Peer-to-peer trades are sustaining Nigeria’s crypto activity despite a ban

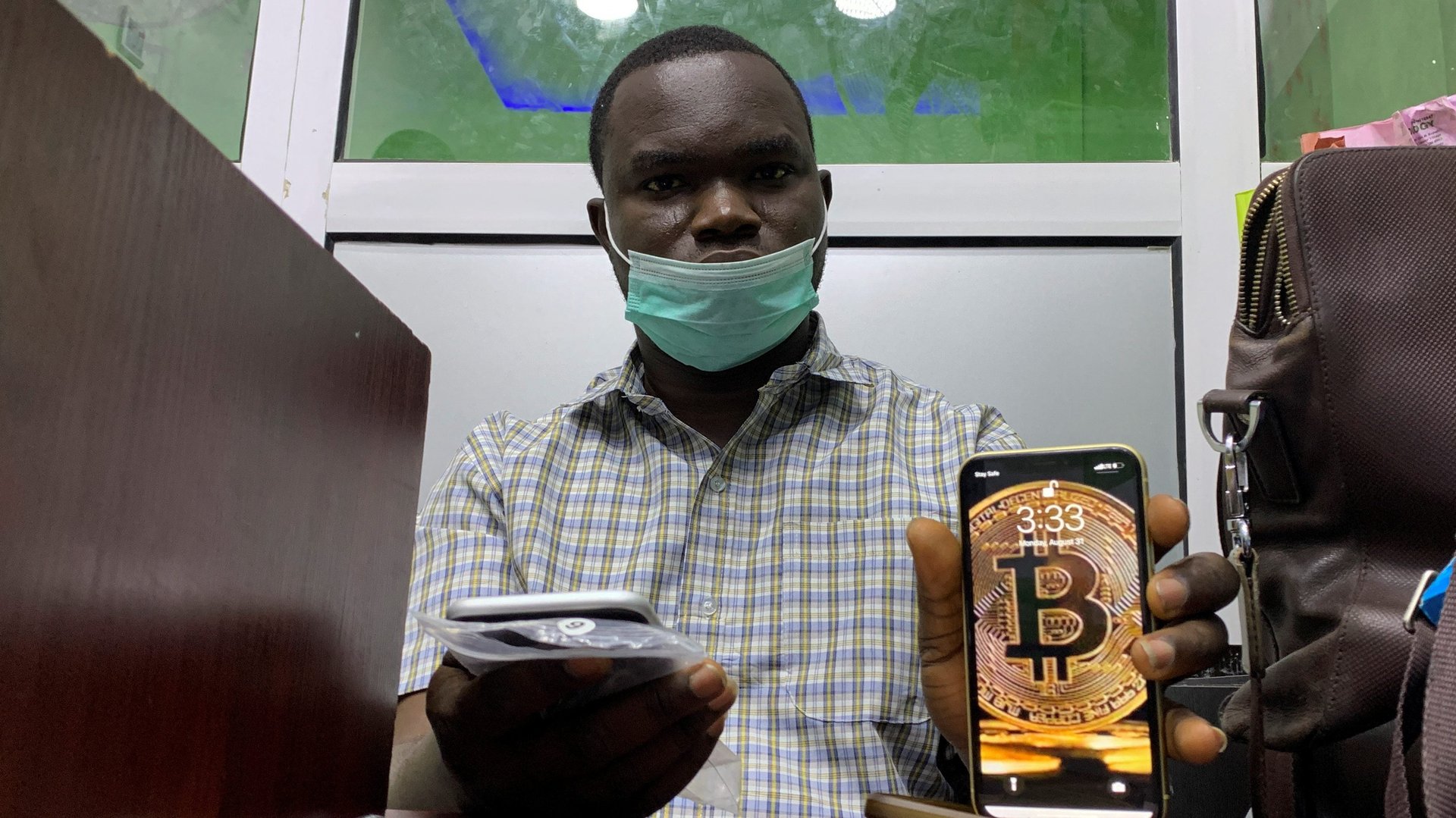

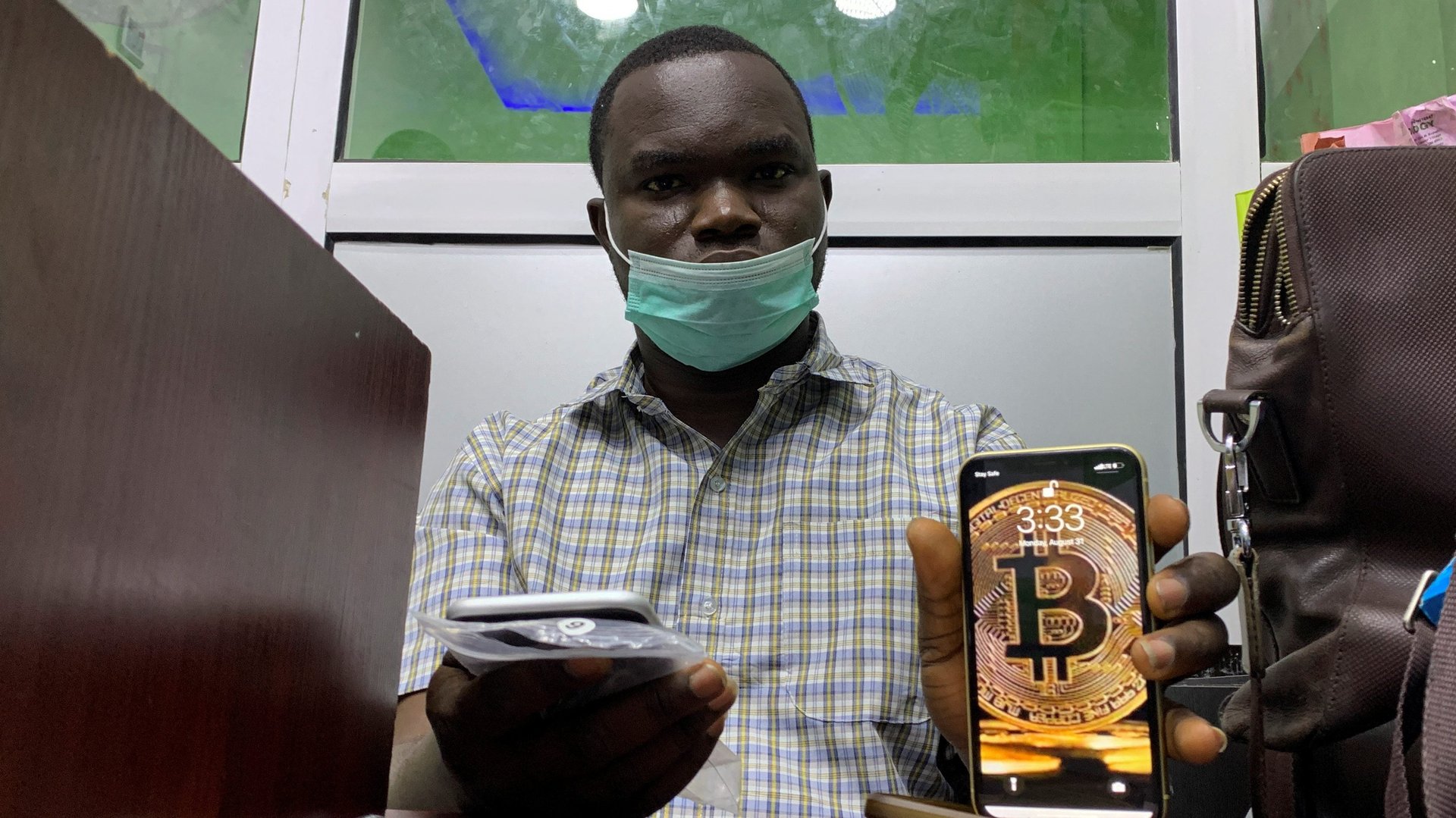

Seven months after Nigerian banks were barred from enabling cryptocurrency transactions, bitcoin remains an actively traded asset in the country, partly due to the presence of platforms that enable peer-to-peer transfers.

Seven months after Nigerian banks were barred from enabling cryptocurrency transactions, bitcoin remains an actively traded asset in the country, partly due to the presence of platforms that enable peer-to-peer transfers.

The value of bitcoin traded on LocalBitcoins and Paxful—two platforms that match crypto sellers with buyers—grew from $32 million in January and February this year to more than $44 million in August. Most of that has been on Paxful, which has 1.5 million users in Nigeria out of its global base of 7 million users.

Upholding Nigeria’s bitcoin wave

Bitcoin and other cryptocurrencies have been popular in Africa for a number of reasons, but wealth creation is arguably the priority for most users. Inflation and low productivity have affected the strength of currencies like Nigeria’s naira, and South Africa’s rand, driving consumers to alternatives to secure their earnings.

In line with that motivation, as of August, peer-to-peer trading in Africa now rivals volumes in North America, according to UsefulTulips, a website that analyzes the trading data of the world’s most popular peer-to-peer Bitcoin trading websites.

Ray Youssef, Paxful’s co-founder and CEO, told Quartz that credit belongs to young people for the momentum. Around 46% of his platform’s African users fall between ages of 25 and 40, while 41% are between 18 and 25. To entrench Africa’s crypto growth at a systemic level, Paxful’s Built With Bitcoin Foundation has built six schools on the continent, the latest being a nursery and primary school opened in August in Kaduna state in northern Nigeria.

Regulation would create a better crypto landscape

Compared to 2020, Paxful expects to have 23% more bank transfer trades, and 36% more bank transfer volume in Nigeria. But Youssef notes that while many have adopted formal peer-to-peer platforms like his to sustain crypto trading; WhatsApp, and Telegram remain where most activity happens.

Trading platforms typically have Know-Your-Customer (KYC) guidelines that ensure transfers are completed, without which crypto users are vulnerable to theft and abuse. Youssef would like Nigeria’s central bank to rethink its stance on the bank ban by crafting regulation for the sector. “If the government will issue some kind of license or maybe even tax transactions, I think that will be fair. Nigerians will happily move their transactions to platforms like ours which have KYC,” he says.

However, the central bank may not be inclined to such an appeal, now that it is piloting a digital currency of its own. Following China’s playbook, Nigeria could intend for its eNaira to quickly replace every cryptocurrency in the long run, forestalling any inclination to make regulation that enables peer-to-peer trades on platforms like Paxful.

Youssef doesn’t see the threat. On the contrary, he is confident that crypto will be more rapidly adopted in Nigeria over the next couple of years. “Everyone will use crypto, and most might not know they are. Crypto will saturate itself into Nigeria’s financial technology ecosystem,” he says. Use cases to drive that growth include the wealth ambitions of young Nigerians, but also cross-border activity like remittances.

Sign up to the Quartz Africa Weekly Brief here for news and analysis on African business, tech, and innovation in your inbox.