How Western advisers helped an autocrat’s daughter amass and shield a fortune

This story was co-published with the International Consortium of Investigative Journalists.

This story was co-published with the International Consortium of Investigative Journalists.

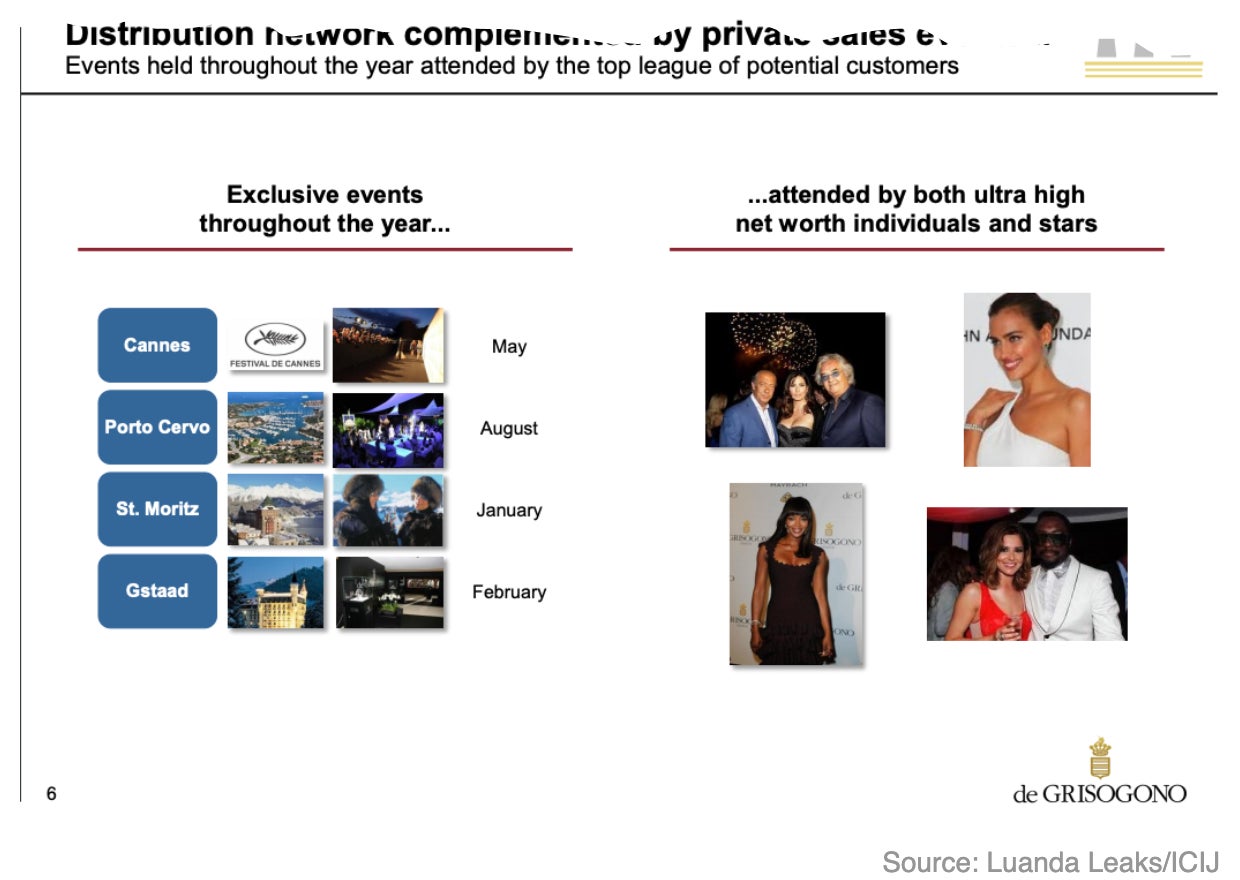

Pausing at the entrance of a star-studded bash at the Cannes Film Festival, 1990s-icon Sharon Stone flashed her one-of-a-kind cuff bracelet. It was a wraparound hippo with rubies for eyes, sapphire nostrils and white diamond teeth.

The dazzling ornament was created by de Grisogono, a Swiss luxury jeweler and host of the exclusive event on the French Riviera.

De Grisogono had thrown Cannes parties before. But this one, in May 2013, was especially sumptuous, with a fireworks show and a chamber orchestra to serenade guests as they took in the seaside views. Underwriting the festivities: the government of Angola, a country with one of the world’s highest poverty rates.

Angola’s diamond trading company, known as Sodiam, and a Congolese businessman married to Isabel dos Santos, daughter of the country’s then-president, had bought a controlling stake in the struggling jeweler the year before. Its new managers, who included former employees of management-advisory giant Boston Consulting Group, hoped the bash would halt a long decline in sales. Stone was that year’s “ambassador,” a star still bright enough to entice the rich and famous to buy a de Grisogono bauble of their own.

The plan didn’t work. De Grisogono sold just $5.6 million of its wares through private sales in 2013, far short of its $33 million target. Angola’s state diamond company now fears its investment of more than $120 million is gone for good.

The de Grisogono investment is just one example of the deals linked to Isabel dos Santos and her family that were made possible by consultants, accountants and lawyers, according to a trove of more than 700,000 emails, contracts and other documents leaked to the Platform to Protect Whistleblowers in Africa (PPLAAF), a Paris-based advocacy and legal group, and shared with the International Consortium of Investigative Journalists, Quartz and other media. A team of more than 120 journalists in 20 countries spent more than eight months combing through the documents, known collectively as the Luanda Leaks, and conducted hundreds of interviews.

The leaked documents and subsequent interviews reveal a remarkable story of an empire built on insider deals, preferential loans, and sweetheart contracts fueled by public money. Dos Santos now has an estimated net worth of at least $2 billion and stakes in telecoms, banking and a range of other industries.

The Angolan government’s unlikely investment in a luxury jewelry company, for instance, can be traced through the documents to a series of transactions in 2012 that quietly routed millions of dollars through shell companies in Malta and the British Virgin Islands. The transactions, according to the documents, gave dos Santos’ husband, Sindika Dokolo, full management control of the Swiss jeweler despite a substantial investment by the Angolan state diamond trading agency.

The documents also offer a window into the lightly-regulated professional services sector, which over the years has carved out a lucrative role in a thriving offshore industry that drives money laundering, tax avoidance, and corruption around the world.

From storefront offices in the tiny tax haven of Malta to conference rooms in Switzerland and Angola, the documents show how Boston Consulting Group, PwC (formerly PricewaterhouseCoopers), KPMG, and other major firms helped sustain dos Santos’ empire for years, long after many Western banks had cut her off amid concerns about the source of her wealth.

Accountants disregarded red flags that experts say should have triggered alarms. Attorneys from prominent Portuguese law firms helped set up shell companies and move money for dos Santos and her husband. And consultants advised ways to run their businesses and avoid taxes.

While banks are subject to stringent regulations that—even if not always enforced—tend to make them proceed with caution, professional firms face far less scrutiny. As such, experts say, they are often less likely to say no to a risky client.

“The incentive structure makes it still too easy and too lucrative and not risky enough for them to engage in that dirty business,” said Markus Meinzer, director of financial secrecy at the Tax Justice Network, a think tank that studies tax evasion and financial regulation.

Angolan authorities have begun to crack down on dos Santos and her husband. In late December, an Angolan court ordered the freezing of dos Santos’ and Dokolo’s assets. The Angolan government told the court it believes the couple and a business associate have caused the state to lose $1.1 billion. State companies “transferred enormous amounts of foreign currency to companies abroad whose ultimate beneficiaries are the defendants, without receiving the agreed return,” the court order states.

Through their lawyers, dos Santos and Dokolo denied allegations of wrongdoing. Dokolo said he was a successful entrepreneur and the target of a politically motivated campaign in Angola.

“This is political persecution,” dos Santos said in a January interview with the BBC, an ICIJ partner, accusing the current Angolan government of targeting her family to distract attention from the country’s economic problems. “My holdings are commercial. There are no proceeds from contracts or public contracts, or money that has been deviated from public funds.”

Dos Santos was scheduled to attend the 2020 World Economic Forum meeting in Davos, Switzerland, after Unitel, a mobile phone company she partly owns, was named an associate partner in 2019. Following the asset freezes, however, the World Economic Forum said dos Santos was no longer coming.

Banks back away

In speeches and interviews, dos Santos brands herself as a self-made billionaire and inspirational figure whose success owes only to her shrewd business dealings. “I’m not financed by any state money or any public funds,” she told The Wall Street Journal in 2016.

But dos Santos’ up-from-her-bootstraps narrative never stood up to much scrutiny.

Her country, and her father’s former regime, had been deemed corrupt for years: In 2013, Transparency International ranked Angola among the world’s most corrupt countries. A stream of stories, including a Forbes magazine investigation published that year, tied dos Santos’ fortune to handouts and preferential deals, including a founding stake in local telecom giant Unitel.

At the same time, Western banks had grown wary. In the wake of the 2008 financial crisis and a string of money-laundering scandals, regulators were already breathing down their necks, and dos Santos and her husband fit the profile of clients many institutions decided they could no longer afford.

In 2012, a Citigroup subsidiary walked away from a financing deal for a Dutch holding company whose shareholders included Dokolo, the leaked documents show. Barclays did the same in 2013. Citigroup and Barclays declined to comment for this article.

In 2014, Spanish giant Banco Santander flagged dos Santos as a “politically exposed person”— a term used by financial regulators for public officials and their family members vulnerable to bribery or corruption—and refused to work with her, the documents indicate. “These guys hear about Isabel and they run like the devil from the cross,” a dos Santos business manager wrote of Santander in an email to a colleague.

Even Deutsche Bank, which US and UK authorities fined more than $600 million in 2017 for failing to stop a Russian money laundering scheme, blocked attempts by dos Santos’ husband to transfer money, according to an email by one of dos Santos’ top advisors. (Deutsche declined to comment. But a spokesperson said the bank carefully monitors risks related to politically exposed persons).

The banks’ refusal to work for dos Santos should have been “a red flag that cannot be ignored,” said Michael Hershman, a co-founder of Transparency International and CEO of the Fairfax Group, a compliance consultancy. “You always have to be concerned about the origin of the money you’re going to be receiving—is it part of the fruit of the poisonous tree?”

“If the money was originally accumulated through corrupt acts or illegal acts, any income or revenue generated from those acts—regardless of how far down the line—is tainted,” he added, speaking to the professional and financial services industry generally.

He acknowledged that it was “difficult but not impossible to find out” that banks had rejected companies tied to the couple. “It’s part of the due diligence process, knowing who the banking relationships are with,” Hershman said.

The advisers hang around

Accountants, consultants and other professional advisers, however, were undeterred.

Each of the Big Four accounting firms worked for dos Santos companies long after many banks had broken ties. Deloitte served as auditor for Finstar, an Angolan satellite TV company partly owned by dos Santos, and Ernst & Young did the same for ZOPT, the company dos Santos uses to hold her stake in Portuguese telecoms giant NOS. KPMG served as auditor for two companies in dos Santos’ retail network and consulted for Urbinveste, dos Santos’ project-management firm.

Among the Big Four, PwC played the biggest role in the dos Santos empire. Dos Santos herself once worked for Coopers & Lybrand, which later became part of the Big Four firm. Her former employer provided accounting and auditing services to companies linked to dos Santos and her husband in Malta, Switzerland and the Netherlands. PwC also gave tax and financial advice to Angolan businesses owned or partly owned by the couple.

Consulting firms also continued to work with dos Santos. The leaked files show that PwC’s consulting arm was among several consultancies that advised her businesses.

PwC’s advice included suggesting creative ways to reduce taxes. In 2017, for example, PwC consultants created a report for a dos Santos retail group called Grupo Condis that proposed ways to take advantage of “very competitive” tax rates “potentially between 0% and 5%” by using a holding company in tax havens like Malta or Singapore. The firm also advised Ciminvest, a dos Santos company with a stake in an Angolan cement producer, on loan repayment and dividend distribution.

Watching the watchdogs

Accountants play a critical watchdog role over business. Their mission is to force companies to be truthful about their finances and to reveal systemic flaws in their operations. Done properly, audits give public pension funds and other investors crucial insight into how those companies are managed and whether they’re a safe place to invest.

When accountants fail, the consequences can be catastrophic.

An accounting fraud scandal at Enron in the early 2000s brought down both the energy giant and its auditor, Arthur Andersen. Each member of the remaining Big Four has since been in the headlines for allegedly putting profit ahead of their professional obligations, including allegations of helping clients carry out or cover up wrongdoing.

But because of their unglamorous role in the financial system and their less stringent regulatory burden compared to banks and other players, accountants have mostly escaped public notice. Lost in the turmoil of the Great Recession were stains like a lawsuit alleging Ernst & Young had helped hide the problems of now-collapsed Lehman Brothers, and the House of Lords’ rebuke of the entire UK accounting profession as “complacent.” (Ernst & Young agreed to pay a $10 million settlement, without admitting wrongdoing.)

The US, which has imposed some of the world’s toughest anti-money laundering laws on banks, has no federal law forcing accountants to vet potential clients or report suspicious activity to law enforcement. The American Institute of Certified Public Accountants has issued guidelines directing its members to vet clients, but in practice there’s no evidence that US accountants ing general “make any more enquiries about customers than is absolutely necessary,” according to the Financial Action Task Force, an anti-money laundering organization of 37 member countries.

Critics say the top US accounting regulator, the Public Company Accounting Oversight Board (PCAOB), hasn’t been aggressive enough in policing the Big Four. A recent investigation by the Project on Government Oversight, a nonpartisan watchdog, found that in the past 16 years, the PCAOB identified 808 defective audits performed by the Big Four, but brought only 18 enforcement cases.

The Big Four have shelled out a lot of money to influence rulemaking. The firms combined spent nearly $90 million on lobbying over the past decade, according to data compiled by the Center for Responsive Politics. Most recently, they fought a bill that would make the PCAOB’s disciplinary proceedings against accounting firms public. The PCAOB is now required to keep disciplinary proceedings secret until its decision is reviewed by the Securities and Exchange Commission or the review period has passed.

In Europe, spotty at best

On paper, European Union rules are far tighter. The EU requires accountants to vet clients and alert national authorities if they suspect a client’s funds “are the proceeds of criminal activity.” Like banks, accounting firms have to file suspicious activity reports if they believe a client is laundering money. The EU includes Malta, where many companies owned by dos Santos and her husband are incorporated.

Under EU rules, senior accounting executives must approve firms signing up “politically exposed persons” and firms must take “adequate measures” to ensure their money is legitimate. This level of scrutiny is supposed to continue throughout the business relationship.

But research shows compliance is spotty. In at least 10 EU countries, accountants filed fewer than 10 suspicious transaction reports in 2015, a European Commission study found. Banks in many of those countries filed thousands of reports over the same period.

Meanwhile, other research finds accountants, either wittingly or unwittingly, often facilitate money laundering. A recent analysis of more than 400 British corruption and money laundering cases, conducted by Transparency International UK, documented the involvement of hundreds of professional advisers, including 62 UK accountancy firms.

“Without the assistance of these people, these corruption schemes and the money laundering that flows from that would be unable to happen,” said Ben Cowdock, a researcher who worked on the report.

But much of the Big Four’s work takes place beyond the reach of Western regulators. Though headquartered in Western capitals, the industry works on a franchise model in which global networks of affiliated firms share the same brand name but are typically independent legal entities subject only to local laws.

“Though they portray themselves as global firms, they only use the word global when they want to win business,” said Prem Sikka, an accounting professor at the University of Sheffield. “When it comes to liability, their claims on globalization vanish and then they say they’re a loose network of national firms — even though they have a global website, a global board.”

In 2018, the Financial Action Task Force took a close look at how criminals hide their ownership of assets to launder money and evade taxes. Professional intermediaries, including accountants, played a key role in a majority of the 106 cases they studied.

“Professional service providers significantly enhance the capacity of criminals to engage in sophisticated money laundering schemes to conceal, accumulate and move volumes of illicit wealth,” the report says.

Buying Credibility

In interviews, dos Santos has pointed to her relationships with major consulting firms as evidence that her wealth is legitimate. In October, she said she had passed careful vetting to work with firms including “consultants who are in the top five worldwide.”

Consulting firms are subject to very few legal requirements to vet their clients, leaving little more than the threat of reputational damage to guide their behavior.

McKinsey & Company, Boston Consulting Group, and Booz Allen Hamilton reportedly continued close relationships with Crown Prince Mohammed bin Salman of Saudi Arabia after the murder of Saudi journalist Jamal Khashoggi, despite the crown prince’s alleged involvement. McKinsey has also worked for other authoritarian regimes, including Turkish president Recep Tayyip Erdogan’s government.

Accenture did work valued as high as $54 million for three dos Santos-linked entities between 2010 and 2015, the files show. When a Portuguese newspaper published a video compiling corruption allegations against dos Santos in 2016, one of Accenture Portugal’s top executives emailed a dos Santos employee to make light of the allegations, according to an email chain found in the files. In 2016, McKinsey & Company created a strategic plan for Efacec Power Solutions, a Portuguese engineering company controlled by dos Santos.

From 2010 to 2016, Boston Consulting charged at least $4.3 million in consulting fees to companies owned or partly owned by dos Santos and Dokolo, including more than $3.5 million for a subcontract from Wise Intelligence Solutions Limited, a Maltese company owned by the couple. The Angolan government had given Wise a contract worth $9.3 million in 2015 to help it restructure Sonangol, the state oil company.

Through her lawyers, dos Santos said the Angolan government sought her involvement in the project “because she is one of very few Angolans with substantial international business experience.” Dos Santos denied receiving any tax advantages from operating through foreign or offshore companies.

Boston Consulting didn’t respond to detailed questions, citing confidentiality restrictions. “BCG senior partners regularly review the type of work we do — before it is taken on and during its delivery,” a spokeswoman said. “In Angola, we reviewed the payment structures and contracts, as we do for all projects, to ensure compliance with established policies and avoid corruption and other risks.”

McKinsey said its relationship with Efacec started before dos Santos became a shareholder. “McKinsey typically serves the management of companies, not individuals or the shareholders,” a spokesman said in an email.

Accenture said it doesn’t comment on the specifics of its work for clients.

PwC didn’t respond to detailed questions about its work for the companies, citing confidentiality restrictions, but said it has “taken action to terminate any ongoing work” for entities controlled by members of the dos Santos family. “We strive to maintain the highest professional standards at PwC and have set expectations for consistent ethical behavior by all PwC firms across our global network,” the firm said in a statement. “In response to the very serious and concerning allegations that have been raised, we immediately initiated an investigation and are working to thoroughly evaluate the facts and conclude our inquiry.”

Deloitte, Ernst & Young and KPMG also cited confidentiality restrictions when declining to answer questions about their work with dos Santos. The firms said they have rigorous screening procedures for potential clients. Deloitte and KPMG said they review existing clients annually while EY Portugal said it reviews its client acceptance procedures every year to make sure they comply with current laws. KPMG said it conducts additional due diligence for audit clients in Angola, including scrutiny from the firm’s forensic team.

Anatomy of a self-deal

De Grisogono was not in a good place in 2012. Sales had plunged after the financial crisis and the company struggled under a growing load of debt. A lifeline arrived from an unlikely pair. Sodiam, the trading arm of the Angolan state diamond company, and Dokolo, dos Santos’ husband, acquired a controlling stake in de Grisogono. Its founder, Fawaz Gruosi, kept a minority stake.

The leaked documents reveal the terms of the acquisition were enormously favorable to Dokolo. It gave him “full control of the management” of the jewelry company, according to a draft shareholder agreement. Dokolo also received a roughly $4 million “success fee,” drawn from the Angolan state money, for arranging the deal that left him in charge, leaked emails and contracts show.

Records indicate Sodiam, then under the influence of dos Santos’ father, initially supplied $45 million to buy off de Grisogono’s debt and acquire shares in the struggling jewelry company. Part of the money was also used to pay the “success fee” to one of Dokolo’s companies in the British Virgin Islands.

Sodiam loaned de Grisogono more than $120 million. At least $98 million of that cash was borrowed at a 9% interest rate from Banco BIC in Angola, a bank partly owned by dos Santos.

Through his lawyers, Dokolo said he invested $115 million in the jeweler initially and subsequently out in significantly more. He said he had received the success fee, which he reinvested in the company, for “the successful complex negotiations and structuring of the acquisition.”

“The strategic vision for the acquisition of de Grisogono, envisaged by Mr. Dokolo, was to achieve a vertical integration of Angola’s diamond industry and to create a value-added business along the entire value chain from mining to polishing to retail sales,” Dokolo’s lawyers said in a letter.

Under new ownership, the jewelry company enlisted consultants from Boston Consulting for several months and later hired several of them for top leadership roles. De Grisogono named Boston Consulting project leader John Leitão CEO in 2013 and Elmar Wiederin, Boston Consulting’s main liaison to the jewelry company, chairman in 2015. In an interview with ICIJ partners at The New York Times, Leitão characterized Boston Consulting’s role at the jewelry company as “shadow management.” (Boston Consulting disputes this and said the firm worked only on three specific projects.

All the while, de Grisogono hemorrhaged cash. The company racked up huge debts, including the loans from Sodiam, while still throwing lavish parties at Cannes. By 2016, de Grisogono had laid off staff in Geneva, New York and London. It struggled to pay suppliers, virtually all of whom lost confidence in the jeweler, one de Grisogono senior manager said.

“I am stunned our top management did not foresee these problems,” Fawaz Gruosi, de Grisogono’s founder and minority owner, complained in a 2015 email. He left the company in early 2019.

Gruosi said he didn’t have information about the company’s corporate structure or finances to answer questions because his role under the new owners was restricted to creative director.

Leitão, the former de Grisogono CEO, told the New York Times the company’s financial problems were exacerbated by sanctions against Russia and a fall in oil prices, which hit Russian and Middle Eastern clients’ pocketbooks.

“In the end I wasn’t successful in turning around the business,” he said.

De Grisogono declined to comment. Wiederin said confidentiality rules prevented him from answering questions about the company’s finances.

A final accounting

Accountants for Victoria Holding and Victoria Limited, the Maltese companies with a majority stake in de Grisogono, seemingly missed red flags in their financial statements.

In 2013, a PwC Malta accountant asked dos Santos’ financial advisers if the BVI shell that received Dokolo’s $4 million “success fee” was connected to the Maltese companies’ shareholders. Dos Santos’ adviser said he didn’t know—even though internal communications suggest he was aware that Dokolo owned the BVI firm. PwC seems to have taken his reply at face value and put the issue aside.

The documents and email exchanges related to PwC’s preparation of the Maltese companies’ 2012 financial statements, which the firm also audited, were shared with four experts: an anti-money laundering specialist, a forensic accountant, a former auditor, and a former US customs investigator. All said the $4 million “success fee” appeared to be suspicious.

“Paying huge and dubious consulting fees to anonymous companies in secrecy jurisdictions should sound all alarm bells,” said Christoph Trautvetter, a Berlin-based forensic accountant.

It’s unclear whether PwC reported the potential red flag to Maltese authorities. PwC didn’t respond to questions about its work for Victoria Holding and Victoria Limited, citing confidentiality restrictions. PwC’s code of conduct, which applies to its global member firms, directs employees to know the identity of their clients and abide by anti-money laundering standards. “Where we suspect criminal behavior, we take appropriate action,” the code reads.

Dos Santos’ advisers didn’t respond to repeated requests for comment.

As of Jan. 17, PwC is still listed in public records as the auditor for the Maltese companies.

Sodiam chair Eugénio Pereira Bravo da Rosa, who was appointed in November 2017, told the BBC that Sodiam “has not profited one single dollar” from its investment in de Grisogono. He criticized the deal that put Dokolo in charge and left Sodiam without a management role. “It is strange,” Bravo da Rosa said. “I can’t believe a person would start a business and let its partner run the business with total power to make all the decisions.”

By the time Sodiam pays off loans taken out in the deal, he added, it will have lost more than $200 million. Dokolo disputes that figure, and has told media outlets he recently filed a case against Sodiam in a London arbitration court accusing the state diamond company of destroying the value of his investment in de Grisogono. He claims Sodiam has stolen documents and violated confidentiality agreements.

Sodiam, which announced its intention to divest from de Grisogono in 2017, is still trying to figure out what happened.

“That is the question we are continually asking,” Bravo da Rosa said. “What has been done with the money?”

Sylvain Besson, Jacob Borg, Rigoberto Carvajal, Antonio Cucho, Douglas Dalby, Will Fitzgibbon, Sydney Freedberg, James Oliver, Micael Pereira, Delphine Reuter, Sonia Rolley, Pauliina Sinauer, and Mago Torres contributed reporting.