Kenya is preparing to crack down on a flood of high-interest loan apps

A new Kenyan bill seeks to license and regulate digital lending platforms in the country, in a bid to clamp down on the issuance of high-interest loans as well as the predatory practices that have accompanied the industry’s massive growth.

A new Kenyan bill seeks to license and regulate digital lending platforms in the country, in a bid to clamp down on the issuance of high-interest loans as well as the predatory practices that have accompanied the industry’s massive growth.

Mobile lending apps have become an easy source of credit for Kenyans who don’t have accounts with banks and other traditional financial institutions, or the regular income needed to borrow from such establishments.

Since the launch of the mobile-based savings and loans product M-Shwari by Safaricom in 2012, dozens of lending apps have popped up offering short-term loans, and with many selling the goal of financial inclusivity. The apps in the market include Silicon Valley–backed Tala and Branch, as well as Zenka, Opesa and Okash, which is owned by the Norwegian software maker Opera.

Financial inclusion—defined as access to useful and affordable financial products and services that meet needs and are delivered in a responsible and sustainable way—rose from 26.7% in 2006 to 82.9% in 2019 in Kenya, driven largely by the growth of mobile money. A 2019 survey on digital credit found that 13.6% of Kenyans had borrowed loans from a digital lender, citing their convenience and ease of access.

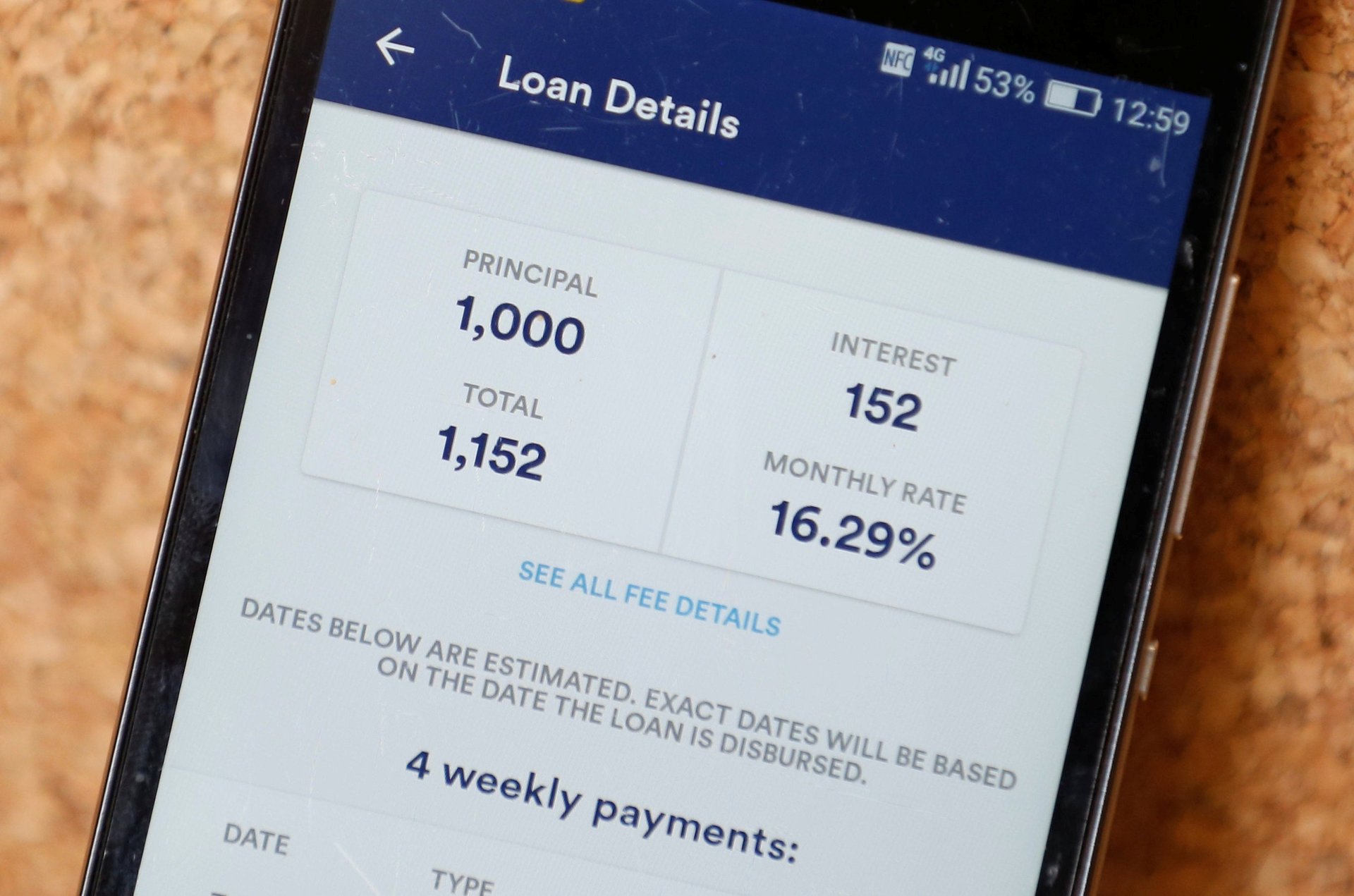

But the industry has been largely unregulated. As a result, some apps offer loans with annual percentage rates of up to 400%, and borrowers have accused them of shady practices including illegally mining customer data, and shaming of defaulters.

As an example of the rates on offer, Tala currently offers 30-day loans with interest of between 7 and 19% per month, while Branch charges interest of between 2 and 16% percent per month for loans of up to $700. A standard bank loan in Kenya has an average rate of approximately 12%.

Digital loans usually have a repayment period of less than one month, and borrowers who roll over their loans have to pay interest on the balance.

While digital loans have helped with access to finance, they have been linked with an increase in personal debt, with a concerning number of customers using the loans to pay for basic household expenses.

The privacy of app users has also been an issue for some time. Some digital lending apps have been accused of collecting data on location, call records, and text messages, many times from unknowing customers, to make financial decisions.

They have also been accused of using data from borrowers’ phones to shame them when they default on the loans, in some cases making threatening calls to the borrower, and sending text messages to contacts in their phone books.

Citing public complaints over the misuse of the credit information-sharing process, the Central Bank of Kenya (CBK) last year stopped digital lenders from forwarding defaulters’ names to credit reporting agencies. It also stopped the blacklisting of defaulters for amounts less than $10. CBK Governor Patrick Njoroge has on many occasions criticized the practices of digital lenders, even comparing the apps to shylocks and calling them fleas.

Google, which hosts loan apps on its store, has also taken measures to protect consumers. In 2019, it barred apps that promote personal loans that require repayment in full in 60 days or less from its app store.

The new bill seeks to have the CBK, the country’s monetary authority, license and regulate digital lenders. Currently, the authority licenses, regulates and supervises deposit-taking institutions. Digital lenders have escaped the CBK’s scrutiny thus far because they don’t take deposits.

“We’re trying to protect or provide a safe space for everyone,” the bill’s sponsor, nominated legislator Gideon Keter, told Quartz.

The proposed legislation will be introduced in parliament on Thursday.

Kevin Mutiso, the chairman of the Digital Lenders Association of Kenya, a group of 20 digital lenders in the country, distanced the association’s members from bad practices and said there’s need for regulation.

“It will bring sanity to the industry because we’ve got some bad actors—rogue actors,” he told Quartz.

Sign up to the Quartz Africa Weekly Brief here for news and analysis on African business, tech, and innovation in your inbox.