reviewed by Quartz. Aircastle paid just $1.5 million in tax, at an effective rate of 2.87%, to the tiny island nation in the Indian Ocean, situated about 2,000 miles from Johannesburg and 9,200 miles from Aircastle’s Stamford, Connecticut, headquarters.

Through a complex scheme involving networks of subsidiaries, it likely avoided $14.8 million in taxes, compared to what it would have paid at the South African government’s business rates at the time. That’s more than double (pdf, p.19) what Johannesburg—the country’s largest city, with 5 million people—spent on its social housing body in 2012-13.

Aircastle is officially registered in the tax haven of Bermuda and has subsidiaries in offshore sites Singapore and Ireland.

“While much of this behavior is legal, it is immoral,” Eric LeCompte, executive director of faith-based anti-poverty group Jubilee USA, said in a statement. “Developing countries are losing vital monies to fight poverty and build infrastructure because of this behavior that avoids paying taxes.”

Many of the beneficiaries of this scheme were Canadian citizens. Between 2013 and 2018, the Ontario Teachers Pension Plan (OTPP) was Aircastle’s second biggest shareholder, with a stake of around 10%, according to SEC filings. OTPP sold its shares in Aircastle last year, but still has a joint venture with the firm, valued at $544 million, according to the 2019 SEC filing. OTPP declined to comment on this story.

The impact of tax dodges

The Aircastle documents were among a trove of some 200,000 confidential records—collectively known as the Mauritius Leaks—belonging to the former Mauritius office of Bermuda-based offshore law firm Conyers Dill & Pearman, which were given to the International Consortium of Investigative Journalists (ICIJ) and shared with dozens of journalists around the world, including reporters at Quartz. The resulting investigation provides a glimpse into how foreign companies and investors have been able to take advantage of the former French colony’s tax code to profit at the expense of African nations.

Aircastle did not respond to requests for comment from ICIJ or Quartz.

Poorer countries lose up to $100 billion each year thanks to tax agreements with offshore jurisdictions like Mauritius, according to UN research. Fixing this imbalance, LeCompte said, is the only way for these nations to meet the Sustainable Development Goals set by the UN in 2015, which established a series of economic and social benchmarks to be attained by 2030. On a broader scale, the Tax Justice Network, a research and advocacy group, estimates that multinationals shifting profits to tax havens costs the world’s governments more than $500 billion per year, with poorer countries losing the most as a percentage of GDP.

How Aircastle did it

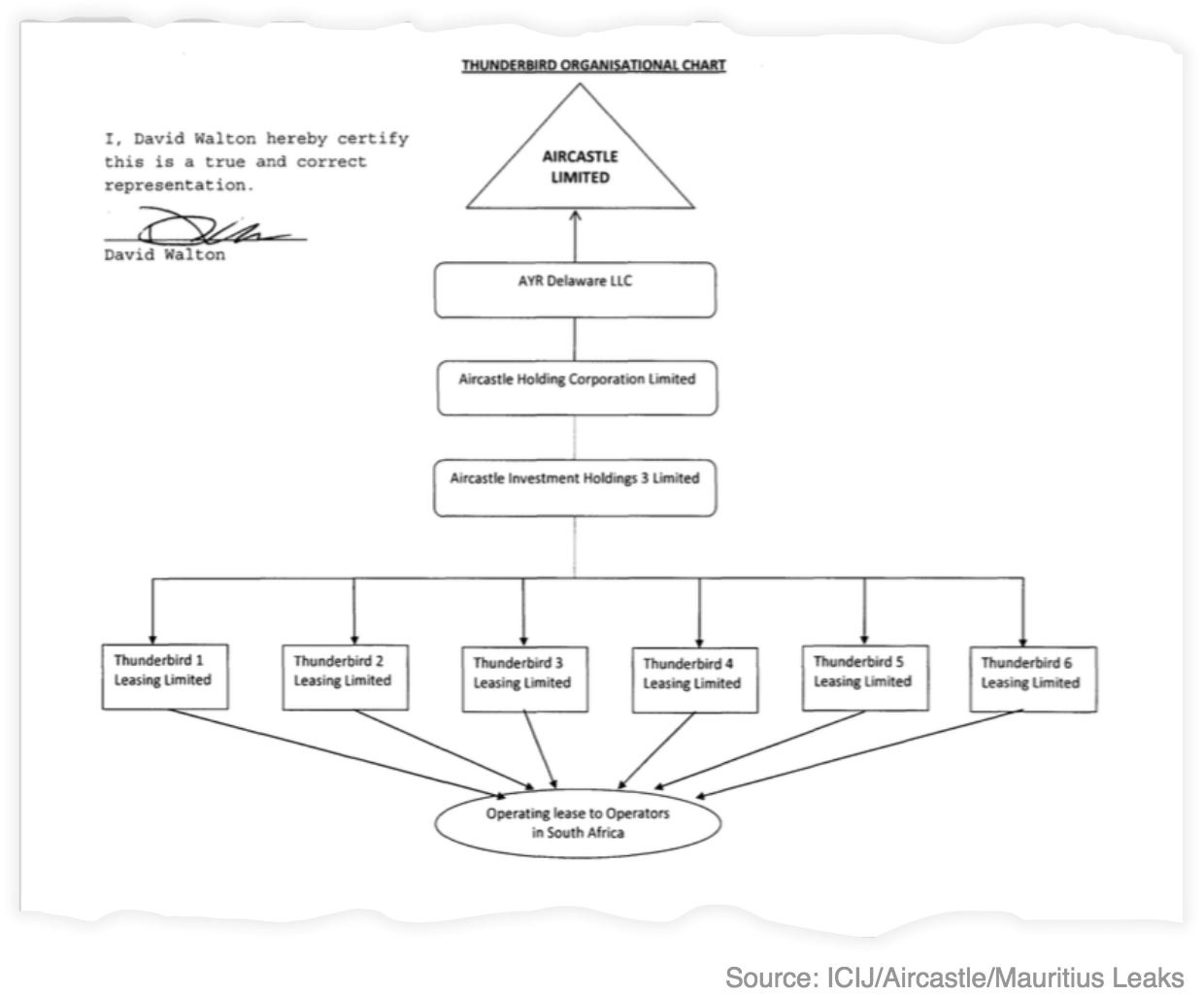

The Aircastle network looked like this: It set up six Mauritian shell companies—Thunderbirds 1, 2, 3, 4, 5, and 6—and, through those, leased at least four planes to South African Airways. Each shell’s sole purpose was to collect rent on an aircraft. All six Thunderbirds were subsidiaries of various other Aircastle companies, in a chain that snaked from Mauritius through fellow tax havens Bermuda and Delaware, until reaching the publicly traded parent company Aircastle Limited.

A South African state company played a role in depriving its own government of tax revenues. Several confidential Aircastle bank statements show South African Airways paid its fees directly into Aircastle’s Mauritian account with Deutsche Bank, though it’s not clear whether the airline knew the account’s location.

SA Airways told ICIJ it currently pays into a Citibank account in New York for its four planes leased from Aircastle. The airline didn’t answer a question about past payments to the Mauritian Deutsche Bank account.

Read more of Quartz’s reporting on how the Mauritius Leaks expose global tax avoidance.